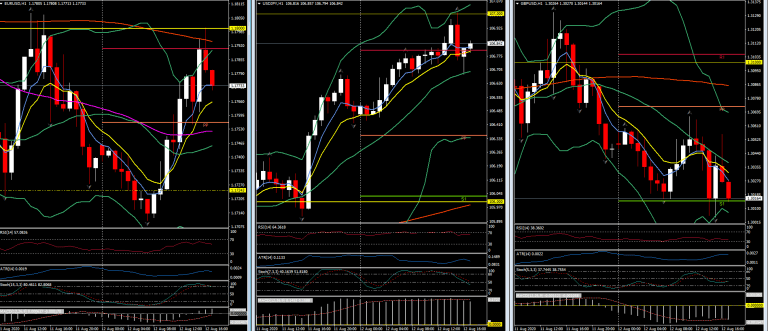

FX update – US inflation rises again

EUR/USD, H1

The July CPI report sharply beat estimates with gains of 0.6% for both the headline and core, following respective June gains of 0.6% and 0.2%, hence leaving the two largest headline gains since the same 0.6% increase in August of 2012.

The June and July gains capped three consecutive monthly declines for both series, as the initial impact of shutdowns was a demand shock, followed by a rebound in oil prices and growing supply constraints for some components that will become increasingly evident as we approach Q4.

July CPI gains rounded from 0.587% for the headline and 0.620% for the core.

The big headline gain didn’t just reflect a 2.5% July rise in energy prices after a 5.1% June surge, after five consecutive declines for the energy component through May.

We also saw huge apparel price gains, of 1.1% in July and 1.7% in June, after declines of -2.3% in May, -4.7% in April, and -2.0% in March.

Used vehicle prices rose by a hefty 2.3% in July after a three-month string of declines, while new vehicle prices rose 0.8%, as demand in the vehicle sector exceeds supply following Q2 factory shutdowns.

The medical care service component rose 0.5% in July, leaving a five-month stretch of big 0.5%-0.6% gains, alongside a 0.4% rise for the separate medical cost measure, which has increased by 0.4%-0.5% since March.

Tobacco prices also rose 0.8%, after a 1.1% June rise.

For price restraint, food prices fell -0.4%, leaving the first drop for the series since April of 2019, and owners’ equivalent rent rose just 0.2%, after a 0.1% June rise that was the smallest gain since the same increase in July of 2013. Beef prices are up 14% y/y and even white bread is up 5.6% y/y and carbonated beverages +9.2%. On the other hand men’s suits were down -12.8% and women’s dresses -23.1% as work wear demand evaporated.

On a 12-month basis, headline CPI accelerated to 1.0% from 0.6% y/y previously, while the core measure rose to 1.6% from 1.2% y/y.

Real average hourly earnings fell -0.4%% in July, after a -1.8% (was -1.7%) June drop, and slowed to 3.7% y/y from 4.1% y/y.

Despite the big June and July gains that have mostly just reversed the pull-back with the pandemic, we still have a net downtrend for CPI increases, given 6-month average price moves of -0.005% for the headline and 0.078% for the core that both undershoot respective 12-month average gains of 0.086% and 0.130%.

The CPI and PPI reports are showing evidence of supply constraints since May, with an uptrend in oil prices and spikes for some prices, after huge March and April declines with the coronavirus hit to aggregate demand. The demand hit remains big, but we should see increasing evidence of supply chain disruptions as we approach Q4.

The Dollar has been pegged back in the last few hours into the US open and the CPI data adds to the mood music. EURUSD is testing the 1.1800 zone again from lows at 1.1709, USDJPY has declined from 107.00 highs to below R1 at 106.75 and Cable has bounced from below S1 at 1.3005 to test the 20-hour moving average at 1.3043. The Swiss Franc is the strongest of the major currencies today with USDCHF trading hands currently at 0.9113 a few above yesterday’s nadir at 0.9105. whilst the Kiwi remains weighed by the Dovish RBNZ earlier today with NZDUSD trading at 0.6575 and the NZDCHF at a 52 day low at 0.5990.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c