Forex Major Currencies Index Forecast for week commencing the 28th of October 2019

DXY-U.S. dollar

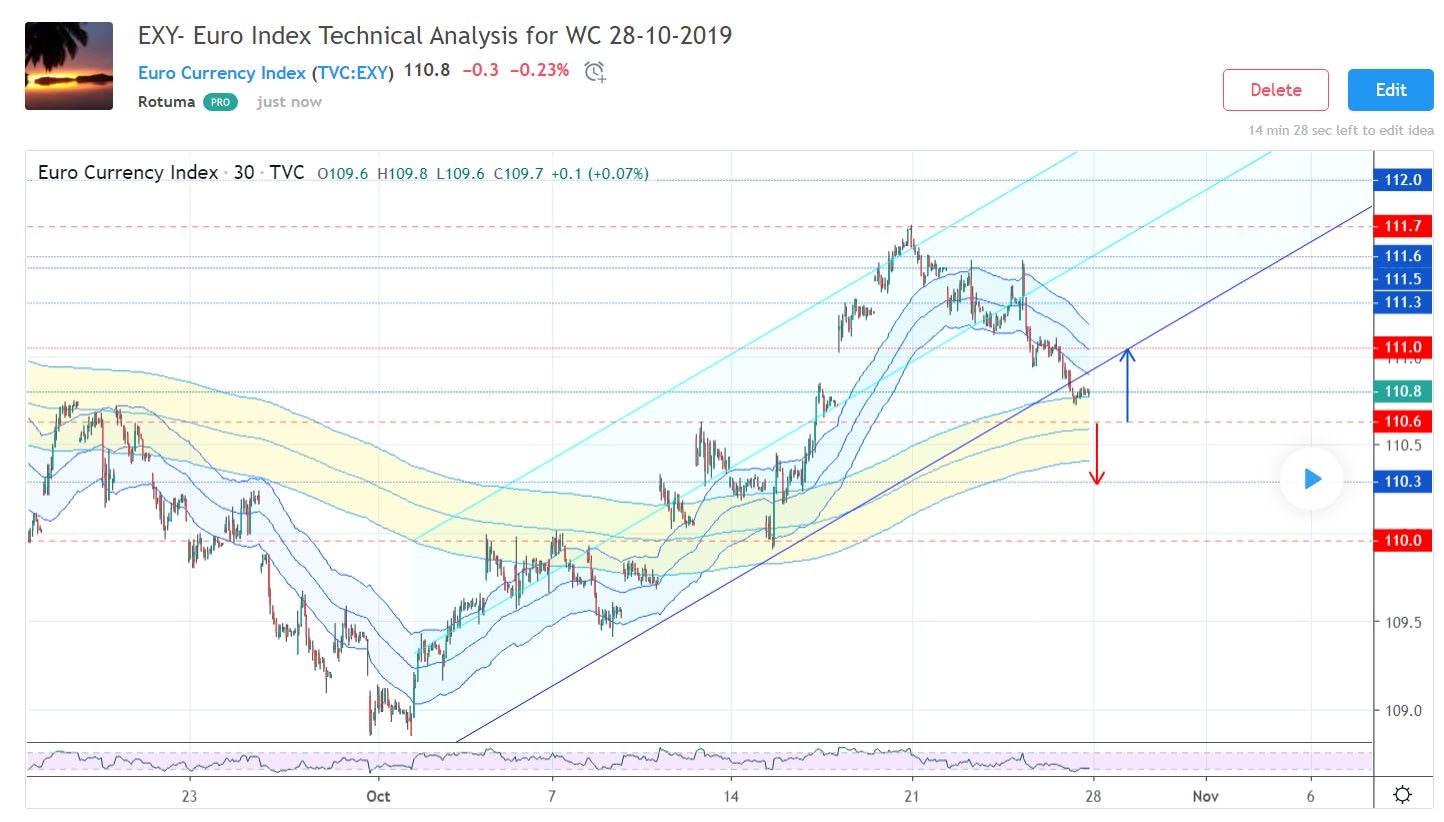

EXY- Euro Index

BXY- British Pound

SXY- Swiss Franc

JXY- Japanese yen

CXY- Canadian dollar

AXY- Australian dollar

ZXY- New Zealand dollar

The U.S. dollar made impressive progress in last week's trading session after a week of a pullback from 99.20 and touching down around 97.17. The Index took out its first major target at 97.65 during its recovery and ended the week's session at 97.83. The next price target is estimated at around 97.95 and 98.20. The U.S. dollar needs to remain above 97.65 to continue the current trend.

The Euro lost - 0.857% about a week of gains from the previous run. The Index lost ground after reaching 111.7, but the final descent took place after two failed attempts to break at 111.5. The Index slipped below 111.0 support and ended the week's session at 110.80. The long term outlook still looks bullish; however, The Index needs to hold above 110.6 to head back up.

The British Pound had a similar trend as the Euro Index in last week's session but with a drop of -1.54% at the end of the trading week. The Index will be looking for support around 128.0 at the beginning of next week opening trades. The long term outlook is still bullish; however, it will need to remain above 128.0 to continue to the upside. The Index could continue down to around 126.9 if it fails at 128.0.

The Swiss Franc failed to capitalise on its breakout on the 17th of October which saw the Index jumped from 100.5 to 101.8. The Index started last week's trading session on a slippery path after the price gap to the downside and continued its downtrend to the end of the trading week ending at 100.5. Major support is at around 100.5 at the bottom of the price channel which could provide some relief and potentially push the Index back up. Support awaits at 100.2 if it fails at 100.5

The Japanese Yen started the week's session with hopes of a continuation of the previous week's results a 0.45% gain which saw the Index attempted to bounce back from a major pullback. However, the Index failed to break out at 92.3 and drifted down the price channel marked on the chart below, ending the trading week at 92.0. The Index could continue down to 91.7 if it fails at 92.1. The breakout point to the upside is at around 92.3

The Canadian dollar had a great run in last week's trading session, picking up the momentum from the previous week run. The Index still looks strong to continue to the upside. A break out above 76.6 could provide another leg to its next target at 76.8. Support is at 76.4 and 76.1

The Australian dollar fell from 68.8 to 68.3 at the end of last weeks session erasing almost half of the previous week gains. The Index closed the week's trading session at 68.3 after bouncing back at 68.2. The long term outlook still looks strong, but it will need to remain above 68.0 to make its way back to 68.5 and 68.8. A drop in prices below 68.0 could drive prices down to around 67.8

The Kiwi dollar rally came to an end after reaching 64.2 from the previous week run. The Index fell on Thursday from 64.0 and continued down on Friday ending the trading week at 63.5. The Index will be looking for support at around 63.4 at the beginning of next week's session. If it fails at 63.4, support is approximately at 63.2. The Index could head back up to 63.7 if it holds at the current support at 63.4.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.