GBP/USD Forecast: Sterling sinks on Delta doom and gloom, bears eye 1.3565

- GBP/USD has hit a fresh five-month low as worries about the Delta covid variant rise.

- The dollar's break from rising looks temporary as investors remain nervous.

- Tuesday's four-hour chart is pointing to oversold conditions.

Do not travel to the UK – that is the message from US authorities in response to the surge in COVID-19 cases in the UK. Putting Britain in Level Four may have also come as fears of an even quicker spread of the Delta variant have risen. This American jab adds to sterling's misery.

Brits were supposed to celebrate "Freedom Day" – the removal of almost all coronavirus-related restrictions, but July 19 proved to be a gloomy Monday. Prime Minister Boris Johnson was forced to stay locked indoors as he was "pinged" by the system. The PM was called to quarantine after coming in contact with Health Secretary Sajid Javid, who tested positive for the virus.

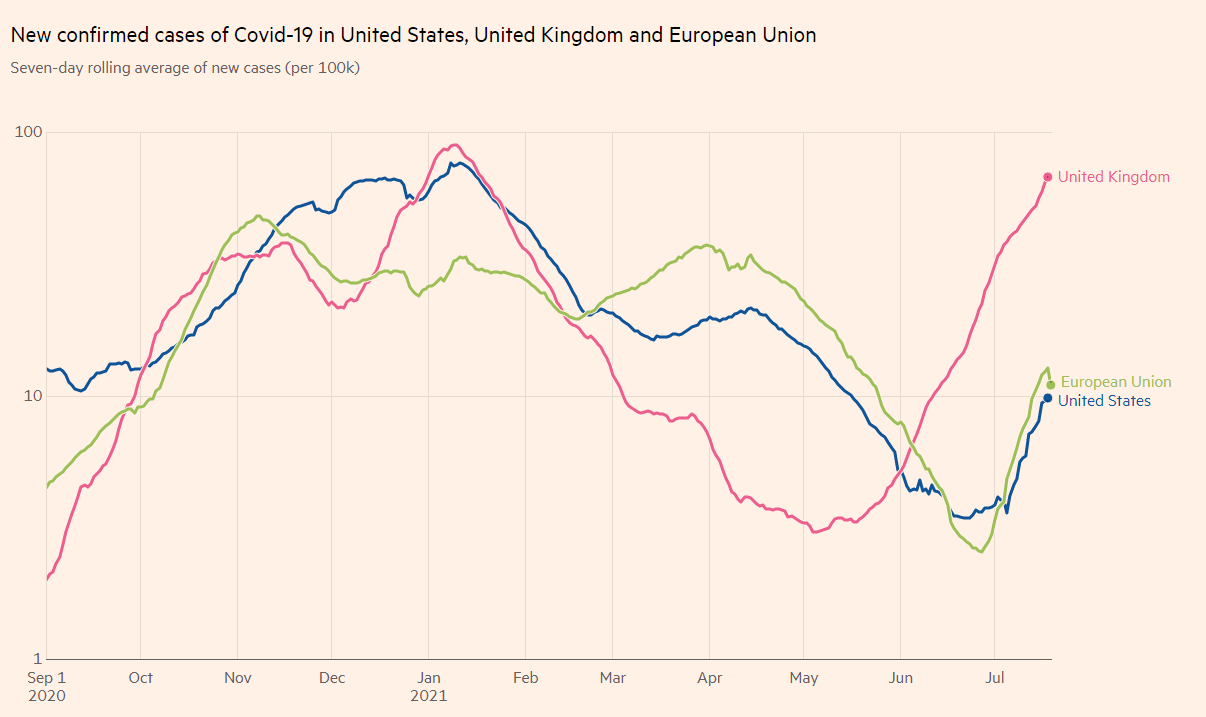

The seven-day rolling average of new cases per 100,000 is nearing the January peak:

Source: FT

Moreover, activity in London seemed similar to the previous week, with workers and employers reluctant to ditch social distancing rules and return to the office. Britain's caseload remains in the tens of thousands, while hundreds of thousands were called to isolate in what is now dubbed "pingdemic."

