GBP/AUD and GBP/NZD Breaking Out on Brexit Headlines

As my colleague Ken has written about so thoroughly, there is a bit of euphoria surrounding the GBP today as the Brexit Party’s Nigel Farage says he will not contest 317 Conservative seats won in 2017 but will contest all Labour seats who broke their election manifesto. As a result, most GBP pairs are bid, however are currently pulling back slightly.

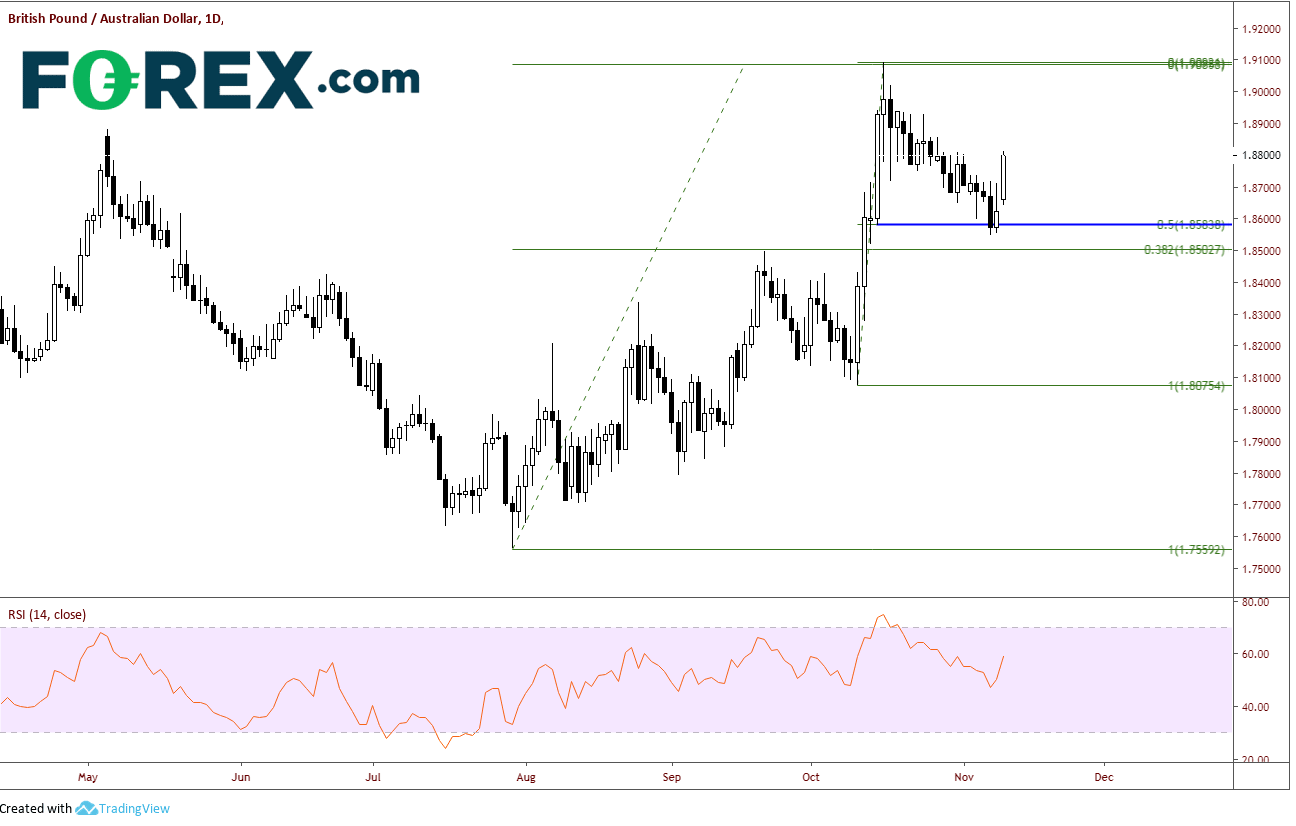

However, 2 pairs in particular that have broken out of their pattern formations are GBP/AUD and GBP/NZD. The RBA last week left rates on hold as widely expected. In addition, Phase One of the US-China trade deal seems to be on course to be signed sometime soon. As a result, after trading higher on AUD weakness throughout the summer, the pair began pulling back since mid-October. On a daily time frame the pair pulled back to horizontal support and the 50% retracement level from the low on October 10th to the October 16th highs. (There is a cluster of support between 1.8500 and 1.8600). However, after the positive GBP news today, along with the continued escalation from the ongoing protests in Hong Kong, GBP/AUD has gapped higher from 1.8620 to 1.8658 and is currently trading higher.

Source: Tradingview, FOREX.com

On a 240-minute chart, GBP/AUD has broken out of a falling wedge pattern. The target for a falling wedge pattern is a retracement of the entire wedge, which would put the pair near recent highs of 1.9094. There doesn’t seem to be much in the way of resistance to stop it from getting there. Support is at a retest of the descending top trendline of the wedge near 1.8675.

Source: Tradingview, FOREX.com

The RBNZ meets this week and a cut of 25bps is widely expected. Therefore, the New Zealand Dollar has been weaker than the Australian Dollar. GBP/NZD is no exception. The RBNZ is meeting this week and a 25bps rate cut is widely expected. In addition, as with the AUD, the potential for Phase One of the US-China trade agreement could be signed soon. As a result, after GBP/NZD had been bid for the latter half of the summer, the pair has been pulling back since mid-October. GBP/NZD has pulled back to the horizonal support and 38.2% Fibonacci retracement level from the lows of October 10th to the highs on October 16th. Like the GBP/AUD, GBP/NZD gapped higher over the weekend from 2.0162 to 2.0182.

Source: Tradingview, FOREX.com

Although the price structure for GBP/NZD isn’t quite as clear as for GBP/AUD, price did break above the descending trendline dating back to mid-October. There is little in terms of resistance from price moving back up to its recent highs near 2.0560. Support comes in back at the retest of the descending trendline near 2.0175. Below that, there is a short-term upward sloping trendline the comes in near 2.0100.

Source: Tradingview, FOREX.com

The RBNZ statement will be closely monitored this week, however as for both these pairs, the driving force is likely to be Brexit headlines until the elections on December 12th.

Author

Forex.com Team

Forex.com