GBP/USD Forecast: Pound keeps ignoring Brexit threat

GBP/USD Current price: 1.3200

- EU chief negotiator Barnier said a deal must be achieved before October 31.

- The greenback remained on the back-foot ahead of US Fed’s Powell speech.

- GBP/USD is trading at the upper end of its monthly range, but its bullish potential is limited.

The GBP/USD is up for a second consecutive day, trading around the 1.3200 level by the end of the US session. The pair surged from a daily low at 1.3116, reached after the release of encouraging US data, which anyway was not enough to support the dollar. The advance seems linked to investor’s cautious approach to the greenback ahead of Fed’s Powell speech on Thursday rather to resurgent demand for the sterling.

Meanwhile, EU´s chief negotiator set a final date for a UK-EU trade deal. "If we are to ensure the ratification of a new treaty in a secure way before the end of the year, we need to have an agreement by around October 31,” Barnier said. The news did not have an impact on the UK currency, yet for sure, is a negative factor that sooner or later will drag in. The UK’s macroeconomic calendar will remain empty on Thursday.

GBP/USD short-term technical outlook

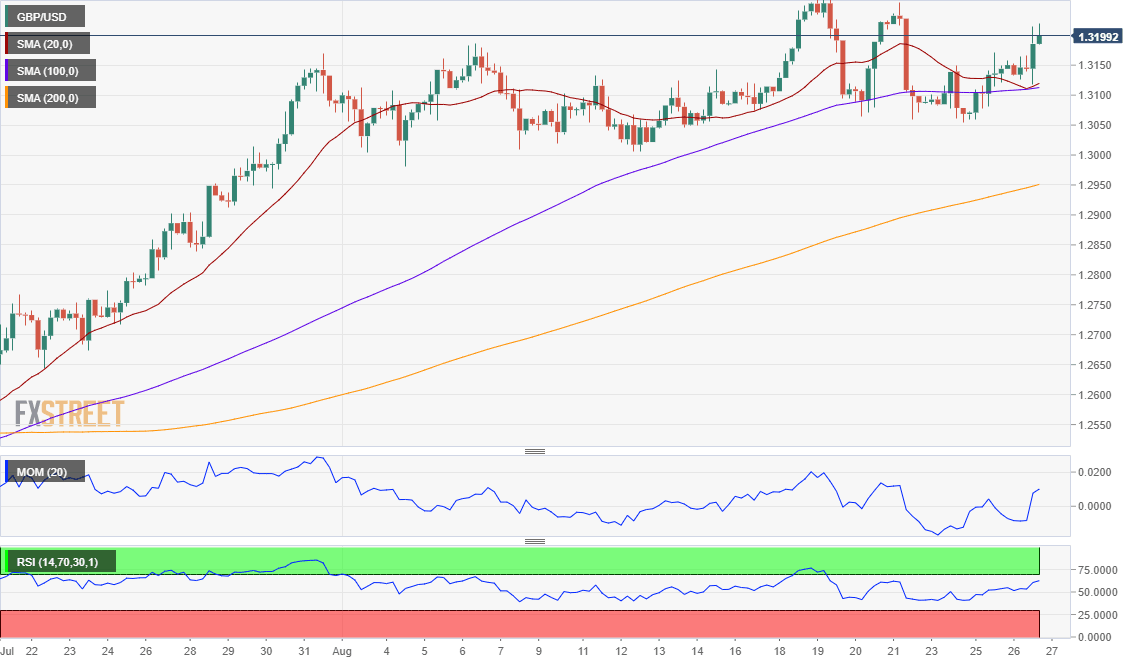

The GBP/USD pair is near the upper end of its latest range, yet still inside its monthly range. In the 4-hour chart, the pair has managed to advance above its moving averages, although the 20 and 100 SMA remain directionless and converging around 1.3120. Technical indicators advanced within positive levels but already lost their upward strength, indicating decreasing buying interest at the current levels.

Support levels: 1.3170 1.3120 1.3085

Resistance levels: 1.3250 1.3290 1.3330

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.