Forex technical analysis and forecast: Majors, equities and commodities

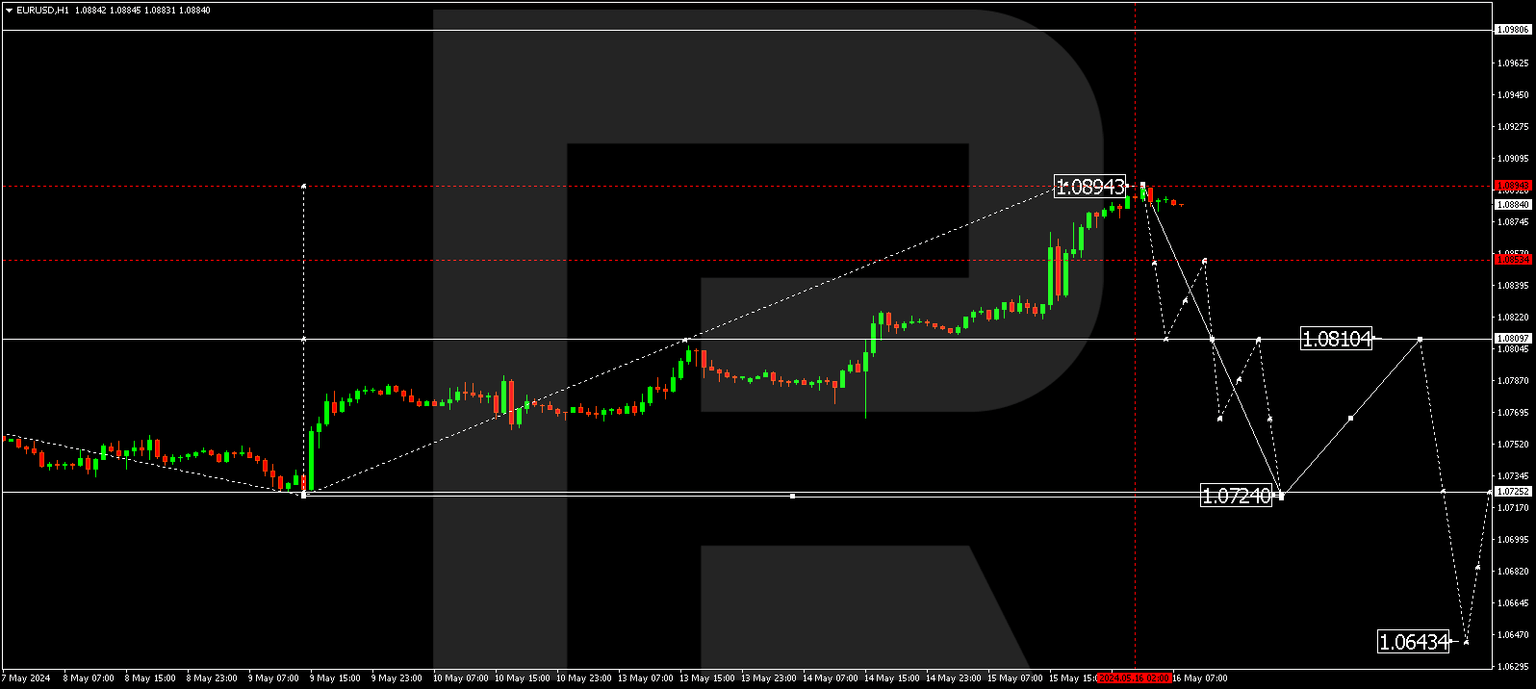

EUR/USD, “Euro vs US Dollar”

The EURUSD pair has exited the consolidation range upwards and completed a corrective wave, reaching 1.0894. Today, a decline wave could develop, aiming for 1.0805. After reaching this level, the price could rise to 1.0850 (testing from below) and then decline to 1.0770, with the trend potentially continuing to the first target of 1.0724.

