GBP/USD Weekly Forecast: Set for a deeper decline amid uglier politics on both sides of the pond

- GBP/USD has surged to new 2020 highs amid dollar weakness but dropped quickly down

- An update to UK GDP, US inflation, and politics on both sides of the Atlantic are set to move markets.

- Early September's daily chart is showing bulls remain in the lead.

The fallout from the Fed's dovishness pushed cable to new highs before falling back down. US politics are set to enter higher gear after the long weekend, and several indicators are set to rock GBP/USD in September's first full week. The fate of the furlough scheme remains in the air.

This week in GBP/USD: Fed fallout continues

The punch bowl seemed bottomless and continued pushing the dollar down and GBP/USD close to the peak in December 2019. The greenback was sold off amid prospects of lower rates for longer – potentially through 2025 – as the Federal Reserve prioritizes employment at the expense of overheating inflation.

Several Fed officials echoed the words of Jerome Powell, Chairman of the Federal Reserve, in the previous week. However, they also conveyed a message that the bank is unwilling to add stimulus in the near-term, contributing to a snapback – especially as positions became extreme.

On the other side of the pond, Bank of England officials have warned that the recovery from the economic slump may extend. Gertjan Vlieghe, a member of the bank, told MPs there is a material risk for a years-long grind higher.

Governor Andrew Bailey reiterated his stance that negative interest rates are in the toolbox but there no plans to use them. His reluctance to set sub-zero borrowing costs supported sterling.

Britain's successful furlough scheme has been one of the most significant contributors to keeping the economy afloat – yet it is set to expire in October and uncertainty looms. The government reportedly mulled raising taxes to plug a hole in finances, weighing on the pound.

Brexit: Michel Barnier, the EU's Chief Negotiator, accused Britain of aiming to keep the benefits of staying in the bloc without the obligations – signaling that talks remain deadlocked. Investors are paying only a little attention to the ongoing acrimony. The transition period expires at year-end.

The US elections campaign somewhat heated up as President Donald Trump benefited from a "convention bounce" – narrowing the gap with rival Joe Biden after shifting the agenda toward protests and crime. However, markets seemed more interested in fiscal stimulus talks than marginal changes in voting intentions.

Steven Mnuchin, America's finance minister, said that he wants Congress to strike another deal – including the much-needed federal unemployment benefit top-up. At the time of writing, Democrats and Republicans seem far apart.

US data has been mixed with ISM Purchasing Managers' Indexes both point to robust growth but employment measures pointed to weakness.

The US unemployment rate surprised with a drop to 8.4%, while headline Non-Farm Payrolls rose by 1.371 million as expected. However, not all is rosy when looking at the details.

NFP Analysis: Time to sell stocks? Under the hood, three factors may turn markets down

Coronavirus cases are edging higher in the UK, triggering new restrictions in Glasgow. However, the situation remains under control, especially when comparing to the US, where infections have stabilized, but at a high level.

Source: FT

UK events: Furlough future, GDP data

Two clocks continue ticking down. First, the government's successful furlough scheme is set to expire in October, and that may take the UK economy off a cliff. Rishi Sunak, Chancellor of the Exchequer, has yet to unveil how it would be wound down – or if it is extended. The program pays workers most of their salaries while they are unable to work, keeping them attached to their jobs.

The second time bomb is Brexit. The transition period expires at year-end and without a new deal, Britain falls to unfavorable World Trade Organization rules. Investors are expecting no progress until the last moment. That means that any positive comment from negotiators could spark a rally in sterling, while mutual accusations would likely be shrugged off.

BOE officials are set to speak, but after Bailey's recent public appearance, there is little the bank can add at this point. More importantly, the final read of Gross Domestic Product figures for the second quarter could shake sterling. The economy collapsed by 20.4% according to the initial read – worse than most developed economies at that time. While the revised figure tends to confirm the first one, this particular one may be different given the magnitude of the fall.

Manufacturing output figures for July are also of interest and are expected to show an ongoing recovery from the depths of the economic paralysis in the spring.

Here is the list of UK events from the FXStreet calendar:

US events: Politics heating up

For American traders, the week beings only on Tuesday, after Labor Day. The return from the long weekend is the time when Americans tune-up to the election campaign – and markets may do so as well.

While markets tend to prefer Republican presidents, a Biden presidency with a GOP-controlled Senate – a scenario that is looking more likely – may result in less fiscal stimulus and may slow the economy. Even worse, the specter of an inconclusive election may also begin gripping markets. In that scenario, the safe-haven dollar may rise.

Early in the week, investors may continue responding to the Non-Farm Payrolls and weekly jobless claims are also of interest for an updated view on the labor market. Inflation figures come into focus on Friday. The Fed's willful ignorance of price development raises the bar for a meaningful reaction, but a rise of Core Consumer Price Index to beyond 2% – currently looking unlikely – may boost the dollar.

While US COVID-19 cases are falling, the mortality rate remains elevated and nears the grim 200,000 deaths milestone. America has recently surpassed Sweden and Mexico in the number of deaths per capita, and is now ranked eighth in the world:

Source: RealClearPolitics

A renewed focus on the disease – especially if the numbers turn upward – could weigh on sentiment.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has exited overbought conditions on the daily chart, with the Relative Strength Index dropping now well below 70 and it trades above the 50, 100, and 200-day Simple Moving Averages. This bullish development is countered by the currency pair's momentum has waned.

All in all, bears are gaining some ground, but bulls remain in the lead.

Some support awaits at 1.3240, an early September low, followed by 1.3180, which was a stepping stone on the way up in late August. A considerable cushion awaits at 1.3050, which provided support several times in August, followed by 1.2980, a low point in early August.

The battle continues around 1.3290, a separator of ranges around the end of August, and it is followed by 1.3350, a line that capped GBP/USD early in the year, and then 1.34, a temporary peak on the way up. The fresh 2020 high of 1.3480 is the next level to watch.

GBP/USD Sentiment

Cable may have gone too far and too fast and the recent fall may be the beginning. Without an extension of the furlough scheme, the US dollar may push the pair lower. A rush back into the safe-haven US dollar – due to political fears, concerns about the economy, and coronavirus – could undo some of the recent months' gains.

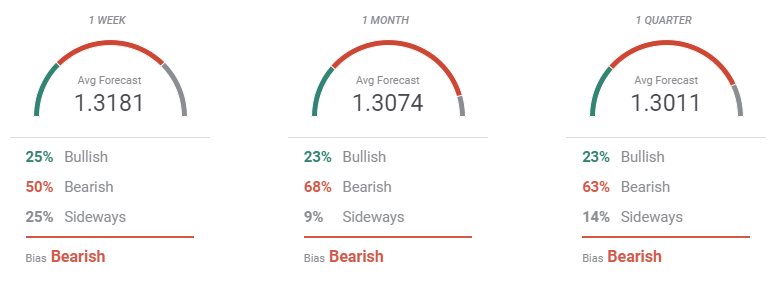

The FXStreet Forecast Poll provides additional insights. It shows that bears are in control, surpassing buying interest in the three time-frame under study. The pair is expected to slowly but steadily grind towards the 1.3000 critical threshold, Bears stand for 50% en the weekly perspective rising to 68% in the monthly one. The stalemate in Brexit talks is a negative factor that will add weigh on the pound in the upcoming weeks.

Interestingly, the Overview chart shows that the weekly moving average is directionless, but the larger ones maintain their bullish slopes. A widespread of possible targets in the 3-month view reflects a persistently high degree of uncertainty.

Related Reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.