GBP/JPY: Bulls and bears battle for control

- GBP/JPY stabilizes its decline at the bottom of a bullish channel.

- Short-term signals reveal some improvement in sentiment.

- A bullish outlook could emerge above 210.70.

GBP/JPY is set to complete the week on the sidelines, consolidating February’s aggressive decline from 214.99 near a two-month low of 207.22, as Japan’s Prime Minister seeks the right elixir to achieve her pledged stimulative Abenomics-style policy while simultaneously easing the ballooning government debt.

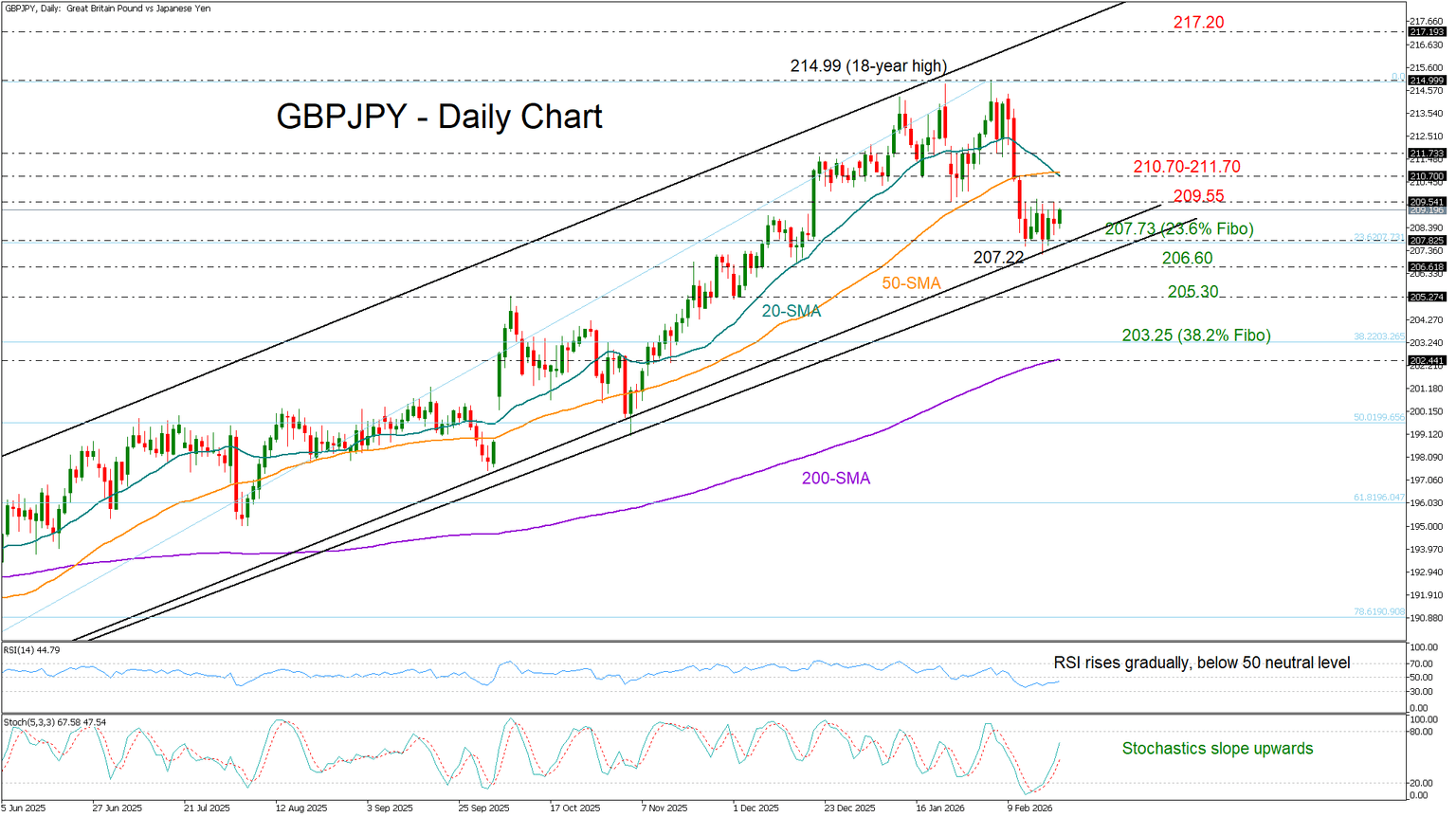

In technical news, the pair appears to be trading near a critical support region, around the 23.6% Fibonacci retracement of the almost one-year-old upleg at 207.73 and at the lower band of a bullish channel. Strikingly, the weekly sideways pattern seems to be taking the shape of an inverse head and shoulders formation on the four-hour chart, with a neckline at 209.55, providing some optimism that the next move in price could be to the upside.

Still, the bar for a positive outlook remains higher, above the 20- and 50-day simple moving averages (SMAs), which are printing a bearish crossover near 210.70. A successful move higher beyond the 211.70 barrier could help the pair reach February’s ceiling around the 18-year high of 214.99.

In the event of a bearish breakout below the trendline zone of 206.60–207.73, selling pressure may accelerate toward the 205.30 constraining zone. Another failure there could trigger a steeper decline toward the 38.2% Fibonacci retracement at 203.25 and closer to the 200-day SMA, currently at 202.45.

Overall, GBP/JPY appears to be standing at a pivot point. While there are some bullish signals in the market, the pair must rebound above 210.70 to attract fresh buying interest.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.