GBP/USD Weekly Forecast: Pound Sterling recovers, not out of the woods yet

- The Pound Sterling rebounded firmly against the US Dollar, snapping the losing streak.

- For further direction, GBP/USD looks to central bank chiefs Bailey and Powell, as well as US Nonfarm Payrolls data.

- Dual Bear Crosses and a bearish RSI could continue threatening the Pound Sterling recovery.

The Pound Sterling (GBP) snapped a two-week downtrend and staged a comeback against the US Dollar (USD), driving the GBP/USD pair back to the 1.2700 threshold.

Pound Sterling came up for air as USD buyers took a breather

GBP/USD returned to the green as a dramatic week drew to a close. Markets witnessed a steep correction in the USD, courtesy of the US fundamental catalysts, offering a much-needed respite to the Pound Sterling buyers.

Starting the week, they jumped in on Monday, helping the pair rebound from the six-month low of 1.2488, set on November 22. The Greenback saw a bearish opening gap in tandem with the US Treasury bond yields and extended the downside in response to the weekend news that US President-elect Donald Trump named billionaire Scott Bessent as his Treasury Secretary. Bessent’s appointment to the critical position in the Trump administration reassured the US bond market as he is seen as a fiscal conservative.

The GBP/USD recovery paused on Tuesday after the Greenback found fresh safe-haven demand following US President-elect Donald Trump's announcement of a 25% tariff on all products from Mexico and Canada and an additional 10% tariff on goods from China once he takes over his office on January 20. Intensifying risk aversion on the looming threat of a global trade war curbed appetite for high-beta currencies such as the British Pound.

However, USD sellers returned on Wednesday alongside risk appetite on easing geopolitical tensions between Israel and Lebanon. Reuters reported that “a ceasefire between Israel and Iran-backed group Hezbollah came into effect at 0200 GMT on Wednesday after US President Joe Biden said both sides accepted an agreement brokered by the United States and France.”

The US currency also suffered due to sustained expectations that the US Federal Reserve (Fed) will likely cut interest rates by 25 basis points (bps) in December. The weakness extended into Thanksgiving Thursday, especially after Wednesday’s US core Personal Consumption Expenditure (PCE) Price Index data failed to alter Fed rate cut expectations for next month.

The Fed’s preferred inflation gauge, the core PCE Price Index, increased at 0.3% on a monthly basis and an annual reading of 2.8%, aligning with market expectations. Thin trading conditions also left the Greenback miring in the weekly troughs, aiding the additional upswing in the Pound Sterling.

On Friday, nothing seemed different from the fundamental perspective as sentiment around the US Dollar remained tepid, pushing GBP/USD to the highest level in two weeks above 1.2700.

Meanwhile, there was no high-impact economic data from the UK during the week, while Bank of England (BoE) policymakers continued to voice caution about further rate cuts. Deputy Governor Clare Lombardelli said Tuesday that she needs to see more evidence of cooling price pressures before she backs another interest rate reduction, per Bloomberg.

The week ahead: Bailey, Powell and US payrolls in sight

An action-packed week unfolds after a relatively quiet one, with labor data from the US likely to dominate the week. In contrast, the UK economic calendar lacks any high-impact data releases in the upcoming week.

Apart from the data publication, risk sentiment will play a pivotal role in influencing the higher-yielding Pound Sterling as global trade war fears mount following US President-elect Donald Trump’s announcement of tariffs on Mexico, Canada, and China.

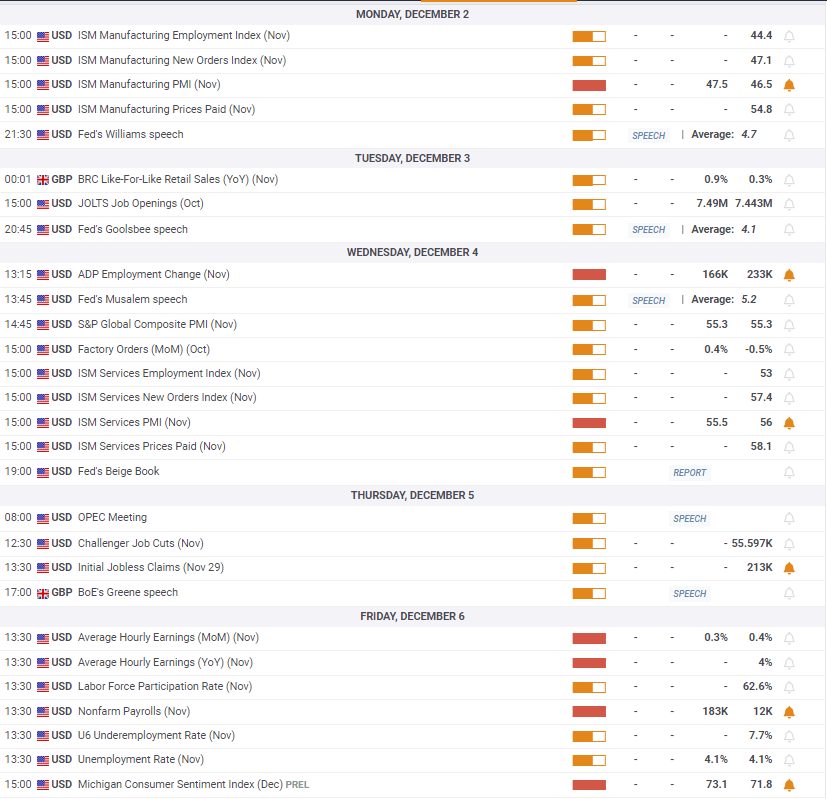

On Monday, the US Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) will stand out following the releases of the S&P Global final UK and US Manufacturing PMI reports.

