GBP/USD Weekly Outlook: Pound Sterling buyers return with a bang

- The Pound Sterling hit five-week lows against the US Dollar, then rebounded.

- GBP/USD stands tall amid US-China trade war escalation, awaiting UK CPI data.

- Technical analysis points to more upside for the pair as the daily RSI turns bullish.

The Pound Sterling (GBP) jumped back into the game against the US Dollar (USD), allowing the GBP/USD pair to stage a solid comeback from five-week troughs.

Pound Sterling found buyers near the 1.2700 region

In doing so, GBP/USD recorded over 1.5% gain over the week, rejoicing in the USD’s demise across the board. Markets smashed US assets such as Wall Street stocks, the Greenback and US government bonds on increased economic and financial stability concerns under US President Donald Trump’s administration.

The pair extended the previous week’s slide at the start of the week on Monday and hit a monthly low at 1.2708 as traders weighed the risks of an intensifying global trade war, led by President Trump. Last Friday, China announced an additional 34% retaliatory tariff on all goods imported from the US, following Trump's reciprocal tariff move on Liberation Day, April 2.

In response, the White House confirmed late Tuesday that 104% duties on imports from China would take effect after midnight on Wednesday. The tit-for-tat tariff game extended as Beijing hit back at Trump's 104% tariffs with its own additional tariffs of 84%, up from the previous 34%, on all American goods.

Later that day, US President Donald Trump announced a 90-day 'pause' on reciprocal tariffs of 10% for all countries except China. Trump raised the tariff rate for China to 125%, effective immediately. The US-China trade rift got even bigger, with Beijing preparing to deepen the China-EU trade, indirectly aiming at American companies, per the Wall Street Journal (WSJ).

Trump’s 90-day breather on the reciprocal tariffs triggered the much-awaited risk rally and led Wall Street indices to record their best day in over a decade. The sharp turnaround in risk sentiment amid deepening US-Sino trade war-led US economic concerns knocked the US Dollar down to its lowest level in nearly two years against its major currency rivals.

Markets continued pricing in three to four interest rate cuts by the US Federal Reserve (Fed) amid increased risks of economic recession and easing inflation, exacerbating the pain in the buck. The US March Consumer Price Index (CPI) inflation came in tamer-than-expected on Thursday, although it did not show the full impact of the trade war. The US CPI rose 0.1% in March, putting the 12-month inflation rate at 2.4%, down from 2.8% in February.

Expectations of divergence between the Fed and Bank of England (BoE) monetary policy outlooks further helped the GBP/USD recovery.

Heading into the weekend, the US Dollar extended its downbeat momentum, undermined by renewed concerns over the Fed’s independence, which could lead to financial instability.

US Supreme Court Chief Justice John Roberts reversed a court ruling, temporarily allowing US President Donald Trump’s Administration to fire members of independent agencies. Markets speculated that Trump could take this opportunity to fire Fed Chair Jerome Powell, raising concerns over the financial stability in the world’s largest economy.

Data published by the Office for National Statistics (ONS) showed on Friday that the British economy expanded by 0.5% in February after recording no growth in January. The market forecast was for a 0.1% growth in the reported period. Stronger-than-expected UK growth numbers helped the Pound Sterling preserve its recovery momentum.

Week ahead: UK data and tariffs in focus

After a tumultuous week of back and forth on Trump’s ‘reciprocal tariffs’ and the resultant volatility, traders gear up for more action in the week leading to Holy Friday.

Monday is quiet in terms of high-impact economic data from both the United Kingdom (UK) and the United States (US). Tuesday will feature the UK employment data.

The Chinese first-quarter (Q1) Gross Domestic Product (GDP) will be released on Wednesday alongside the Retail Sales and Industrial Production. Amidst big banks’ revising their China growth forecasts lower, the data could trigger a significant market reaction, impacting risk sentiment and higher-beta currencies such as the Pound Sterling.

Later that day, the UK CPI and US Retail Sales data will also grab attention. On Thursday, only the US weekly Jobless Claims data will be highly relevant.

On Friday, most of the world markets will remain closed because of Good Friday.

