FTSE 100 futures retreat amid plan B concerns

The British pound and FTSE 100 futures declined on Thursday morning as concerns about the UK economy remained. The main challenge is that the number of Covid-19 cases in the UK has been rising in the past few days. Most of the new cases are of the Delta and Omicron variants. Therefore, there are concerns that Boris Johnson will announce the new Plan B directives today. These directives will ask more companies to let more people work from home. The government would also impose vaccine passports and mask mandates. As a result, in a report, analysts at Goldman Sachs said that the BOE will be patient in the upcoming meeting.

The Canadian dollar was little changed after the latest Bank of Canada interest rate decision. The bank, which is led by Tiff Macklem, decided to leave interest rates unchanged at 0.25% as officials watched the impact of the Omicron variant. The statement said that the economy was doing well although risks like the variant and the devastating floods in British Columbia could have a negative impact. Still, analysts at ING believe that the bank is on course for about 4 rate hikes in 2022. They attributed this to the fact that inflation is rising and that the economy is doing well.

The economic calendar will have some key events today. In the morning session, Germany will publish its latest trade numbers. Analysts expect that the country’s trade surplus widened to about 13.4 billion euros in November. These numbers will come a day after Olaf Scholz became the country’s chancellor. In Switzerland, the State Secretariat of Economic Affairs (SECO) will publish its economic forecast. The previous estimate showed that the economy will expand by more than 3.4% this year. In the United States, the government will publish the latest initial jobless claims numbers. The data will come a day after numbers showed that the great resignation was going on.

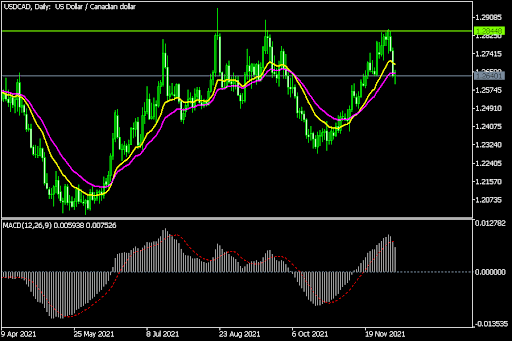

USD/CAD

The USDCAD was little changed after the latest BOC interest rate decision. It is trading at 1.2638, which is significantly lower than this month’s high of 1.2845. The pair has formed a cup and handle pattern and is along with the 25-day and 50-day moving averages. This decline is part of the handle section. Therefore, with the BOC done, the pair will likely resume the bullish trend.

EUR/USD

The EURUSD pair made a bullish breakout on Wednesday after Scholz became chancellor. It is trading at 1.1345, which is higher than yesterday’s low of 1.1268. On the four-hour chart, the pair is slightly below the 38.2% Fibonacci retracement level. The Relative Strength Index and the Stochastic Oscillator are also pointing higher. Therefore, the pair will likely keep rising as bulls target the 50% retracement level at 1.1455.

GBP/USD

The GBPUSD pair declined after media reported on Plan B. The pair is trading at 1.3235, which is slightly above this week’s low of 1.3165. On the four-hour chart, the bearish trend is being supported by the 25-day moving averages. The Relative Strength Index (RSI) is along with the neutral level of 43 while the MACD is below the neutral level. Therefore, the pair will likely bounce back today since the Plan B news has already been priced in.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.