GBP/USD Forecast: BOE doves could weigh on Pound Sterling

- GBP/USD has gone into a consolidation phase below 1.2400 early Thursday.

- Bank of England is forecast to lift its policy rate to 4%.

- The vote split and Governor Bailey's comments could trigger the next big action.

GBP/USD has lost its bullish momentum after having recovered toward 1.2400 on Wednesday. Investors refrain from betting on further Pound Sterling strength ahead of the Bank of England's (BOE) policy announcements and the near-term technical outlook points to a lack of buyer interest.

Despite the heavy selling pressure surrounding the US Dollar late Wednesday, GBP/USD's gains remain limited, especially when compared to EUR/USD.

Although FOMC Chairman Jerome Powell reiterated that additional rate increases will be appropriate following the decision to raise the policy rate by 25 basis points, his acknowledgement of disinflation in goods triggered a US Dollar selloff. Powell also admitted that a faster than expected decline in inflation will be reflected in future policy decisions, keeping hopes high for a policy pivot later in the year.

On Thursday, the BOE is expected to raise its policy rate by 50 bps to 4% from 3.5%. In December, two members of the BOE's Monetary Policy Committee (MPC), Tenreyro and Dhingra, voted to keep rates unchanged at 3% while Mann voted to raise it to 3.75%.

At this point, a 25 bps BOE rate hike would be a dovish surprise and weigh heavily on the Pound Sterling. Even if the bank goes for a 50 bps increase but three or four members vote for a smaller hike, or a no-change, GBP/USD is likely to extend its slide. On the other hand, the pair could regain its traction if members who voted for a no-change in December turn hawkish and vote for a 50 bps hike.

BoE Interest Rate Decision Preview: The last 50 bps hike but not the end yet.

BOE Governor Andrew Bailey's comments on the policy outlook should impact Pound Sterling's valuation following the initial reaction to the policy statement. Although the UK economy is widely anticipated to tip into recession this year, latest data releases suggest that the economy could be more resilient than initially estimated. In case Bailey adopts a more optimistic tone on the growth outlook, the Pound Sterling could stay resilient against its rivals. On the flip side, Bailey could force GBP/USD to come under renewed bearish pressure if he signals that they are approaching the end of the tightening cycle.

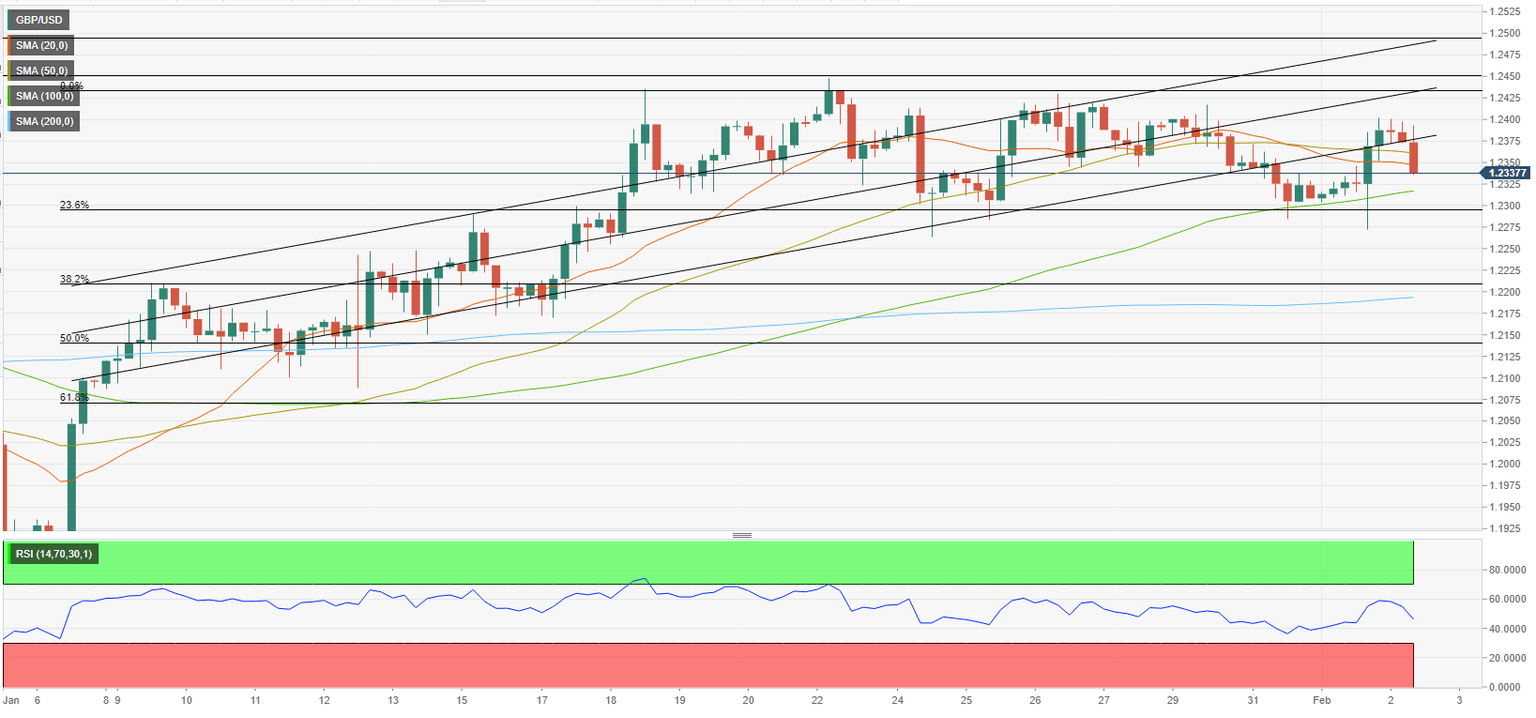

GBP/USD Technical Analysis

GBP/USD failed to stay within the ascending regression channel coming from early January after having recovered within it late Wednesday. Additionally, the pair was last seen trading below the 20 and the 50-period Simple Moving Averages (SMA) on the four-hour chart with the Relative Strength Index (RSI) indicator dropping below 50, highlighting the lack of buyer interest.

On the downside, the 100-period SMA aligns as first support at 1.2325 ahead of 1.2300 (psychological level, Fibonacci 23.6% retracement of the latest uptrend). A four-hour close below the latter could attract sellers and cause the pair to decline toward 1.2270 (static level) and 1.2210 (Fibonacci 38.2% retracement).

1.2360 (50-period SMA) forms interim resistance before 1.2400 (psychological level, static level). If buyers manage to flip the latter into support, GBP/USD could extend its recovery toward 1.2450 (static level, mid-point of the channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.