GBP/USD Forecast: Pound Sterling fails to attract buyers ahead of BoE

- GBP/USD trade below 1.3000 in the European session on Thursday.

- The BoE is widely anticipated to leave the policy rate unchanged.

- The near-term technical outlook highlights a lack of buyer interest.

GBP/USD stays on the back foot and trades in negative territory below 1.3000 in the European morning on Thursday as markets assess the latest data releases from the UK, while waiting for the Bank of England's (BoE) policy announcements.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.27% | 0.24% | -0.10% | 0.15% | 0.63% | 0.83% | -0.11% | |

| EUR | -0.27% | -0.04% | -0.36% | -0.12% | 0.36% | 0.57% | -0.37% | |

| GBP | -0.24% | 0.04% | -0.33% | -0.09% | 0.40% | 0.61% | -0.33% | |

| JPY | 0.10% | 0.36% | 0.33% | 0.24% | 0.72% | 0.91% | 0.07% | |

| CAD | -0.15% | 0.12% | 0.09% | -0.24% | 0.48% | 0.69% | -0.26% | |

| AUD | -0.63% | -0.36% | -0.40% | -0.72% | -0.48% | 0.21% | -0.72% | |

| NZD | -0.83% | -0.57% | -0.61% | -0.91% | -0.69% | -0.21% | -0.96% | |

| CHF | 0.11% | 0.37% | 0.33% | -0.07% | 0.26% | 0.72% | 0.96% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The Federal Reserve left the policy rate unchanged at 4.25%-4.5% following the March meeting, as expected. The revised Summary of Economic Projections (SEP), also known as the dot plot, showed that policymakers still project a total of 50 basis points (bps) reduction in rates in 2025. Although the US Dollar (USD) struggled to gather strength with the immediate reaction, it managed to find a foothold during Fed Chairman Jerome Powell's press conference.

Powell reiterated that they will not be in a hurry to move on rate cuts, adding that they can maintain policy restraint for longer if the economy remains strong.

In the European morning on Thursday, the UK's Office for National Statistics (ONS) reported that the ILO Unemployment Rate held steady at 4.4% in the three months to January, matching the market forecast. Other details of the jobs report showed that the Employment Change was up by 144,000 in this period. Finally, annual wage inflation, as measured by the changed in the Average Earnings Including Bonus, declined to 5.8% from 6.1%.

The BoE is forecast to maintain the bank rate at 4.5%. Since there will not be a press conference, investors could react to the vote split. In case the BoE leaves the rate unchanged but three or four policymakers vote in favor of a rate cut, Pound Sterling could come under selling pressure with the immediate reaction. On the other hand, a unanimous vote could have the opposite impact on the currency's valuation, allowing GBP/USD to gain traction.

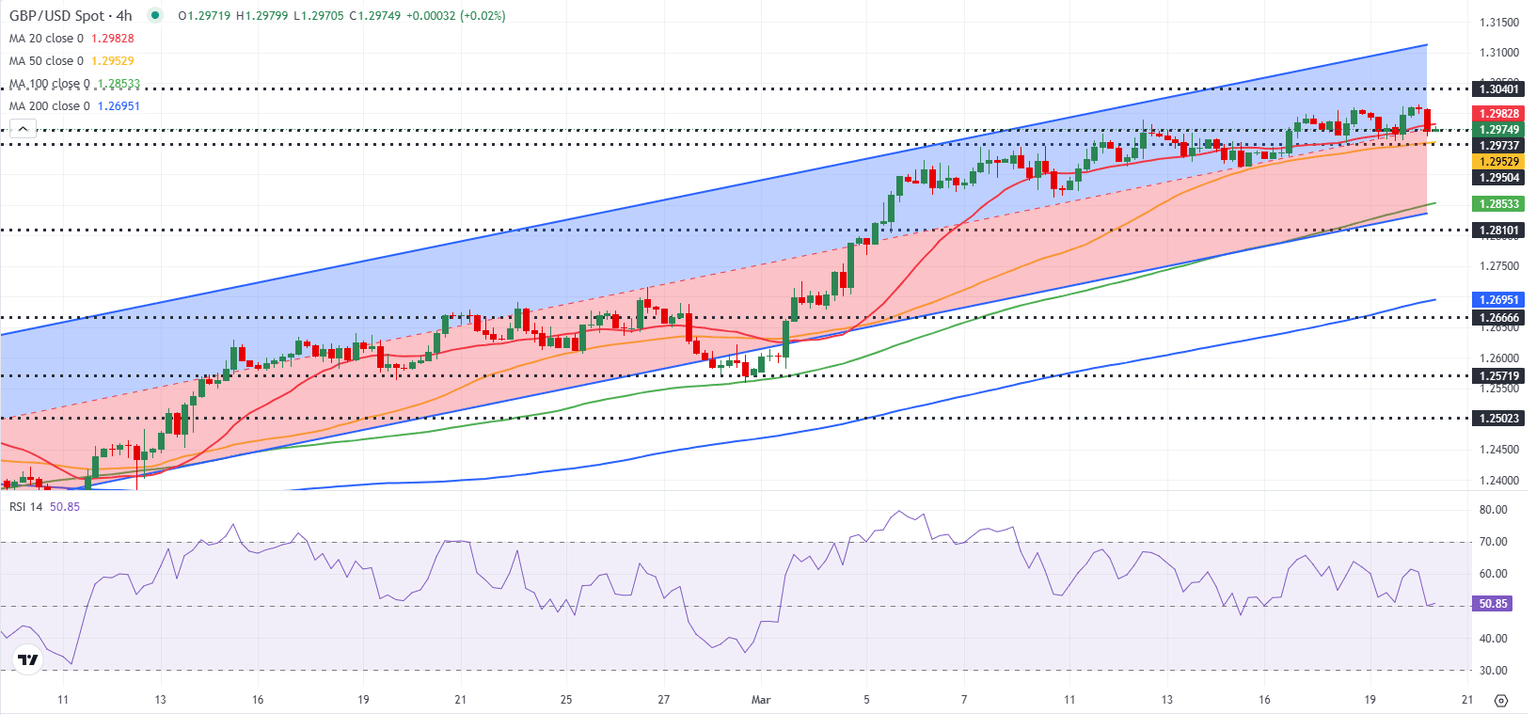

GBP/USD Technical Analysis

The Relative Strength Index on the 4-hour chart stays near 50 and GBP/USD's last 4-hour candle closed slightly below the 20-period Simple Moving Average (SMA) and the mid-point of the ascending regression channel, reflecting a lack of buyer interest.

In case GBP/USD confirms 1.2970 (mid-point of the ascending channel) as resistance, technical sellers could remain interested. In this scenario, 1.2900 (round level, static level) could be seen as next support before 1.2850 (lower limit of the ascending channel, 100-period SMA).

On the upside, resistances could be seen at 1.3000 (static level, round level), 1.3040 (static level) and 1.3120 (upper limit of the ascending channel).

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.