GBP/USD Forecast: Northern lockdown for the pound? Extremely overbought conditions can trigger fall

- GBP/USD has surged above 1.31 amid a massive dollar sell-off.

- The new lockdown in parts of northern England and end-of-month flows may trigger a correction.

- Friday's four-hour chart is pointing to extremely overbought conditions.

North in Lockdown 2 – the headline of one of Britain's tabloids sums up the developments with which around 4.3 million Brits living in Manchester and in other parts of northern England have to deal with. The spike in cases in these regions triggered an announcement late on Thursday, triggering confusion.

Nevertheless, GBP/USD has extended its relentless northbound ride – stemming in full from the dollar's weakness. The greenback is suffering from a multitude of reasons. Safe-haven flows continue unwinding while speculation of further Fed stimulus – as Yield Curve Control (YCC) are pushing returns on bonds lower, dragging the dollar down with them.

US Gross Domestic Product for the second quarter came out better than expected – but still a devastating 32.9% annualized drop. Moreover, continuing claims for the week ending July 17 – the period when Non-Farm Payrolls surveys are conducted – disappointed by topping 17 million.

Personal income and spending figures for June and the revised University of Michigan's Consumer Sentiment Index for July are of interest later in the day.

See Personal Income, Spending, and Prices June Preview: After all the agony just an average quarter?

While the UK seems to slap restrictions before coronavirus cases leap, some US states are not as strict – or at least the outcomes are far from satisfying. The caseload has stabilized at a high rate of around 70,000 per day while daily deaths continue advancing, surpassing the 1,200 level on average.

And while the UK government is keen on providing relief and stimulus, American lawmakers continue tussling on the next steps while the unemployed are losing their special federal benefits. Optimism about progress in talks between Republicans and Democrats may help the dollar – but investors will believe it when they see it.

Nevertheless, the surge in GBP/USD may screech to a halt – at least on the last day of the month. Money managers may rush to adjust their portfolios and this phenomenon may favor a correction.

GBP/USD Technical Analysis

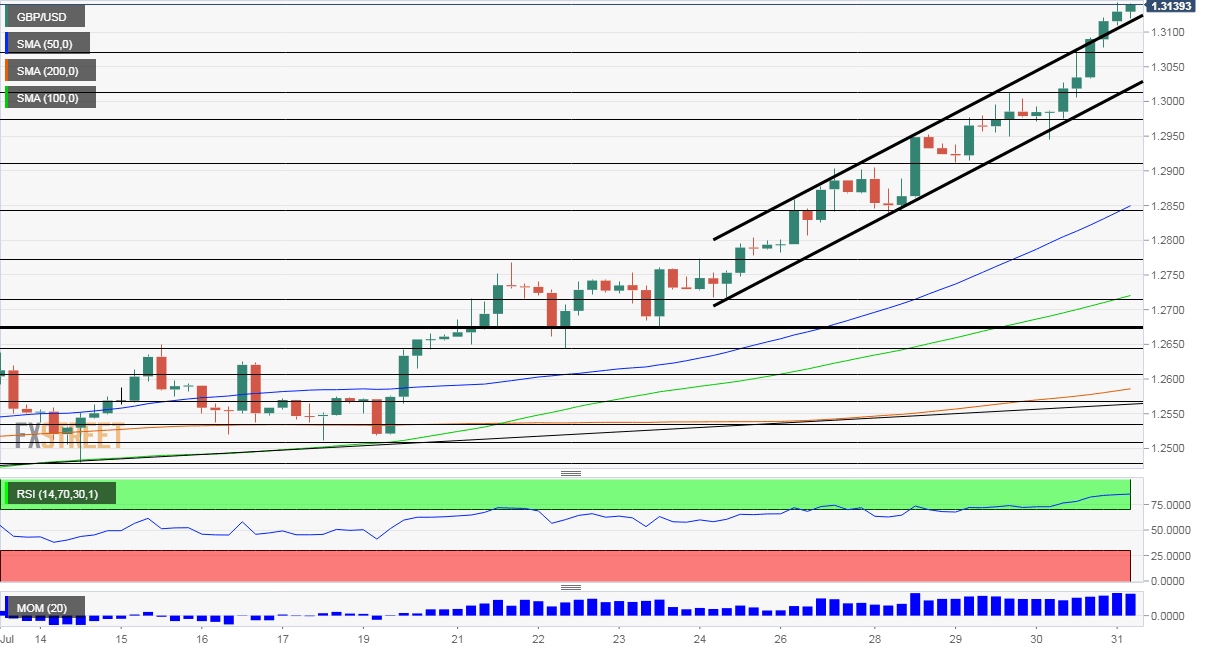

The Relative Strength Index on the four-hour chart is pointing to extremely overbought conditions, around 85. Pound/dollar appears over-stretched also on the daily chart. Cable broke above the uptrend channel that had accompanied it since last week, but this move may prove unsustainable.

The recent high of 1.3145 is the first level to watch. It is followed by 1.32, a high point in March. Further above, 1.3270 and 1.3330 are the next level to watch.

Support awaits at 1.3070, a line that played a role in February. The next cushion is 1.3010, a temporary resistance line on the way up. Next, 1.2970 and 1.2910 await it.

More Where next for the dollar, stocks and the US economy after downbeat data and the Fed

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.