GBP/JPY charts new high but with caution [Video]

-

GBP/JPY loses momentum after charting new high.

-

Downside moves likely; resistance within 188.00-189.00 area.

![GBP/JPY charts new high but with caution [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/GBPJPY/iStock-1151541926_XtraLarge.jpg)

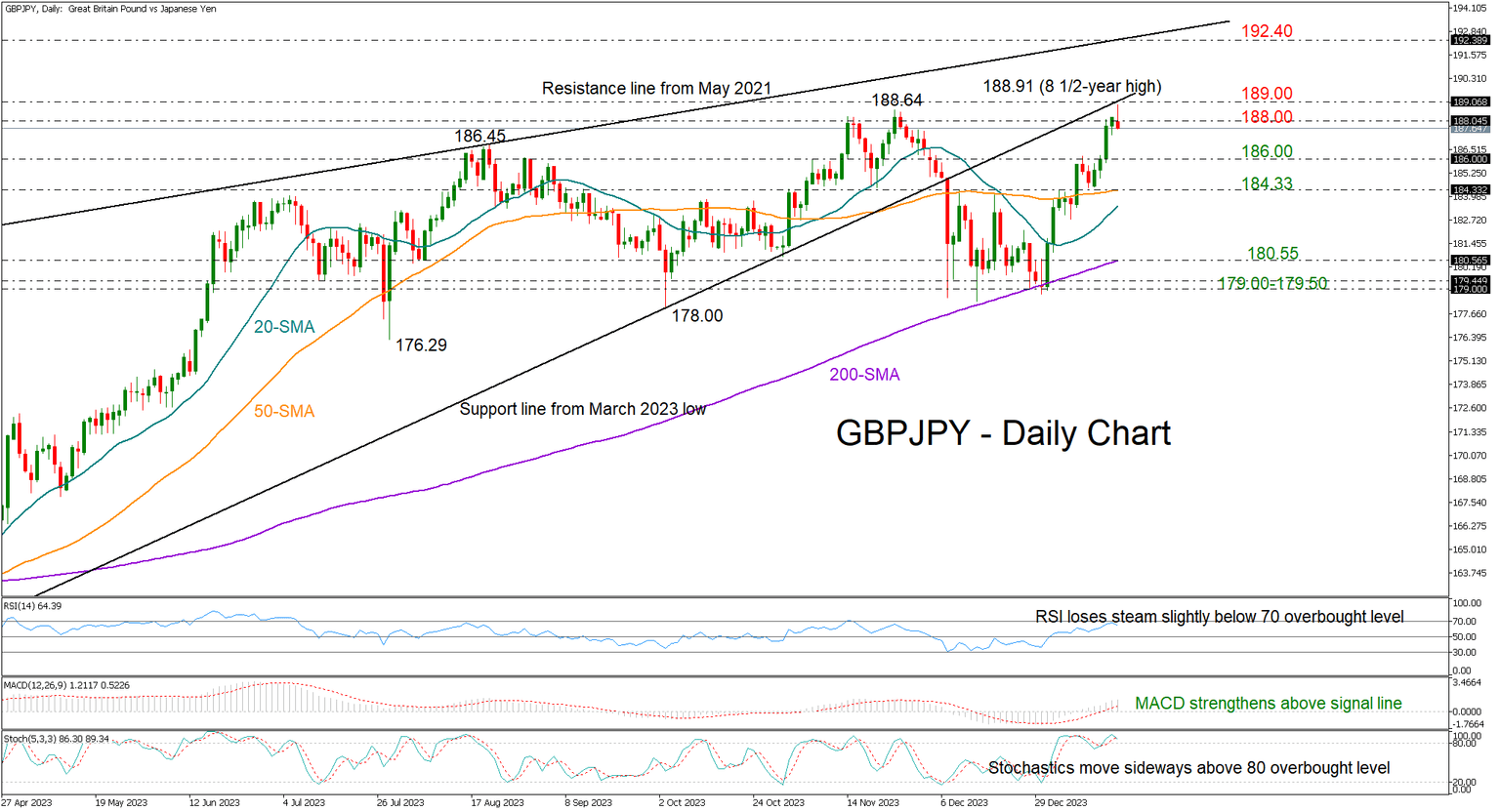

GBPJPY ascended almost vertically after touching its 200-day simple moving average (SMA) at the start of January, erasing its latest bearish wave to print a new higher high of 188.90 on Friday—the highest level since August 2015.

The 188.00 round level remains a tough obstacle, as the technical indicators detect some skepticism among investors. Specifically, the stochastic oscillator keeps fluctuating sideways within the overbought region and the RSI seems to be losing steam slightly below its 70 overbought level, suggesting room for improvement could be limited.

An extension above the 189.00 mark, where the upward-sloping line from the March 2023 low is placed, could clear the way towards the tough resistance line from May 2021 at 192.40. Additional gains from there could stabilize around the 2015 ceiling of 195.30-195.85.

Should the 188.00 barrier stand firm, the pair could initially seek support near the 186.00 constraining zone and then somewhere between its 50- and 20-day simple moving averages (SMAs) at 184.33 and 183.50, respectively. The 200-day SMA could be the next destination at 180.60, a break of which could immediately bring the 179.00-179.50 floor under examination.

In brief, GBPJPY is facing some difficulty in surpassing November’s wall around the 188.00 number, while the 189.00 mark could be another challenge as overbought signals are present.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.