GBP/USD Forecast: Sterling surrenders to King Dollar ahead of critical testimonies, levels to watch

- GBP/USD has been drifting lower amid a mixed market mood and after mixed UK jobs.

- The testimony by America's top economic officials is eyed.

- Tuesday's four-hour chart is showing bears are gaining ground.

"Build build build" – UK Prime Minister Boris Johnson's enthusiastic calls to boost Britain are now paling in comparison to plans coming from the other side of the pond. President Joe Biden's advisors have been putting the final touches on an ambitious $3 trillion infrastructure program which means a hotter US economy. That is boosting the dollar.

Moreover, broad investment in roads, trains, the internet, and also yet-to-be-defined "human infrastructure" mean elevated debt issuance. While ten-year Treasury yields have been stabilizing below 1.70%, that is likely a result of tensions ahead of critical testimonies later in the day.

Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell will appear before Congress and they are set to shed light on current conditions and expectations for the future. Republicans will likely quiz them on inflation prospects, especially with grand expenditure. The proposed infrastructure plan comes as the $1.9 coronavirus relief program is being deployed.

Fed Chairman Powell CARES Testimony: Mums the word on higher rates

In the UK, Johnson is not busy with the building but rather with calming nerves around vaccines. After the EU threatened to block exports of AstraZeneca doses made in the continent to Britain, London and Brussels are trying to find solutions that may assure the ongoing flow of jabs on both sides of the Channel. Any compromise from Johnson could slow the UK's vaccination campaign, but after reaching 50% of the population, the risk seems low.

In the meantime, the labor market is sending mixed signals. While the UK's Unemployment Rate surprisingly dropped to 5% in January, jobless claims shot up by 86,500 in February. The more recent figures seem to have the upper hand – adding to sterling's misery.

All in all, while the pound has reasons both to rise and fall, dollar strength is overwhelming.

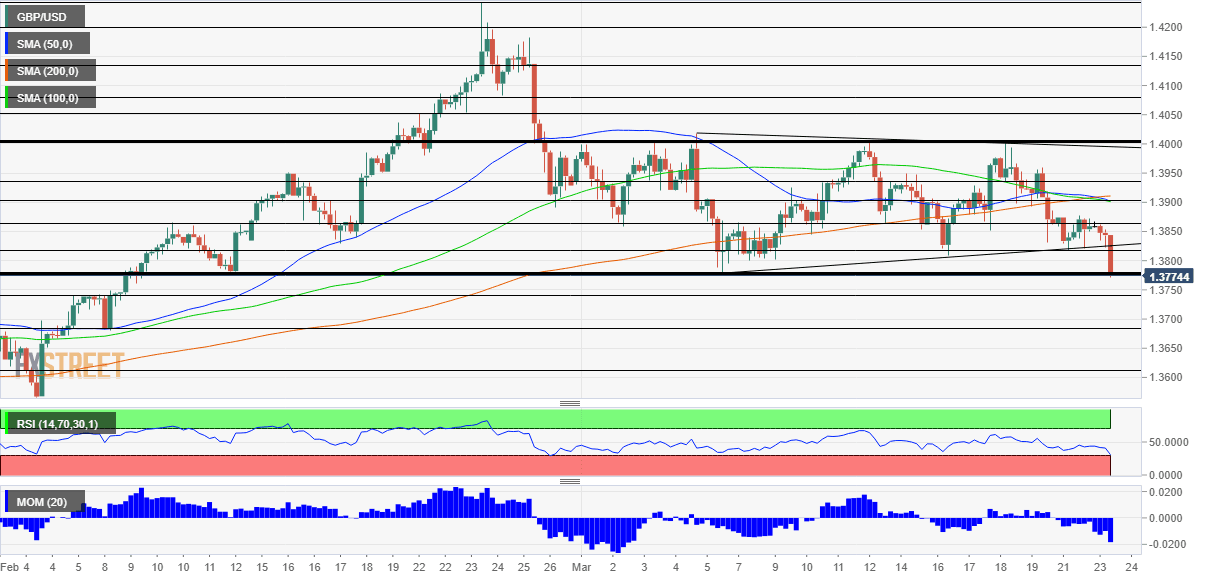

GBP/USD Technical Analysis

Pound/dollar has slipped below 1.3775, which was the previous March low, and also provided support in mid-February. At current levels, cable is back to where it was early in February. Momentum remains to the downside and the pair trades below the 50, 100 and 200 Simple Moving Averages.

If the break below 1.3775 is confirmed, the next cushion is at 1.3745, which capped GBP/USD in early February. It is followed by 1.3580, a support line from the same period, and then by 1.3610 and by 1.3565.

Some resistance is at 1.3810, a support line from last week, followed by 1.3860. Further above, the three SMAs converge around 1.39.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.