The US JOLTS Job Openings Survey will be the only vital data published on Tuesday. Wednesday will feature the top-tier US ADP Employment Change and ISM Services PMI data. Additionally, appearances from BoE Governor Andrew Bailey and Fed Chairman Jerome Powell will hog the limelight that day.

Powell’s appearance will be his last public one before the Fed enters the ‘blackout period’ on December 7.

The usual weekly US Jobless Claims will be reported on Thursday, followed by BoE policymaker Megan Greene’s speech.

All eyes will be on Friday's critical US Nonfarm Payrolls (NFP) for fresh signs on labor market conditions and the Fed’s rate outlook.

Speeches from several Fed policymakers will be listed throughout the week and could be significant as the ‘blackout’ period kicks on Saturday ahead of the December 17-18 policy meeting.

GBP/USD: Technical Outlook

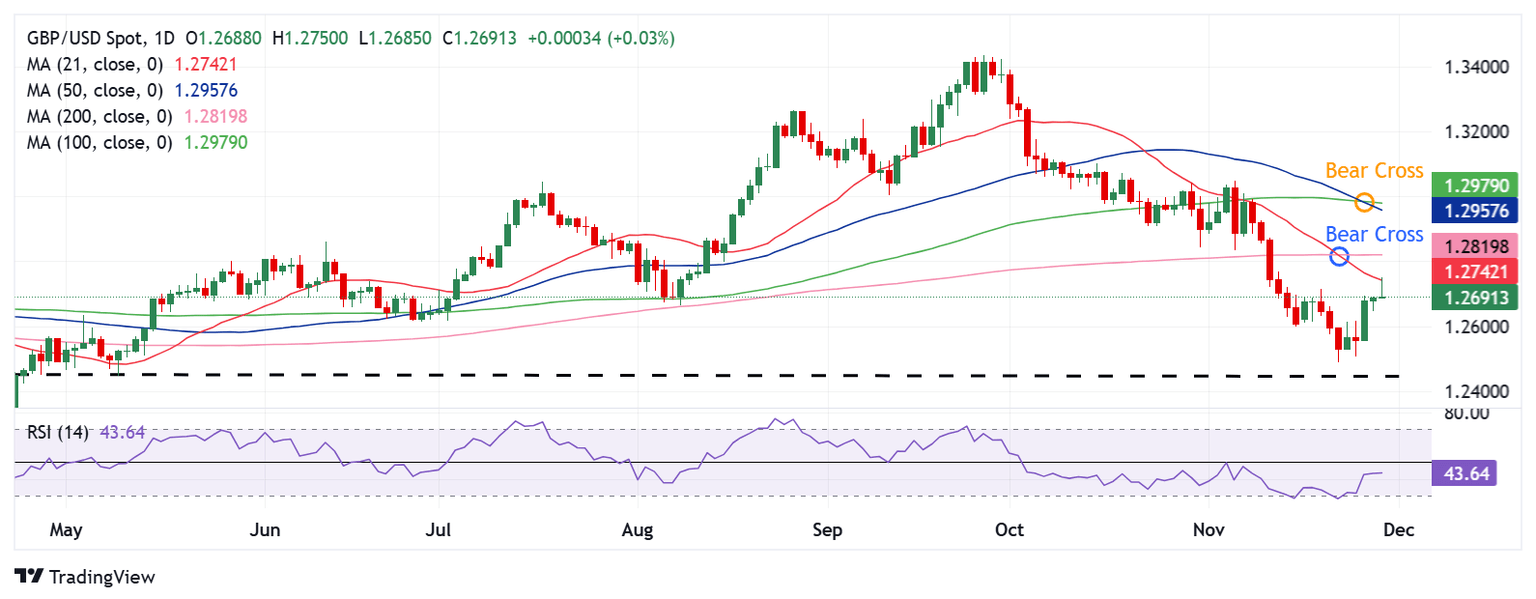

From a short-term technical outlook, the GBP/USD pair's downside risks remain intact as long as the 14-day Relative Strength Index (RSI) remains below the 50 level.

Despite the latest recovery, the leading indicators currently trade near 45.

Adding credence to the negative outlook, the pair charted dual Bear Crosses on the daily time frame.

On November 22, the 21-day Simple Moving Average (SMA) closed below the 200-day SMA, while the 50-day SMA cut the 100-day SMA from above on a daily closing basis on November 27.

The Pound Sterling needs a sustained break above the 200-day SMA at 1.2820 to initiate a meaningful uptrend toward the strong contention area near 1.2975, where the 50-day SMA and the 100-day SMA hang.

Further up, the 1.3000 psychological level could challenge the bearish commitments.

On the downside, strong support aligns at the 1.2600 round level, below which the weekly low of 1.2507 will be tested.

A failure to defend that level will open the downside toward the six-month low of 1.2487, followed by the May 9 low of 1.2446.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.