GBP/USD Weekly Forecast: Sellers remain hopeful whilst below key Fibo level

- GBP/USD gains for the first time in four weeks, but downside remains favored.

- Optimism on UK PMI doused by political woes, rail strike and upbeat Powell.

- 61.8% Fibo at 1.2360 is a tough nut to crack for bulls, with eyes on Powell, Bailey.

GBP/USD snapped a three-week downtrend and staged a decent comeback despite a variety of mixed fundamental factors from the UK. A pullback in the US dollar from two-decade highs kept cable afloat, although within a familiar 200-pip trading range. Persistent inflation and recession worries kept investors on edge.

GBP/USD entered a consolidative phase

GBP/USD kept its range between 1.2160 and 1.2360, struggling for a clear directional bias after a slightly upbeat start to the week. After reversing the previous recovery gains on Friday, cable found its feet in the first half of the week, as the greenback resumed its retreat from the highest levels in over twenty years against its major peers. Risk sentiment improved as investors took of the previous week’s sell-off in global stock amid the rate hike announcements by the Fed and BOE. Meanwhile, comments from the UK Junior Treasury Minister Simon Clarke that the UK economy is unlikely to tip into recession underpinned GBP bulls.

Further, cautious remarks from St. Louis Fed President James Bullard on the implications of the bank’s tightening guidance, combined with hawkish BOE commentary, aided the GBP/USD rebound in the early part of the week. BOE policymaker Catherine Mann made a case for a double-dose rate hike in August amid a weaker sterling. Meanwhile, BOE Chief Economist Huw Pill said in a Bloomberg interview that he expects further tightening in the coming months.

The upside lost traction on Wednesday as the return of risk-off flows, and relatively softer UK inflation figures weighed on the GBP/USD pair. The annualized UK inflation rate hit the highest level since March 1982 at 9.1% in May, meeting the market consensus. However, the core CPI inflation (excluding volatile food and energy items) eased to 5.9% YoY last month versus 6.2% booked in April. Markets re-priced the probability of a 50 bps BOE rate hike in August, with the odds declining from 74% to 60% following the mixed UK CPI data. Additionally, the sentiment around the pound was undermined by the UK rail strike, the biggest in over 30 years, as rail unions demanded wage increases to keep up with inflation.

Any modest rebound in GBP/USD remained a good selling opportunity in the second half of the week. The Preliminary UK Services Business Activity Index for June steadied at 53.4 when compared to the expected drop to 53.0. The positive surprise on the UK June Services PMI was quickly sold off into the upbeat testimony from Fed Chair Jerome Powell, where he showcased the central bank’s strong commitment to fighting inflation. On day two of his testimony, Powell said the Fed is committed to bringing inflation back down, and the American economy is very strong and well positioned to handle tighter monetary policy. The dollar received the much-needed boost from Powell, but the upside remained capped by the disappointing US Manufacturing and Services PMI reports, allowing GBP bulls some breathing space.

GBP/USD buyers made another recovery attempt on Friday but struggled to find additional demand following the mixed UK Retail Sales print and the Conservatives Party’s defeat in the parliamentary by-elections. The UK Retail Sales dropped by 0.5% over the month in May vs. a 0.7% decline expected, while on an annualized basis, the gauge plunged 4.7% in May versus a drop of4.5% expected and a 5.7% fall prior. Early Friday, the UK’s ruling Conservative Party lost by-elections, with the loss of two Tory seats after ballots were cast in Wakefield, Tiverton and Honiton, putting PM Boris Johnson’s leadership under the radar.

