Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

After completing the descending wave at 1.1263, EURUSD is correcting to test 1.1300 from below. Later, the market may resume falling to break 1.1250 and then continue trading within the downtrend with the target at 1.1174.

GBP/USD, “Great Britain Pound vs US Dollar”

GBPUSD is still consolidating around 1.3434. Possibly, the pair may break this range downwards and reach 1.3290. After that, the instrument may start a new growth to reach 1.3380 and then resume falling with the target at 1.3163.

USD/RUB, “US Dollar vs Russian Ruble”

After forming a new consolidation range around 72.37 and breaking it to the upside, USDRUB is expected to continue the correctional wave towards 73.73. Later, the market may form a new descending structure to return to 72.37 and then resume trading upwards with the short-term target at 74.20.

USD/JPY, “US Dollar vs Japanese Yen”

After breaking 114.68 to the upside, USDJPY is expected to continue growing towards 115.22. Later, the market may correct to reach 114.00 and then form one more ascending structure towards with the target at 115.55.

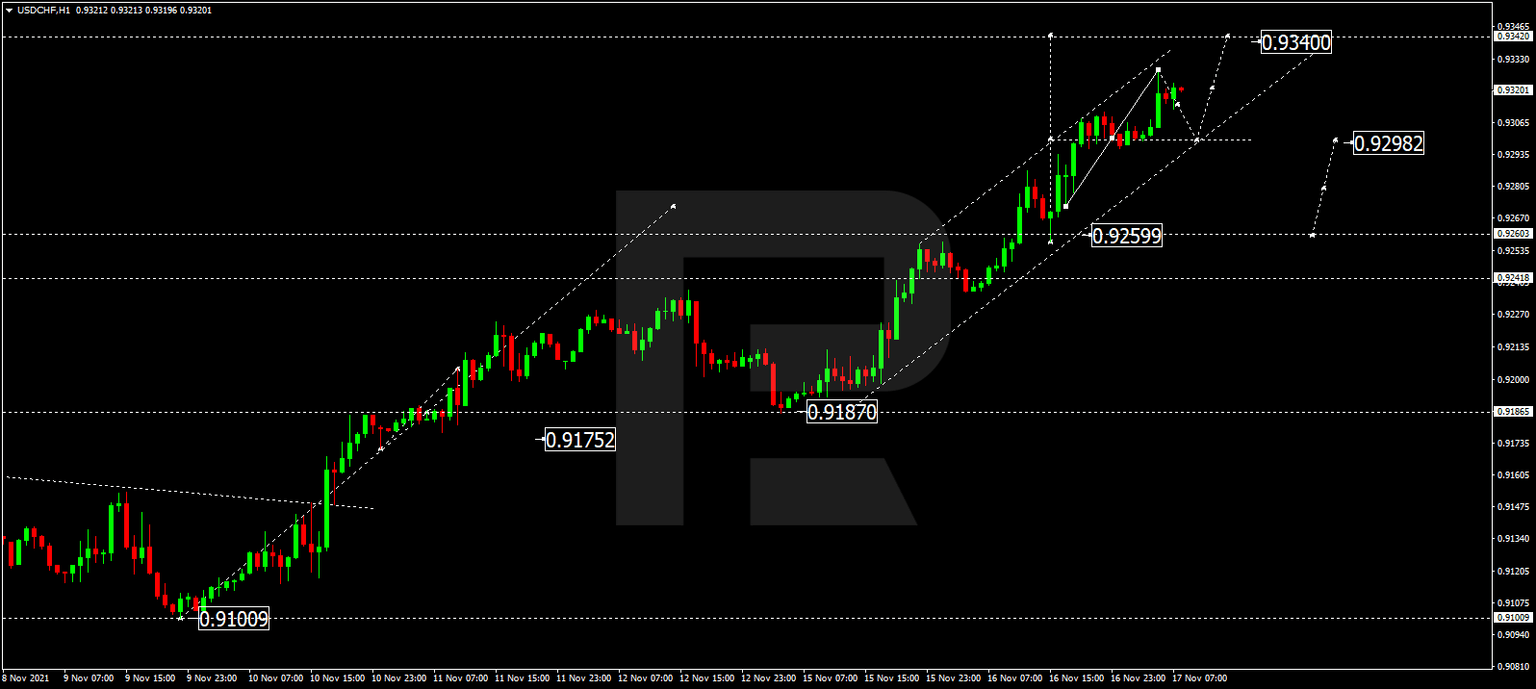

USD/CHF, “US Dollar vs Swiss Franc”

