FTSE 100 wavers after strong BP and HSBC earnings

The FTSE 100 wavered today as traders reacted to strong earnings and the rising number of Covid-19 cases in Europe. In a report earlier today, HSBC, the biggest European bank by assets, said that its profit before tax rose to $3.07 billion, 36% lower than in the same quarter in 2019. But the results were better than the $2.07 billion that analysts were expecting. The firm also hinted that it will return money to shareholders through dividends once the Bank of England accepts. In another report, BP made a profit of $100 million as the energy supermajor tried to recover. Still, the company warned of volatility in the oil and gas industry.

United States futures rose today as traders reacted to the latest mergers and acquisition push. Futures tied to the Dow Jones, S&P 500, and Nasdaq 100 rose by 0.30%, 0.40%, and 0.45%, respectively. In a statement, chip-maker, AMD said that it would acquire Xilinx for $35 billion as competition in the chip-making industry continued. The company is attempting to take market share from Intel in the data centre sector. This announcement came a few weeks after Nvidia announced that it would acquire Arm holdings in a $40 billion deal.

The US dollar wavered as traders reacted to the better durable goods order numbers from the United States. According to the Bureau of Statistics, the country’s durable goods orders rose by 1.9% in September. The core durable goods orders also rose by 0.8% after they rose by 0.6% in August. Without defence and aeroplanes, the goods rose by 3.4%. The currency will later react to the consumer confidence data from the Conference Board. It will also react to the latest coronavirus statistics in the United States.

UK100

The FTSE 100 index rose to an intraday high of £5792 thanks to the positive earnings by BP and HSBC. On the four-hour chart, the price is attempting to move above the 15-day exponential moving average. The signal and main line of the MACD are still below the neutral line while the Average True Range (ATR) has been rising. The price is also slightly above the important support at £5765. Still, even with today’s bounce, the index is expected to continue falling as bears target the next support at £5700.