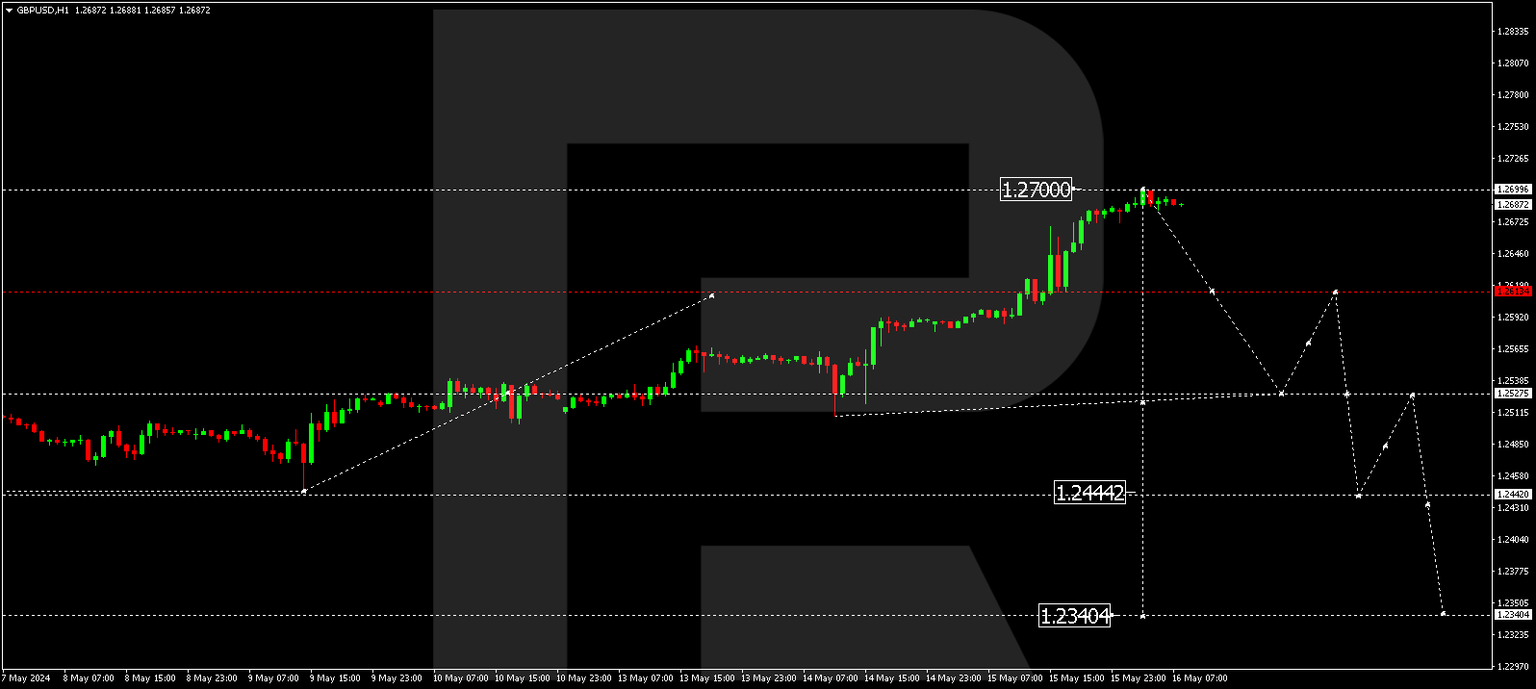

GBP/USD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has exited the consolidation range upwards and completed a corrective wave, reaching 1.2700. Today, a new decline wave could develop, aiming for 1.2615. A breakout of this level will open the potential for a wave to 1.2525. This is the first target of another decline wave.

