GBP/USD Forecast: Pound is weaker on Brexit woes

GBP/USD Current price: 1.3189

- UK PM Boris Johnson’s office said the UK would prosper even without a deal with the EU.

- UK Secretary of State for Health and Social Care Matt Hancock hopeful about a vaccination program.

- GBP/USD is losing positive momentum, may gain bearish strength in the near-term.

The GBP/USD pair peaked for the day at 1.3242 amid the ruling upbeat mode but is ending the day in the red sub-1.3200, as the pound got hit by discouraging Brexit-related news. An EU official said that it might be too late already to clinch a trade deal, while UK PM Boris Johnson’s office said in a statement that they are confident that the UK will prosper if they fail to reach a trade deal with the EU.

Meanwhile, UK PM Johnson has self-isolated after having close contact with a coronavirus case, although he is well and without symptoms. PM Johnson has already contracted COVID-19 back in April. The number of COVID-19 contagions in the UK stays above 20K per day despite the ongoing restrictive measures. However, UK Secretary of State for Health and Social Care Matt Hancock, said he is hopeful a vaccination program will be ready to go next December. The UK calendar has nothing relevant to offer this Tuesday.

GBP/USD short-term technical outlook

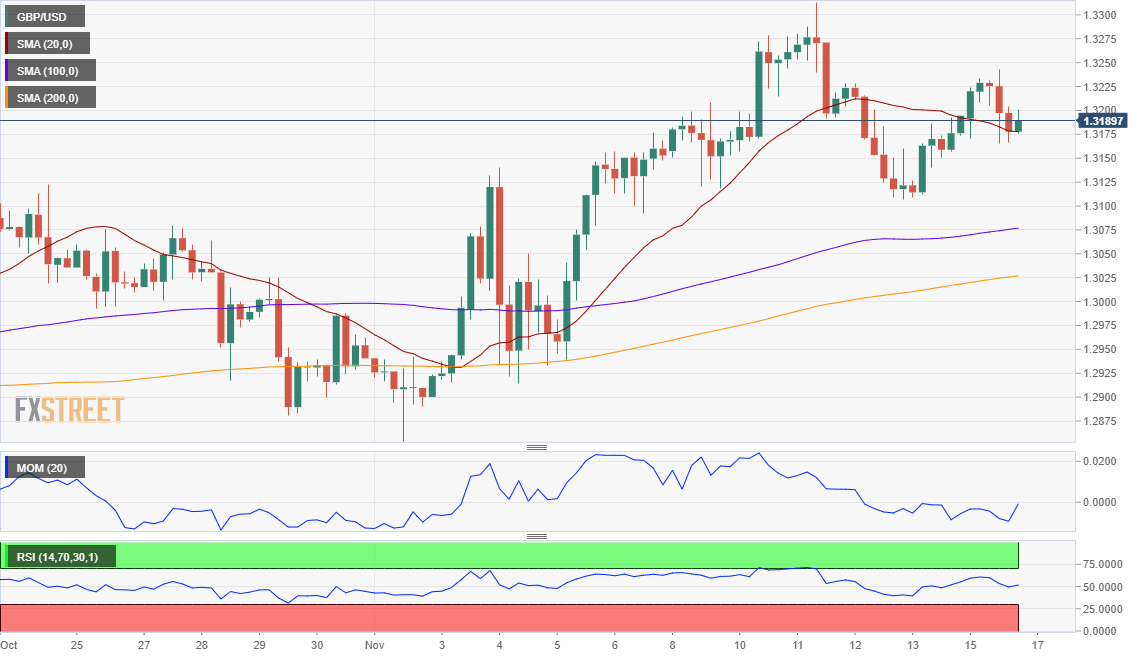

The GBP/USD pair is trading a handful of pips below the 1.3200 level, neutral in the near-term. The 4-hour chart shows that the price has spent the day hovering around a bearish 20 SMA, now a few pips above it. The larger moving averages remain well below the current level, while technical indicators lack directional strength around their midlines. The pair bottomed for the day at 1.3165, with further declines expected on a break below the level.

Support levels: 1.3165 1.3120 1.3070

Resistance levels: 1.3220 1.3260 1.3310

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.