GBP/USD Forecast: Under pressure but around 1.3900

GBP/USD Current price: 1.3885

- The UK Marking Manufacturing PMI improved to 60.4 in July.

- Tensions related to the Northern Ireland Protocol undermine the pound’s demand.

- GBP/USD is at risk of falling in the near-term, mainly once below 1.3865.

The pound started the week with a weak tone, with GBP/USD falling to 1.3875, its lowest in three days. The pair peaked at 1.3932, helped by the UK Markit Manufacturing, which improved to 60.4 in July, as anticipated. Poor US data hit the market’s mood, leading to sharp Wall Street’s losses and mild demand for the safe-haven dollar. Persistent tensions around the Northern Ireland Protocol. The EU has paused its legal action against the UK for alleged breaches of the Northern Ireland Protocol last week but refused to review the Protocol that the UK wants to change.

The UK won’t publish macroeconomic data on Tuesday, with the focus on the BOE’s Super Thursday.

GBP/USD short-term technical outlook

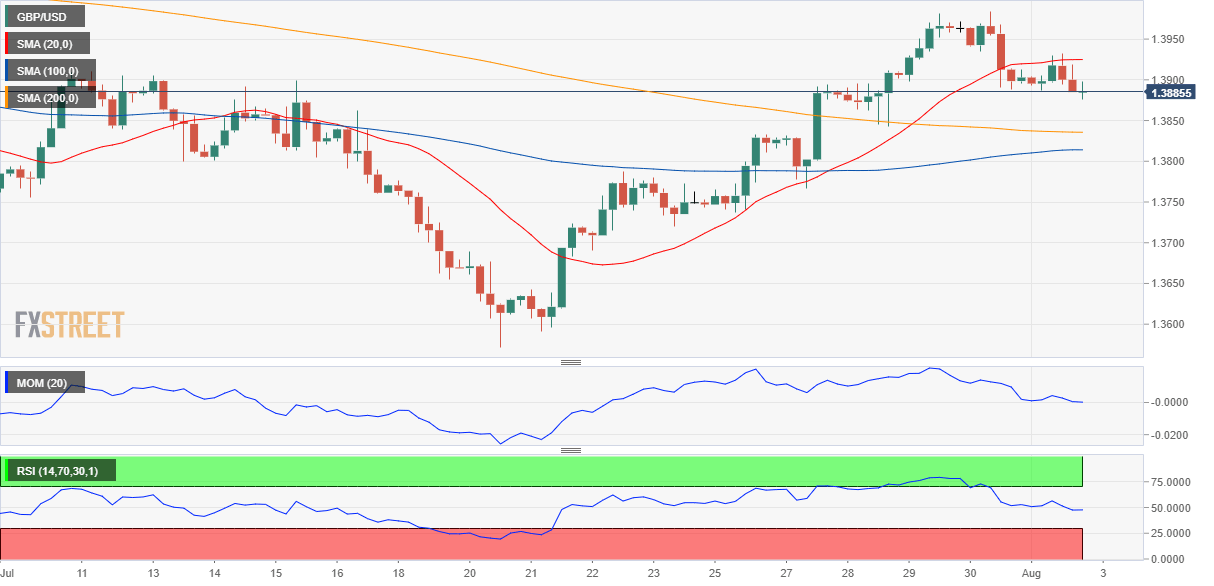

The GBP/USD pair trades a handful of pips below the 1.3900 level, and it is at risk of falling further. The 4-hour chart shows that it has been unable to advance beyond a flat 20 SMA, currently providing dynamic resistance around 1.3920. The longer moving averages are losing directional strength below the current level, while technical indicators are flat just below their midlines. Chances of a bearish continuation will likely increase on a break below 1.3865, the immediate support level.

Support levels: 1.3865 1.3820 1.3770

Resistance levels: 1.3920 1.3975 1.4020

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.