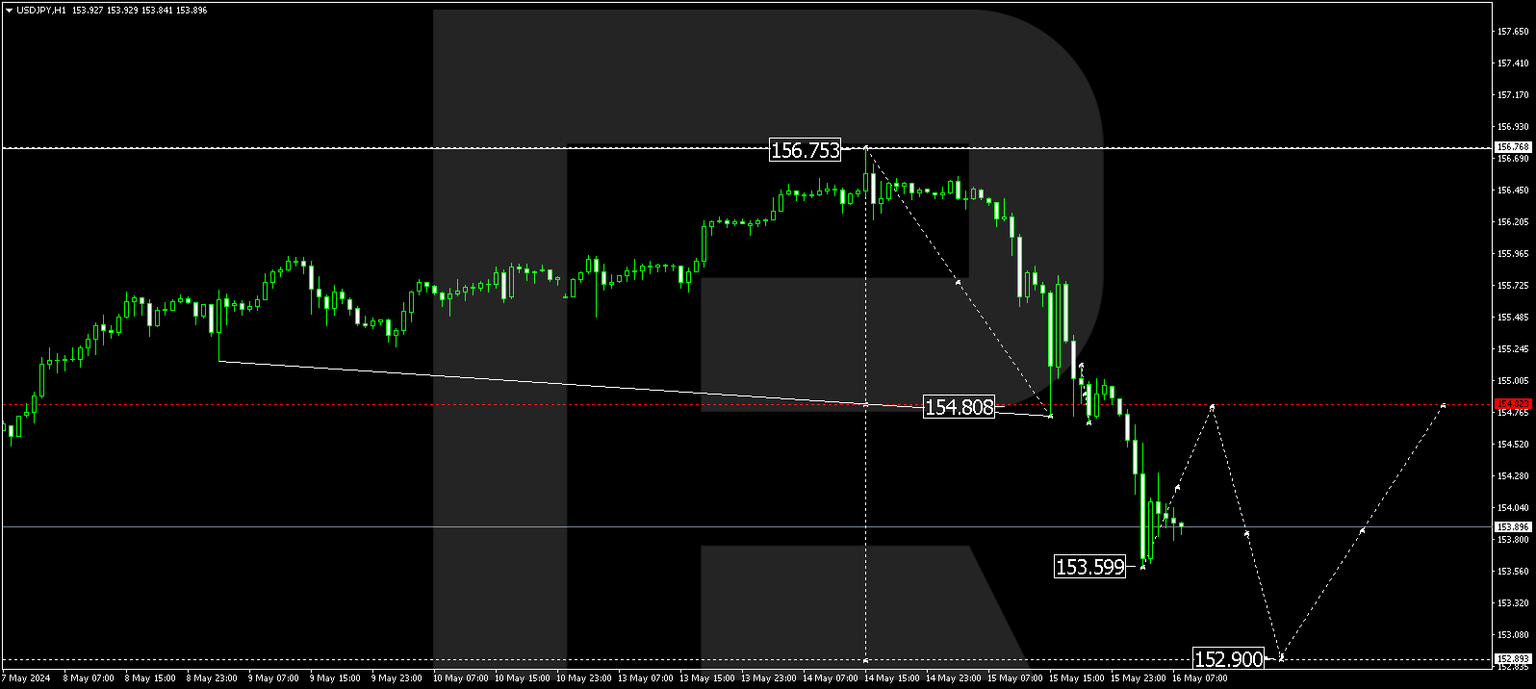

USD/JPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a decline impulse to 154.80 and corrected to 155.75. Today, the market is forming a decline wave targeting 153.60. Once the price hits this level, a rise to 154.82 (testing from below) could follow. Subsequently, a decline wave could start, aiming for 152.90 as the first target of the downtrend.

