Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The EUR/USD pair has completed a decline wave towards 1.0606. Today the market is forming a consolidation range above this level. With a downward escape from the range, the potential for a wave targeting 1.0585 might open. This is a local target. With an upward escape, a correction link towards 1.0733 is not excluded, followed by a decline to 1.0585.

GBP/USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair has completed a decline wave towards 1.2405. Today the market is forming a consolidation range above this level. With a downward escape from the range, the potential for a wave towards 1.2380 might open. This is a local target. With an upward escape, a correction link towards 1.2544 is not excluded, followed by a decline to 1.2380.

USD/JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair has completed a growth wave at 154.77. Today the market is forming a consolidation range under this level. With a downward escape, a correction link towards 154.20 is not excluded. With an upward escape, the potential for a wave towards 155.22 could open, from which level the trend could extend to 155.72.

USD/CHF, “US Dollar vs Swiss Franc”

The USD/CHF pair continues forming a consolidation range around 0.9127 without any obvious trend. A decline link to 0.9185 is not excluded today, followed by a rise targeting 0.9168. This is a local target. Next, a correction to 0.9140 is not excluded (testing from above). Once it is over, a new wave aiming at 0.9180 might begin.

AUD/USD, “Australian Dollar vs US Dollar”

The AUD/USD pair has completed a decline wave at 0.6388. Today the market is forming a consolidation range above this level. With an upward escape from the range, a correction link towards 0.6464 is not excluded. With a downward escape, the wave might extend to 0.6330, from which level the trend could continue to 0.6300. This is a local target.

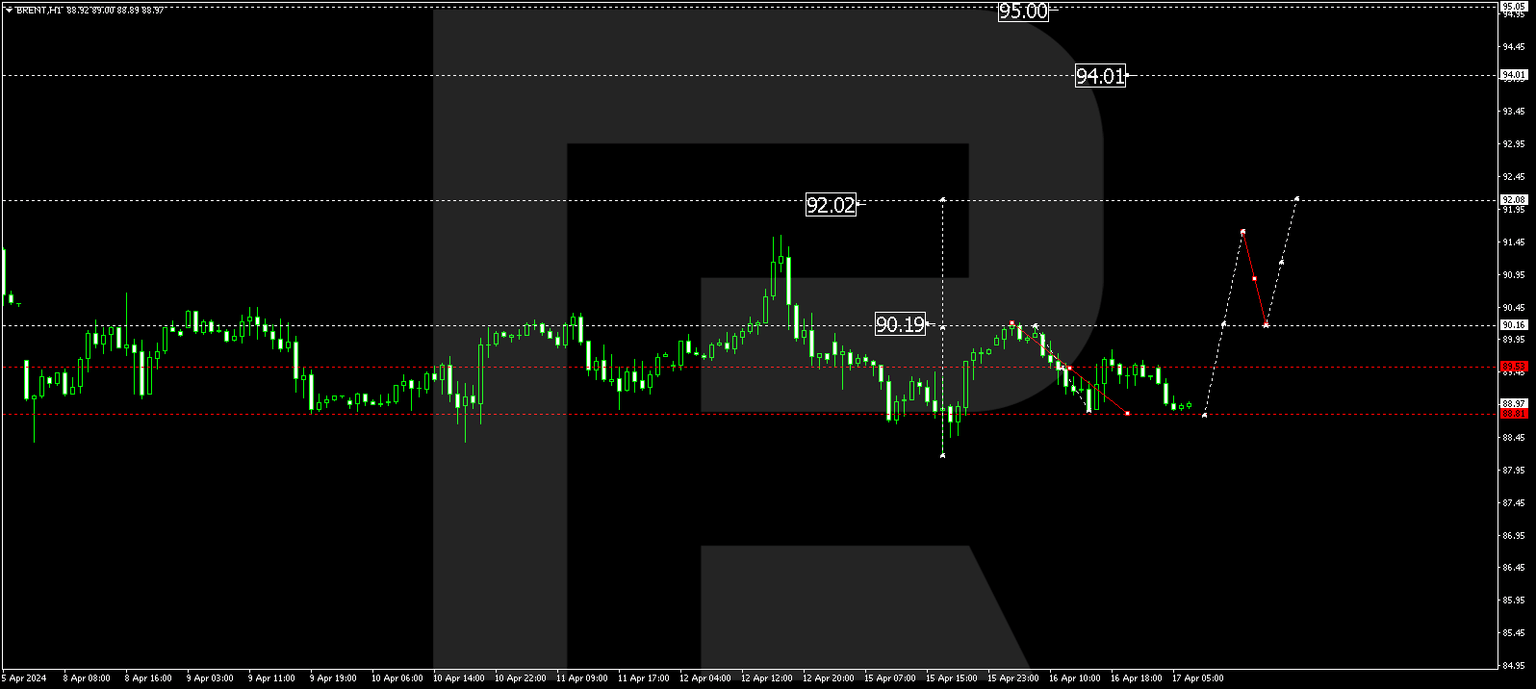

Brent

Brent continues developing a consolidation range around 89.55. A decline link towards 88.80 is not excluded today. Next, a growth link to 90.20 is not excluded. And if this level also breaks, the potential for a wave towards 92.00 might open, from which level the trend could extend to 94.00. This is a local target.

XAU/USD, “Gold vs US Dollar”

Gold continues forming a consolidation range above 2362.75. With a downward escape from the range, a corrective decline wave towards 2306.66 is expected. Next, a growth link to 2355.00 might form, followed by a decline towards 2266.00.

S&P 500

The stock index has formed a decline wave towards 5040.8. Today the market is forming a consolidation range above this level. With an upward escape from the range, a correction link to 5107.0 is not excluded, followed by a decline to 5000.5. With a downward escape, the decline link might extend to 5000.5, from which level the trend could continue to 4927.7.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.