During the week, tariff talks will be under intense scrutiny as the US-China trade war deepens. Additionally, speeches from several Fed policymakers will also be closely followed for fresh hints on the Fed’s interest rate move in May.

GBP/USD: Technical Outlook

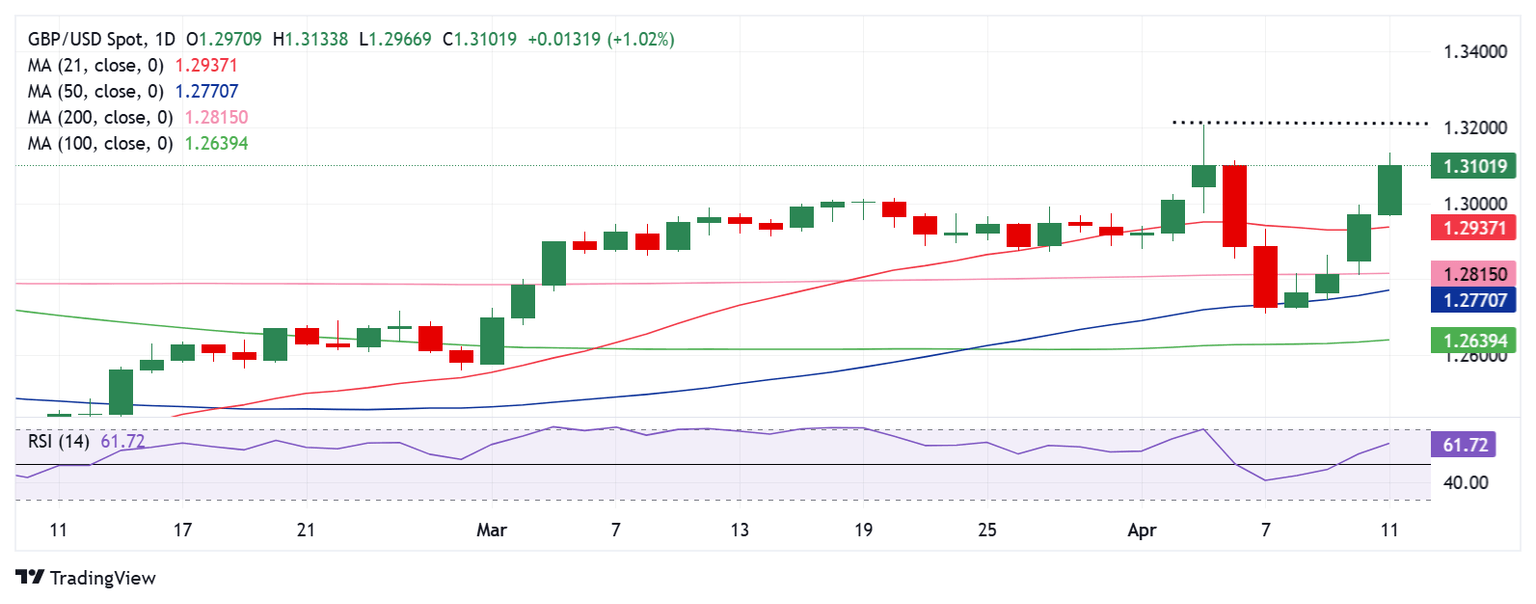

The short-term technical outlook for GBP/USD appears in favor of buyers as the 14-day Relative Strength Index (RSI) regained the midline, currently near 61.

Further, the pair has reclaimed its position above all major daily Simple Moving Averages (SMA), adding credence to the bullish potential.

The pair must close the week above the 1.3100 barrier to resume its journey toward the half-yearly high of 1.3207.

The next upside target for buyers is aligned at the 1.3300 threshold.

On a failure to resist at higher levels, sellers could fight back control, with the immediate support seen at the 21-day Simple Moving Average (SMA) at 1.2932.

Additional declines will likely challenge the 200-day SMA at 1.2815, below which the 50-day SMA at 1.2768 will be scrutinized.

A sustained move below that support level will expose the downside toward the 100-day SMA at 1.2638.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.