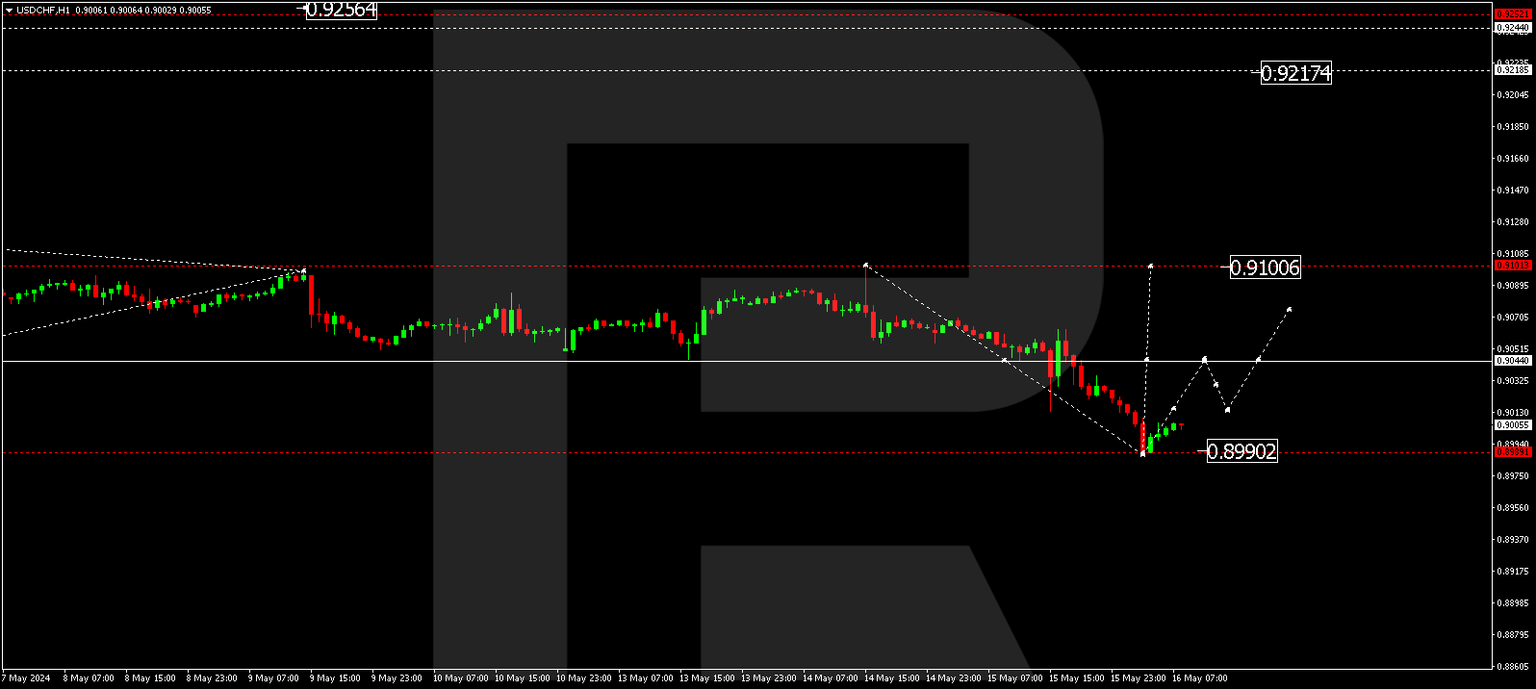

USD/CHF, “US Dollar vs Swiss Franc”

The USDCHF pair has exited the consolidation range downwards and completed a corrective wave, reaching 0.8990. Today, a growth wave could follow, aiming for 0.9044 and potentially continuing to 0.9100. This is the first target of the growth wave.