Week ahead: Central bankers in focus

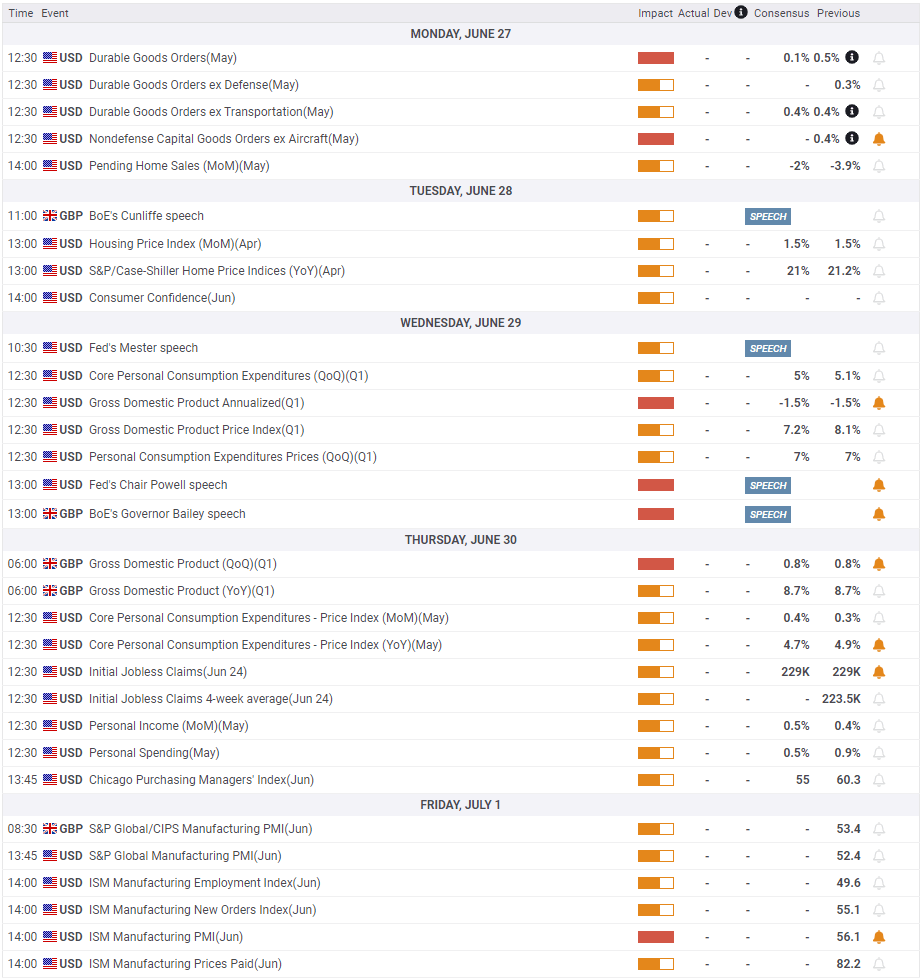

The week ahead kicks off with the US Durable Goods Orders and Pending Home Sales due for release on Monday. Tuesday will see the US CB Consumer Confidence data and BOE Deputy Governor Jon Cunliffe’s speech. The US data could provide fresh hints on the strength of the economy, which could have a significant impact on the Fed sentiment and the dollar trades.

On Wednesday, traders will brace for the final revision of the US Q1 GDP print. However, a panel discussion titled "Policy panel" at the ECB Forum on Central Banking in Sintra, Portugal will hog the limelight. Fed Chief Powell, ECB President Christine Lagarde and BOE Governor Andrew Bailey will participate in the panel discussion, making it the most awaited event of the week.

The UK final quarterly GDP will be released, followed by the US jobless claims and Core PCE Price Index. The US ISM Manufacturing PMI will wrap up a relatively data-light week. Chatters surrounding a potential recession, UK pollical uncertainty, and central banks’ tightening bets will remain the main market-moving factors ahead.