After rebounding from 0.9259, USDCHF is still growing towards 0.9340. Later, the market may start a new correction to reach 0.9260 and then resume trading upwards with the target at 0.9400.

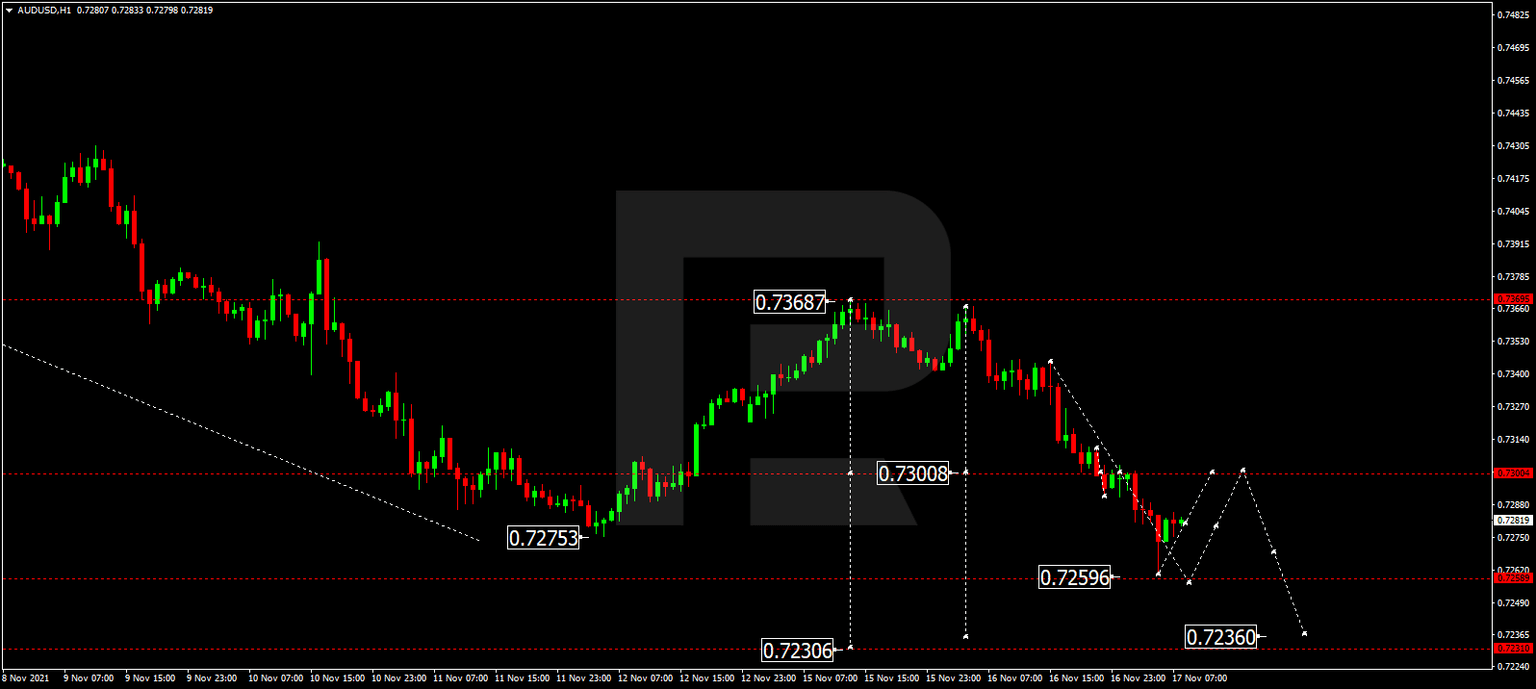

AUD/USD, “Australian Dollar vs US Dollar”

AUDUSD has finished another descending structure at 0.7262. Today, the pair may correct to test 0.7300 from below and then resume trading downwards with the short-term target at 0.7236.