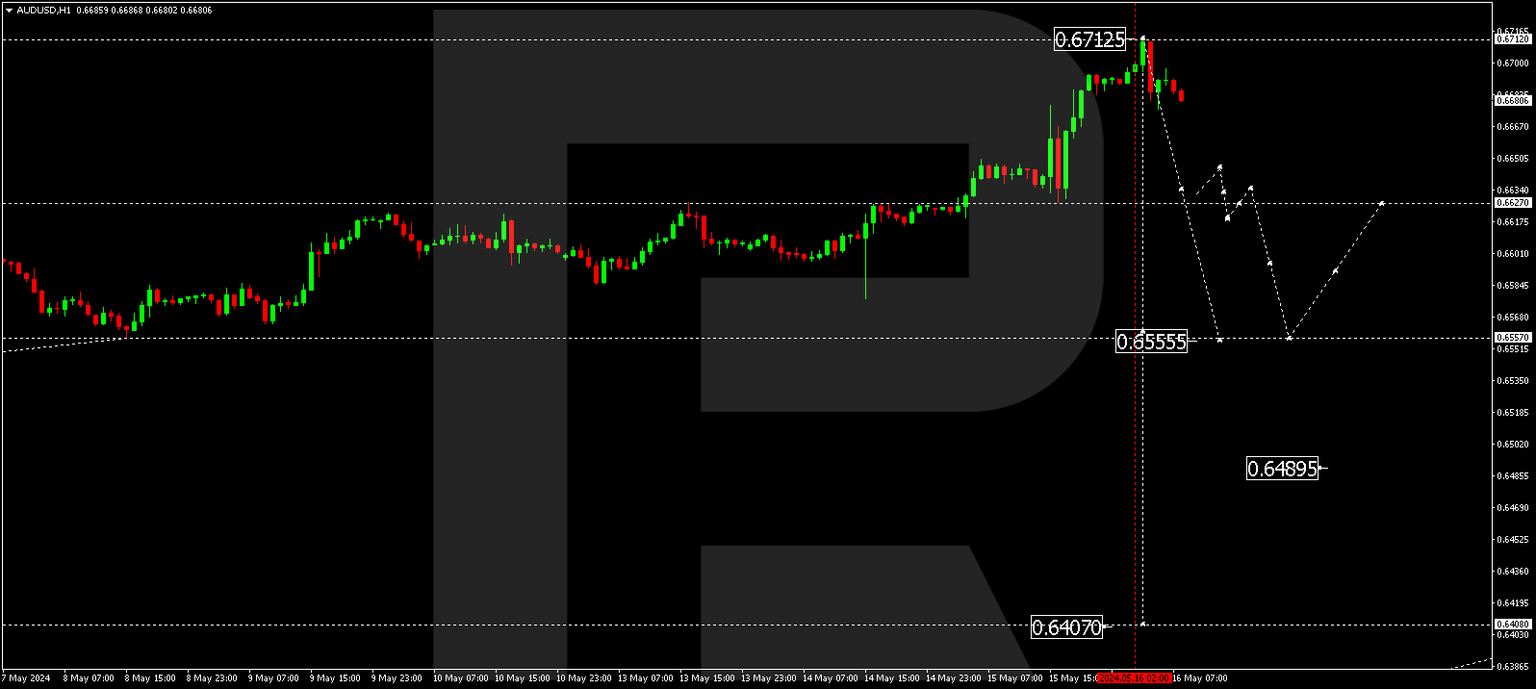

AUD/USD, “Australian Dollar vs US Dollar”

The AUDUSD pair has exited the consolidation range upwards, reaching 0.6712. Practically, the correction is considered to be complete. Today, a new decline wave is expected, aiming for 0.6626 and potentially continuing to the first target of 0.6555.

