GBP/JPY makes a backflip, but patience needed

-

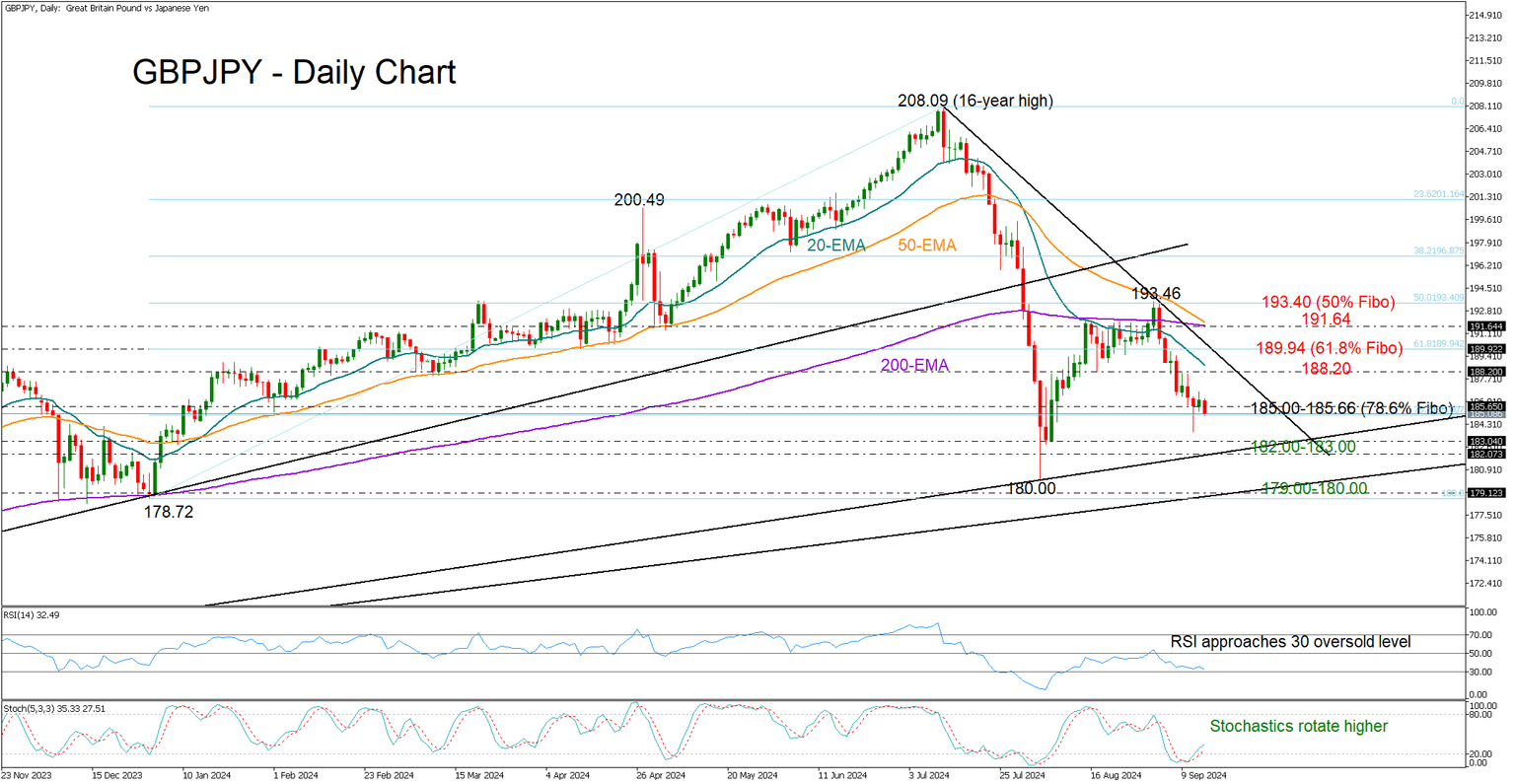

GBPJPY resumes negative momentum, but hopes for a pivot remain.

-

Sellers need a close below 185.65 to take full control.

GBPJPY came under renewed downside pressure after closing Thursday’s session with mild gains around 186.00.

The pair shifted from a recent low of 183.70 earlier this week, forming a hammer candlestick and giving hope for a potential upward reversal. If the bears manage to close below 185.00-185.65 today, the candlestick pattern may not be a reliable signal despite the RSI and stochastic oscillator being near oversold levels.

A continuation lower could retest August’s base of 183.00, while slightly beneath that, the price could meet the support trendline, which joins the lows from 2022 and 2024 at 182.00. Breaking that floor too, the sell-off could pick up steam towards the 180 psychological level or closer to the extension of the ascending trendline last seen in Q1 2023 at 179.00.

To improve the short-term outlook above September’s high of 193.46, the bulls will have to put in a lot of effort. The 20-day exponential moving average (EMA) could be the first obstacle near 188.20. Then, some congestion might occur around 189.84, where the 61.8% Fibonacci retracement of the 2024 uptrend is placed. Further up, the door will open for the 50- and 200-day EMAs currently seen around 191.64.

Overall, GBPJPY has not escaped downside risks, though it could postpone any further selling if it manages to close above 185.00-185.65 once again.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.