Brent

Brent is still falling towards 80.00. After that, the instrument may correct to reach 83.24 and then trade downwards with the short-term target at 79.00.

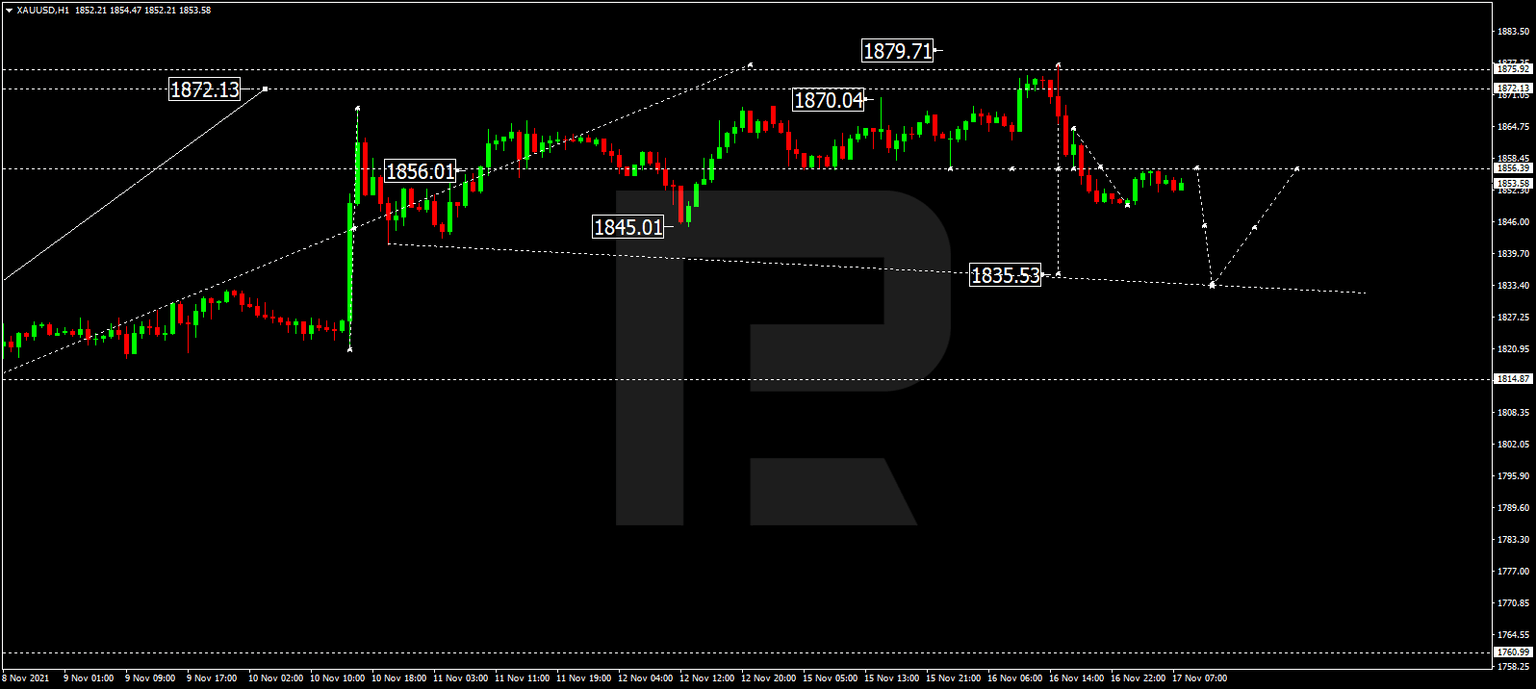

XAU/USD, “Gold vs US Dollar”

Gold has completed the ascending wave at 1879.00; right now, it is falling towards 1835.00. After that, the instrument may resume growing to break 1880.00 and then continue trading upwards with the target at 1950.00.