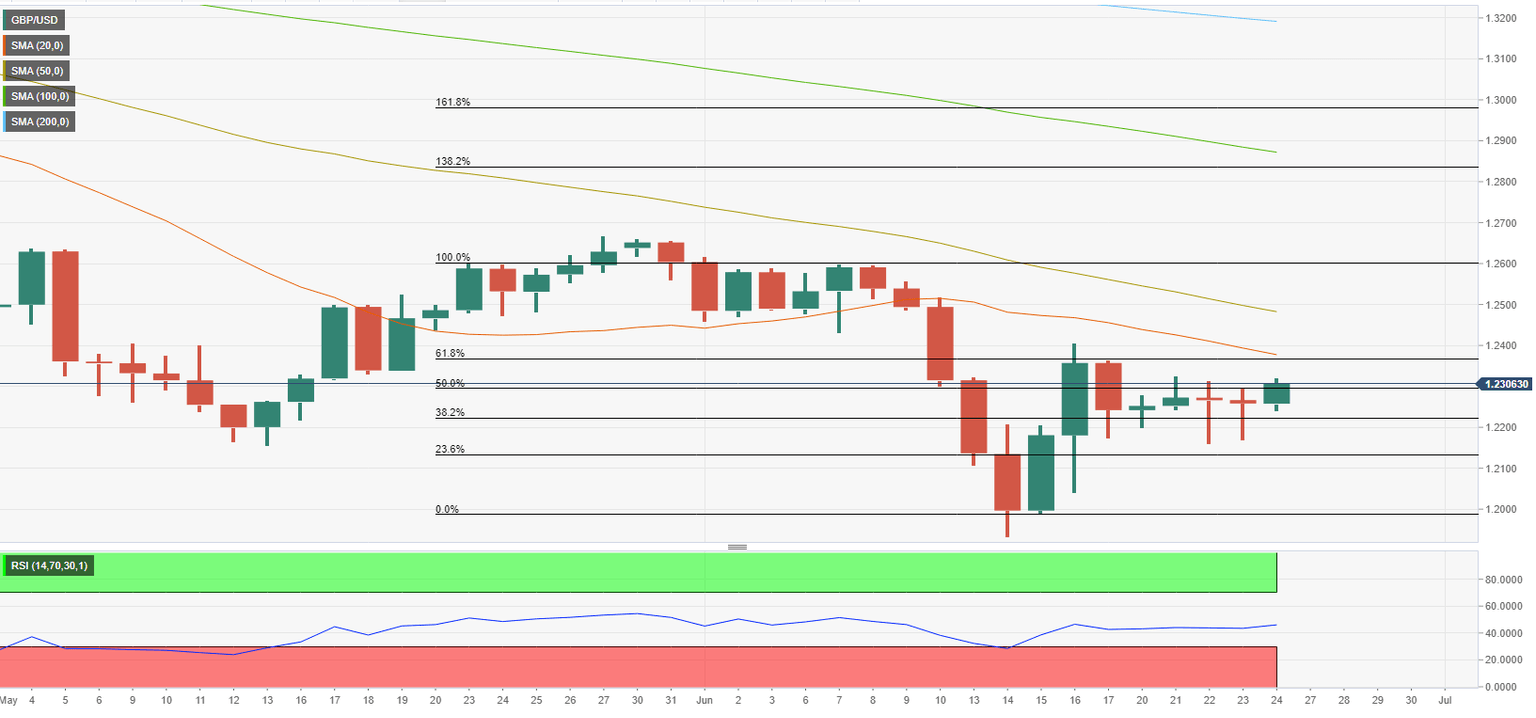

GBP/USD: Technical outlook

GBP/USD is facing first resistance at 1.2360, where the Fibonacci 61.8% retracement of the latest downtrend is located. The 20-day SMA is reinforcing that level as well. In case the pair manages to clear that hurdle and starts using it as support, this could be seen as a significant bullish development. In that scenario, 1.2500 (50-day SMA) and 1.2600 (the starting point of the downtrend) could be seen as the next bullish targets.

On the downside, 1.2200/1.2220 area (psychological level, Fibonacci 38.2% retracement) aligns as support before 1.2130 (Fibonacci 23.6% retracement) and 1.2000 (the end point of the downtrend).

In the meantime, the Relative Strength Index (RSI) indicator on the daily chart continues to move sideways slightly below 50, suggesting that buyers remain on the sidelines for the time being.

GBP/USD: Sentiment poll

The FXStreet Forecast Poll fails to provide a clear direction clue in the short term. On the one-month view, however, the majority of polled experts remain bullish on GBP/USD with the average target sitting near 1.2400.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.