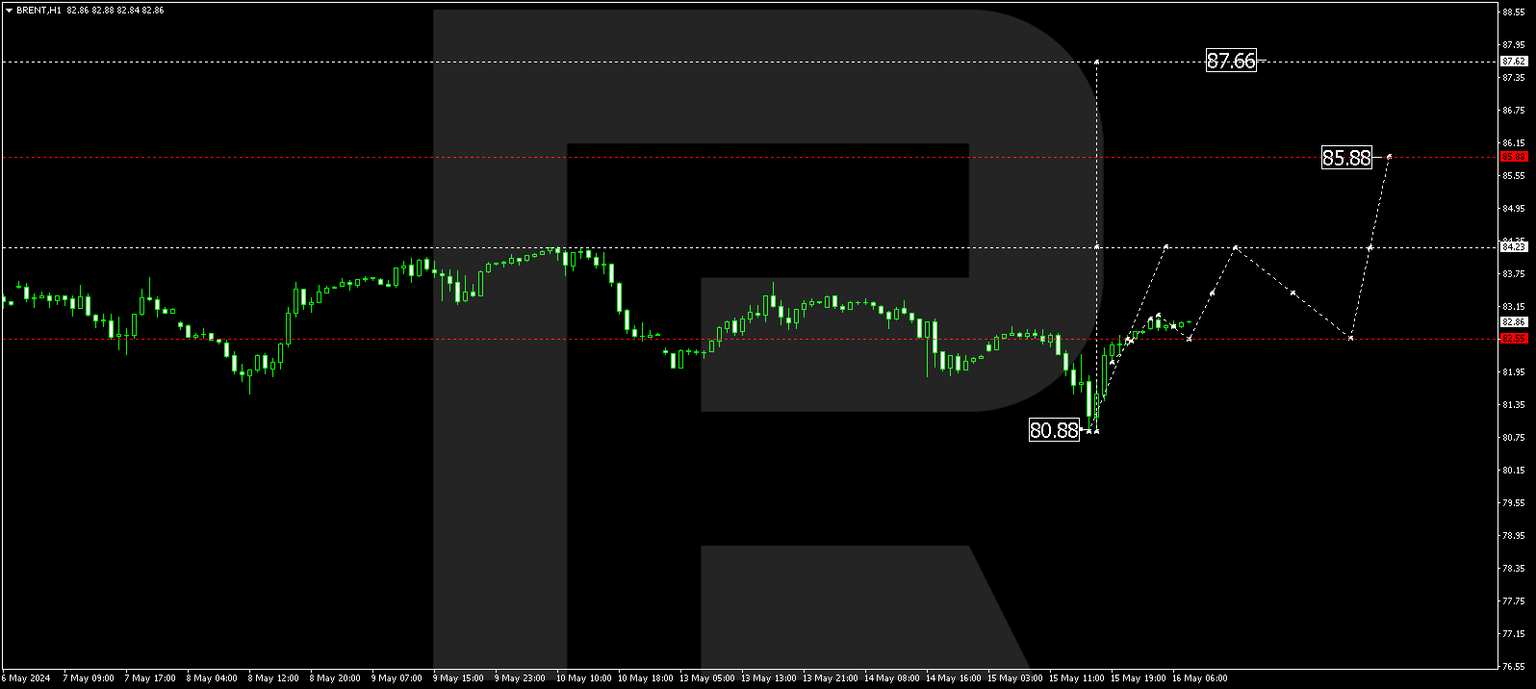

Brent

Brent is currently in a consolidation phase around 82.55. Today, a growth wave targeting 84.24 could develop. After the price reaches this level, a correction to 82.55 (testing from above) is expected, followed by another growth wave to the local target of 85.88.

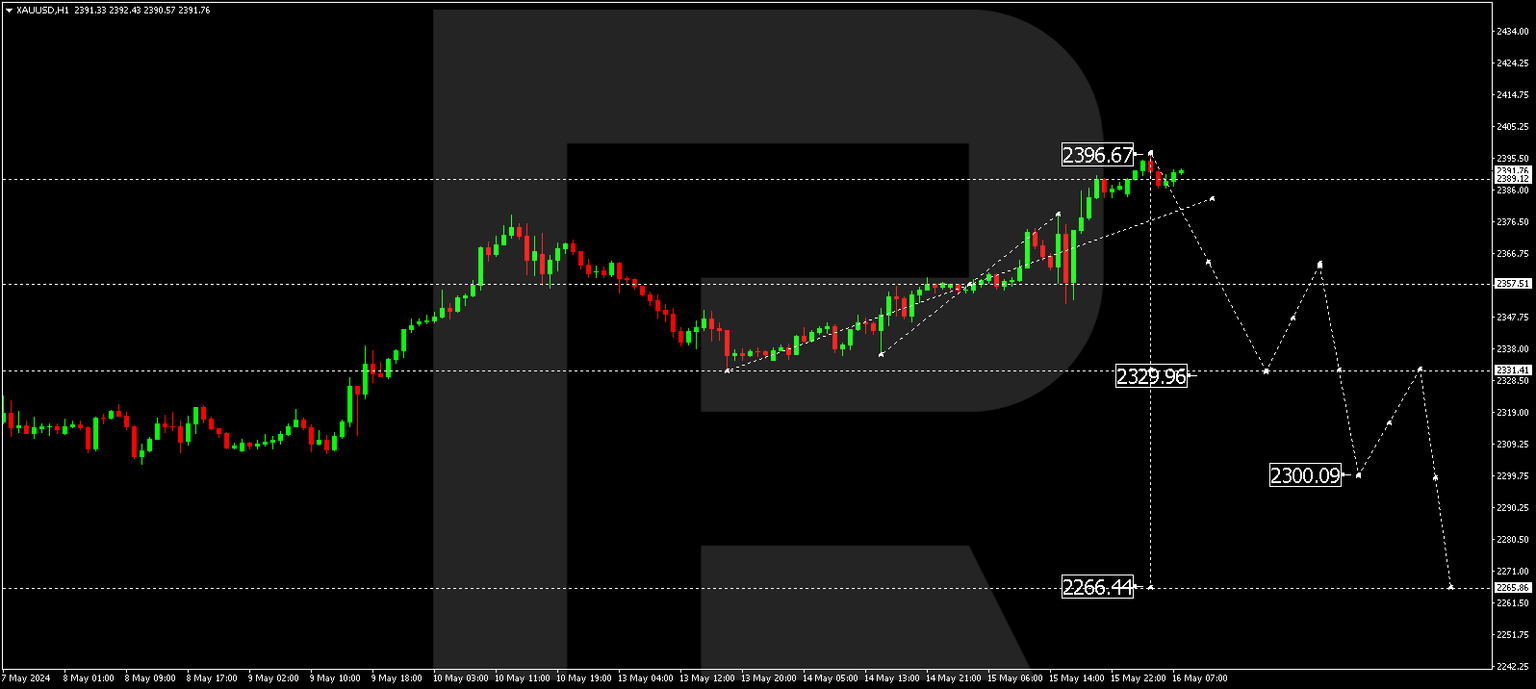

XAU/USD, “Gold vs US Dollar”

Gold has exited the consolidation range upwards and completed a corrective wave, reaching 2396.66. Today, a decline wave could start, aiming for 2329.96 as the first target of the decline wave.

