GBP/USD Forecast: Under mild-pressure, corrective decline may continue

GBP/USD Current price: 1.3678

- UK PM Boris Johnson hinted the government is planning a way out of lockdown.

- A scarce macroeconomic calendar in the United Kingdom seems to help pound.

- GBP/USD is easing within range, further slides expected once below 1.3655.

The GBP/USD pair has reached a higher high for the year at 1.3758 early London, to finally give up to risk aversion. The pair fell to 1.3658 as investors rushed into the safe-haven dollar at the beginning of the US session, to later bounce towards the current 1.3700 area. The UK didn’t publish macroeconomic data, but UK Prime Minister Boris Johnson hinted a way out of the current lockdown, as he expected to report in the next few weeks, “how to exit pandemic," adding that a perpetual lockdown is not the answer. He added that the government hopes to reopen schools by March 8.

The UK won’t publish macroeconomic data for the rest of the week, with the market instead focusing on US figures and UK coronavirus-related news.

GBP/USD short-term technical outlook

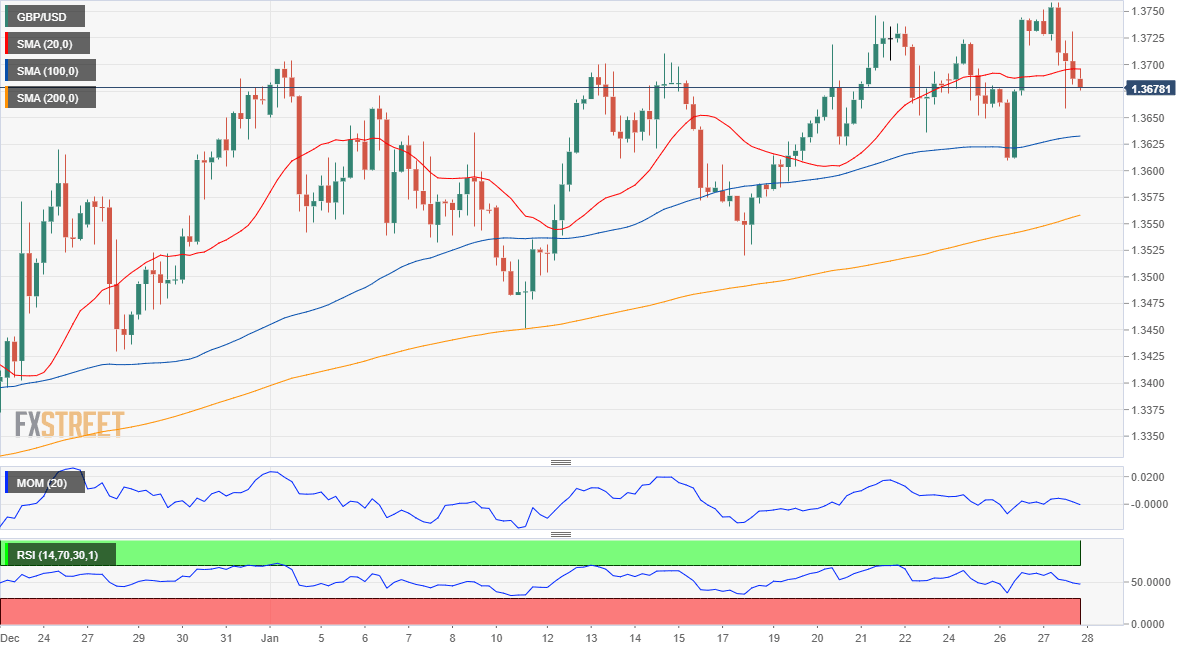

The GBP/USD pair trades below the 1.3700 level ahead of the Asian opening, as the pair seems resilient to the dollar’s demand. The near-term picture is neutral-to-bullish as it continues trading above the longer moving averages while struggling around the 20 SMA, which anyway lacks directional strength. Technical indicators are mute just above their midlines, indicating paused buying interest, instead of upward exhaustion. The pair still has room to advance, particularly if it storms through 1.3760. The pair could gain bearish strength in the near-term on a break below 1.3655

Support levels: 1.3655 1.3605 1.3560

Resistance levels: 1.3725 1.3760 1.3810

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.