FTSE 100 forms bullish flag after strong mining earnings

The British pound wavered today even after the relatively strong UK inflation numbers. According to the Office of National Statistics (ONS), the headline consumer price index declined by 0.2% in January, leading to an annualised increase of 0.7%. This increase was better than the median estimate of 0.7%. The core consumer price index increased by 1.4%, slightly better than the expected 1.3%. These numbers are still below the Bank of England's (BOE) target of 2%. Meanwhile, the retail price index rose by 1.4% while the PPI input rose by 1.3%. Further data from the UK showed that car registrations declined by more than 30% in January because of the new lockdown. The country's house price index rose by 8.5% in January.

UK stocks wavered today even after the relatively strong earnings by some large British companies. The FTSE 100% declined by about 0.40%. In a report earlier today, Rio Tinto said that its annual profit rose by 22%, helped by higher iron ore prices. The company even announced a new special dividend, which pushed the stock up by more than 3%. The results came after BHP and Glencore also published strong annual and quarterly results. Other top performers in the FTSE 100 were Antofagasta, BP, Rolls-Royce, Royal Dutch Shell, and Anglo American.

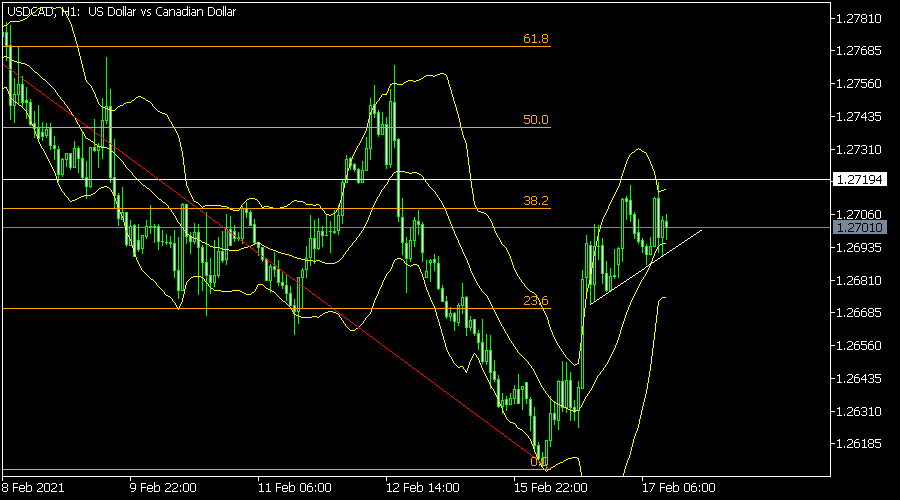

The Canadian dollar was little changed as investors reacted to the latest US retail sales and Producer Price Index (PPI) and Canada's CPI data. According to the US statistics bureau, the overall retail sales rose by 7.4% in January after rising by 2.90% in the previous month. The core retail sales rose by 5.9% while the PPI rose by 1.7%. In Canada, the headline CPI rose by 1.0% while the core CPI rose by 1.4%.

USD/CAD

The USD/CAD price is trading at 1.2700, which is slightly below the double-top level of 1.2720. It is also slightly above the white ascending trendline. It is also slightly below the 38.2% Fibonacci retracement level and is between the middle and upper lines of the Bollinger Bands. Therefore, the uptrend will remain so long as the pair is above the ascending trendline. As such, there is a possibility that it will move above the double-top level.

UK100

The FTSE 100 index is trading at £6,713, which is slightly above the intraday low of £6,698. On the hourly chart, the index has formed a bullish flag that is shown in white. In most cases, this pattern tends to lead to a bullish outcome for an asset. Therefore, there is a likelihood that the index will resume the uptrend and retest the YTD high of £6,789.

EUR/USD

The EUR/USD pair declined to an intraday low of 1.2060, which is the lowest it has been since February 9. On the hourly chart, the price managed to move below the important support at 1.2080, the lowest level on February 12. The price has also moved below the 25-day and 15-day moving averages while the Relative Strength Index (RSI) has moved closer to the oversold level. Therefore, the pair will likely continue falling as bears target the next support at 1.2000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.