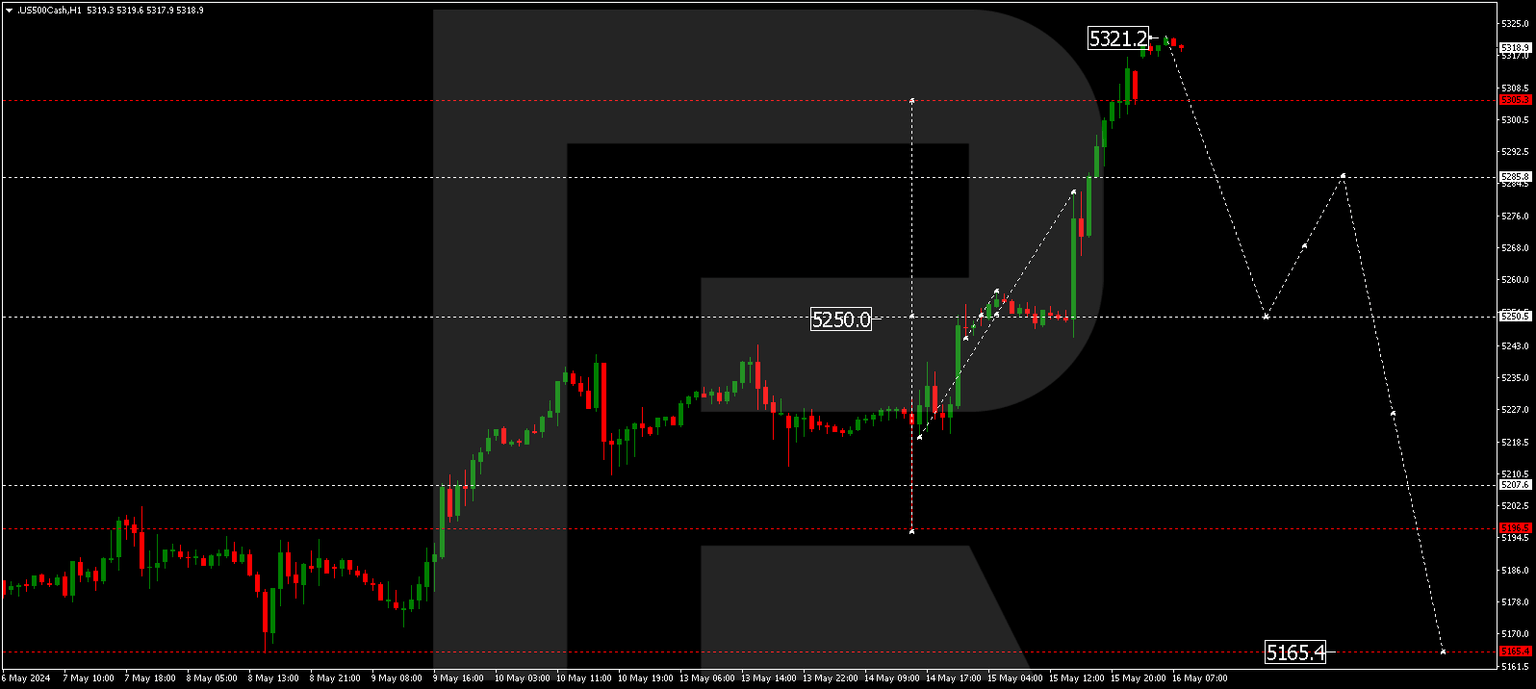

S&P 500

The stock index has exited the consolidation range upwards and completed a growth wave, reaching 5321.2. Today, a decline wave towards 5250.5 could start. After the price reaches this level, a corrective phase could follow, targeting 5285.0 (testing from below). Next, a decline wave could start, aiming for 5200.0 as the local target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.