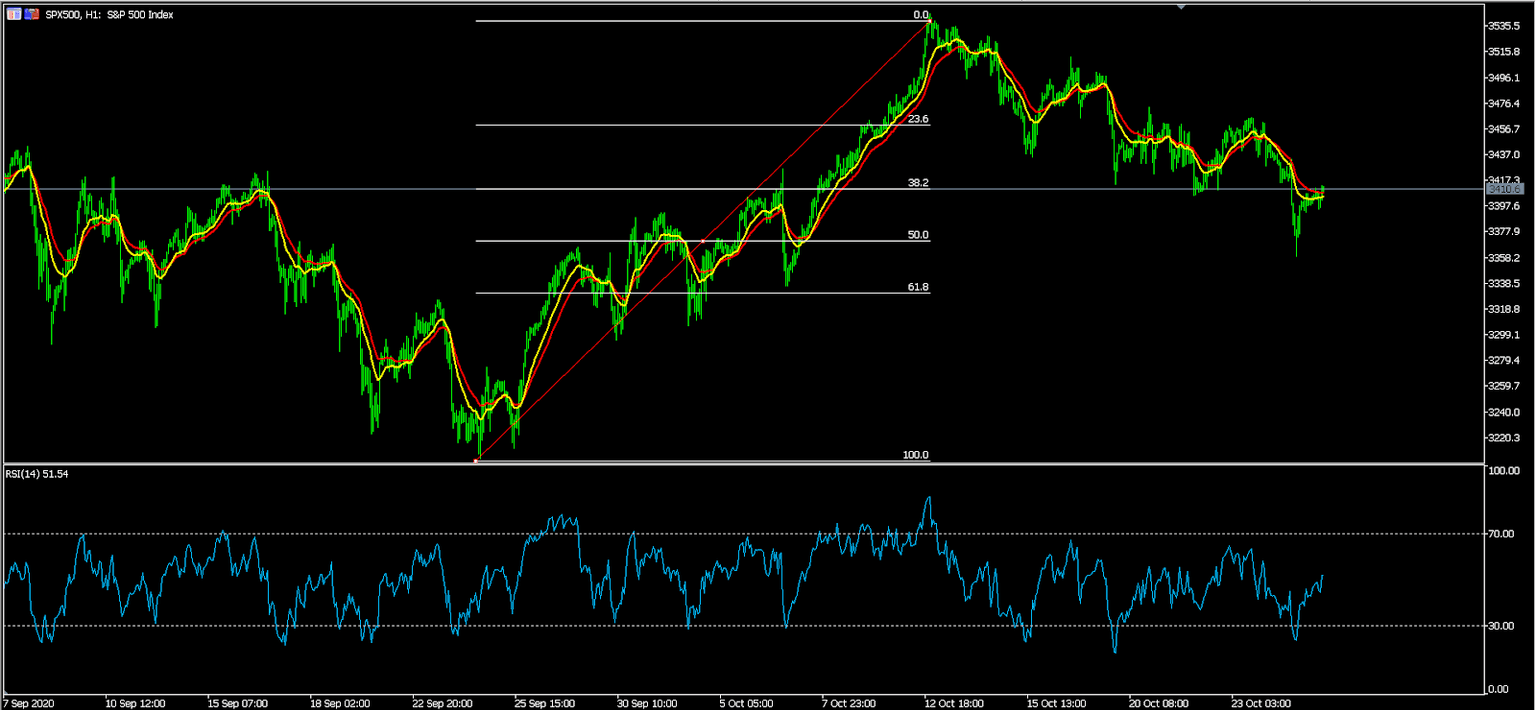

SPX500

The S&P 500 index is up slightly in the futures market as traders react to the ongoing consolidation. On the hourly chart, the price is above yesterday’s low of $3360. The price is also along the 38.2% Fibonacci retracement level. It is also below the 25-day and 15-day exponential moving averages. The RSI has also moved from the oversold level of 24 to the current 51. While the index may continue rising, there is also a likelihood that bears will return to the market and push it lower.

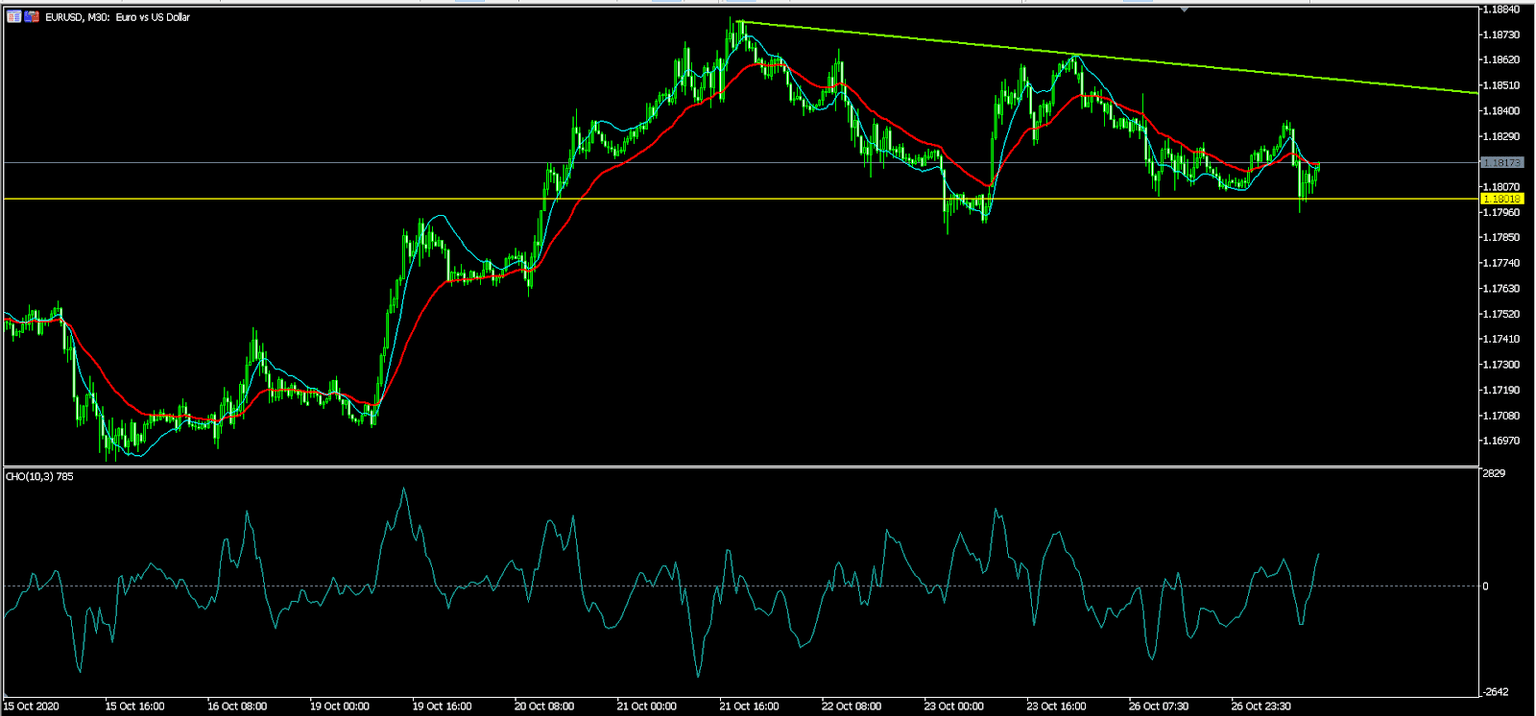

EUR/USD

The EUR/USD price rose slightly today because of the overall weaker dollar. On the 30-minute chart, the price is along the 15-day and 25-day exponential moving averages. It is also below the descending trendline shown in green. The Chaikin oscillator has also moved above the neutral line. Therefore, the pair will remain in a bearish trend so long as it is below the green line.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.