GBP/USD Forecast: Selling opportunity? Dead-cat bounce leaves critical support in danger

- GBP/USD has bounced off the lows as the dollar takes a breather from gains.

- Rising covid cases, Brexit and infrastructure uncertainty in the US weigh on the pair.

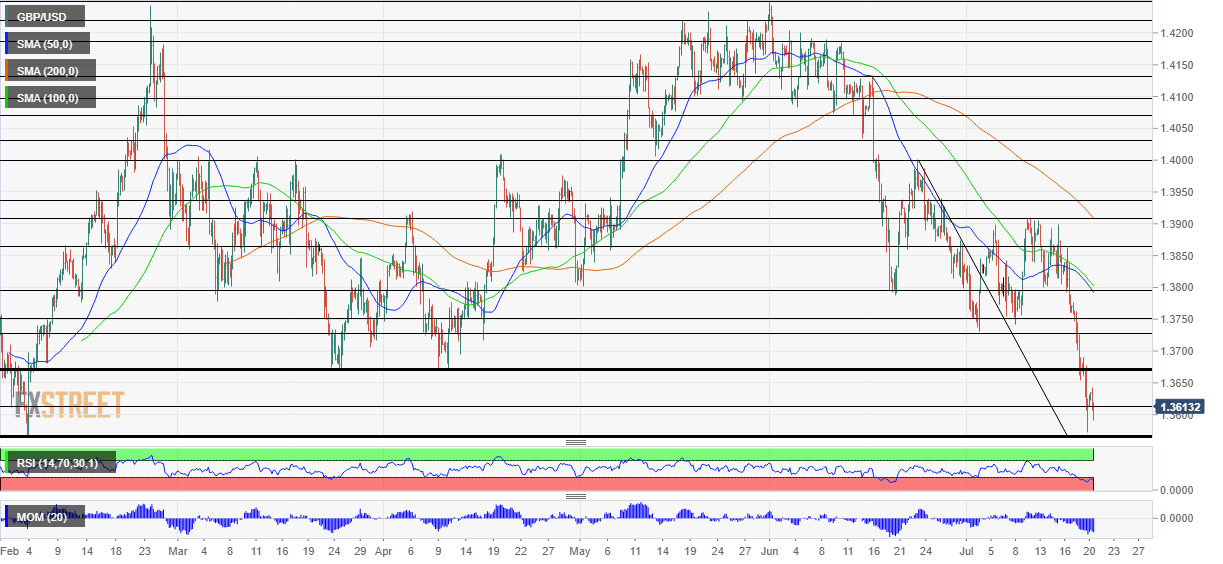

- Wednesday's four-hour chart is showing that the pair is exiting oversold conditions.

Every trend has a countertrend – yet if the move in the opposite direction has no justification, it could prove short-lived. GBP/USD has bounced off the fresh five-month low of 1.3570 as the dollar has taken a break from gains. The greenback is falling as Treasury yields rise – a change in correlation. It seems that demand for bonds and the dollar are now linked.

Markets' "Turnaround Tuesday" has helped cable climb from the abyss, but it is hard to find any noteworthy fundamental change that justifies an upswing. First and foremost, COVID-19 cases remain elevated in Britain, nearing 50,000 per day once again. Vaccinations slow the increase in hospitalizations and deaths, but cannot fully keep them down.

Source: FT

Britain's abandonment of covid restrictions is seen as a gamble in the UK and outside it – weighing on cable. Infections are surging in America, but remain at relatively low levels. Moreover, the dollar is a safe haven – benefiting from concerns about global growth. Markets can sour as quickly as they recovered, and any "Turnaround Tuesday" could be followed by a "Wobbly Wednesday."

Delta Doom is set to storm America, the dollar could emerge as top dog

Brexit is another topic that keeps pressure on the pound, just by refusing to die. The EU and the UK remain at loggerheads about the Northern Irish protocol, in a clash that was supposed to be delayed to after the summer.

In the US, the Senate is set to hold an initial vote on a bipartisan infrastructure bill later in the day – and it is unclear if it could muster enough support. Uncertainty in Washington adds to market fears.

All in all, there are no fundamental reasons for cable to climb back up.

GBP/USD Technical Analysis

Pound/dollar's bounce makes sense when looking at the Relative Strength Index (RSI) on the four-hour chart – it dropped below 30, entering oversold conditions. However, this recovery is only enough to push the RSI above 30 and could end in a "dead-cat bounce" – one that is followed by a downfall.

GBP/USD continues suffering from downside momentum and trades below the 50, 100 and 200 Simple Moving Averages on the four-hour chart.

Critical support awaits at the 1.3565-1.3570 region. Cable hit 1.3565 back in February and is now forming a double-bottom. If the pair tumbles below that line, the next significant support line is only 1.3450.

Some resistance is at 1.3670, a former double-bottom that collapsed earlier this week, and the by 1.3730 and 1.3750.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.