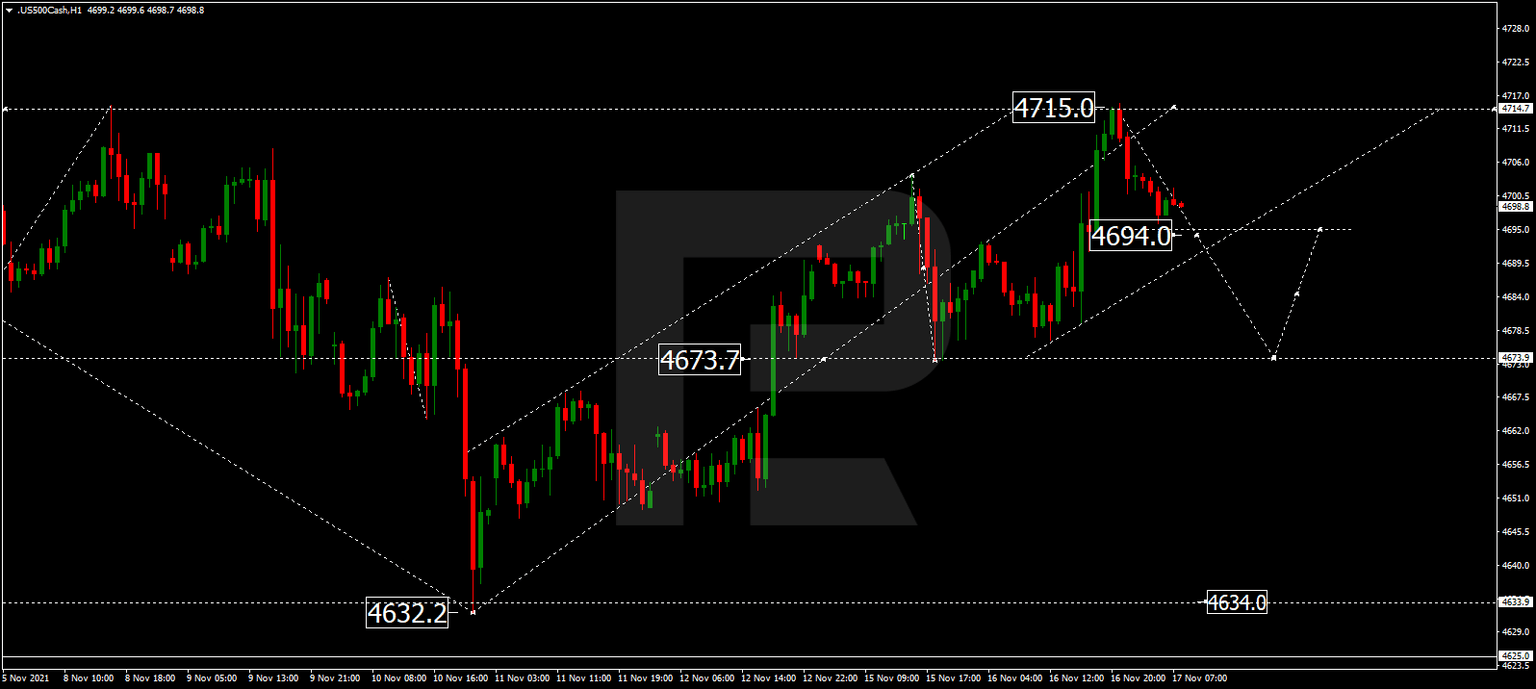

S&P 500

The S&P index has completed the ascending wave at 4715.0; right now, it is correcting towards 4694.8, thus forming a new consolidation range between these two levels. If later the price breaks this range to the downside, the market may resume falling to break 4673.0 and then continue trading downwards to reach 4634.0; if to the upside – form another ascending wave with the target at 4800.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.