GBP/USD's tumble below the 1.3670 double-bottom was also exacerbated by the risk-off mood in markets, which favors a light to the safety of the US dollar. The delta strain is spreading rapidly all over the world, causing investors a rethink the economic recovery. The dollar's breather early on Tuesday and cable's inability to take advantage of it is a bearish sign. A currency pair that cannot recover is set to tumble.

The long list of countries includes America, but the greenback's special status means it benefits – even if US Treasury yields collapse. Returns on the benchmark 10-year bonds slipped under 1.20% on Monday.

Delta Doom is set to storm America, the dollar could emerge as top dog

Can the ship turn around? Advanced vaccination campaigns in the US and especially the UK should keep hospitalizations and deaths at low levels – this wave is far less deadly than the previous ones. However, the suffering has yet to peak – it is still not the time to buy the Delta dip.

In the meantime, sterling was also hit by dovish comments from Monetary Policy Committee member Jonathan Haskel, who prefers refraining from tightening. Brexit issues continue weighing on the pound. The EU and the UK remain at loggerheads around the Northern Irish protocol.

All in all, fundamentals point to further falls.

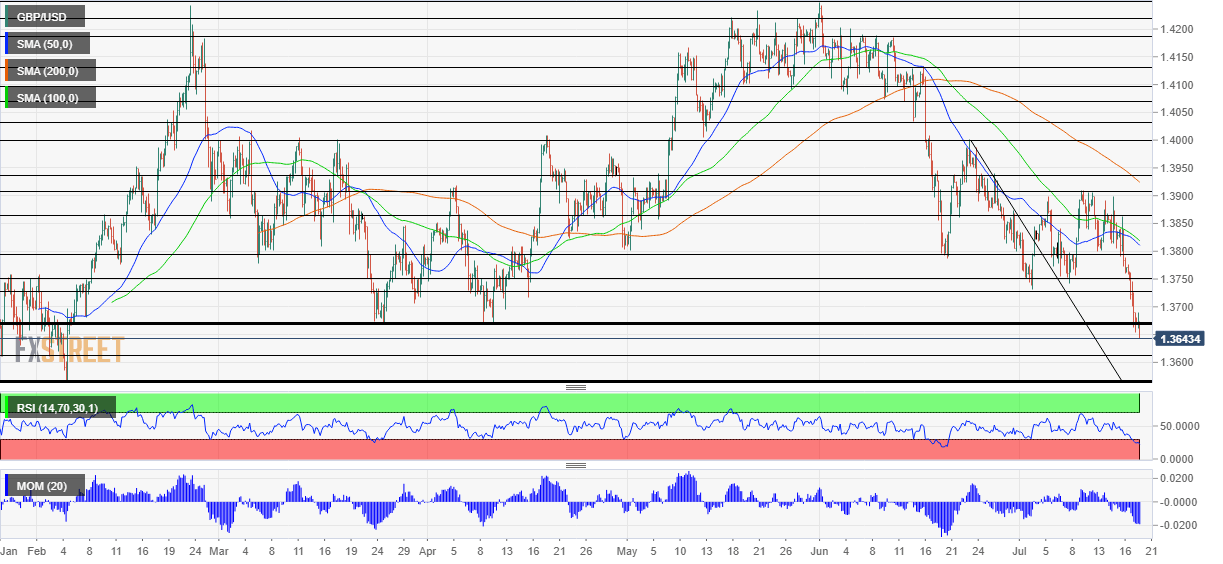

GBP/USD Technical Analysis

Pound/dollar is experiencing oversold conditions according to the Relative Strength Index on the four-hour chart. The RSI is below 30. That implies a temporary bounce before another dip, supported by other bearish indicators such as downside momentum and the pair's trading below the 50, 100 and 200 Simple Moving Averages.

Immediate support is at 1.3627, the fresh five-month low. The next cushion is at 1.3610, a support line from early in the year. The critical level to watch is 1.3565, which is the February trough. Further down, 1.3450 awaits GBP/USD bears.

The broken double bottom of 1.3670 switches to resistance. It is followed by 1.3730, 1.3750 and 1.38, all levels that provided support before the recent fall.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.