Forex: 25 bp cut likely per Waller, but Harris-Trump debate might steal the spotlight

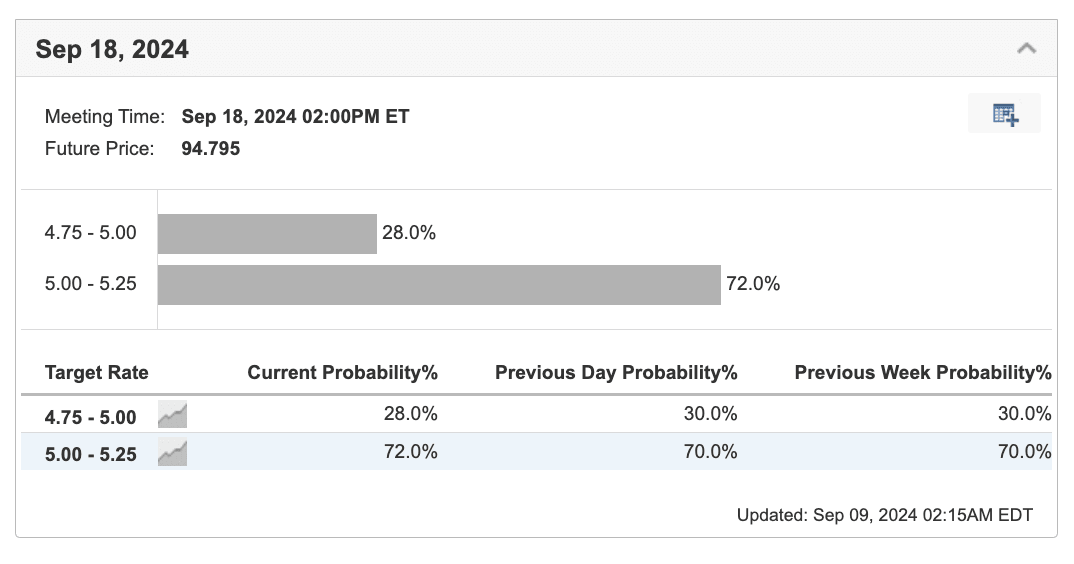

It’s looking more like a 25bps Fed rate cut in September, as markets seem to have washed out any serious chance of a 50bps cut. This has caused some short USD bets to be trimmed, but the rates market has really just kicked the can into 2025, where it looks more dovish—likely a response to recession concerns that aren't imminent yet, but the warning signs are still there. So, don’t expect the US dollar to go on a bullish tear anytime soon.

While Asia’s markets slipped, US and EU shares are doing a bit of short-covering after the 142,000 NFP headline number. A recession isn't on stock pickers' near-term radar, but that 25bps cut certainly is. We've argued before that a 25bps cut might be the stock market’s sweet spot, as a 50bps cut would likely cause some “What do they know that we don’t?” whispers to ripple through Wall Street. And hey, if anyone’s found that feel-good factor, send it my way!

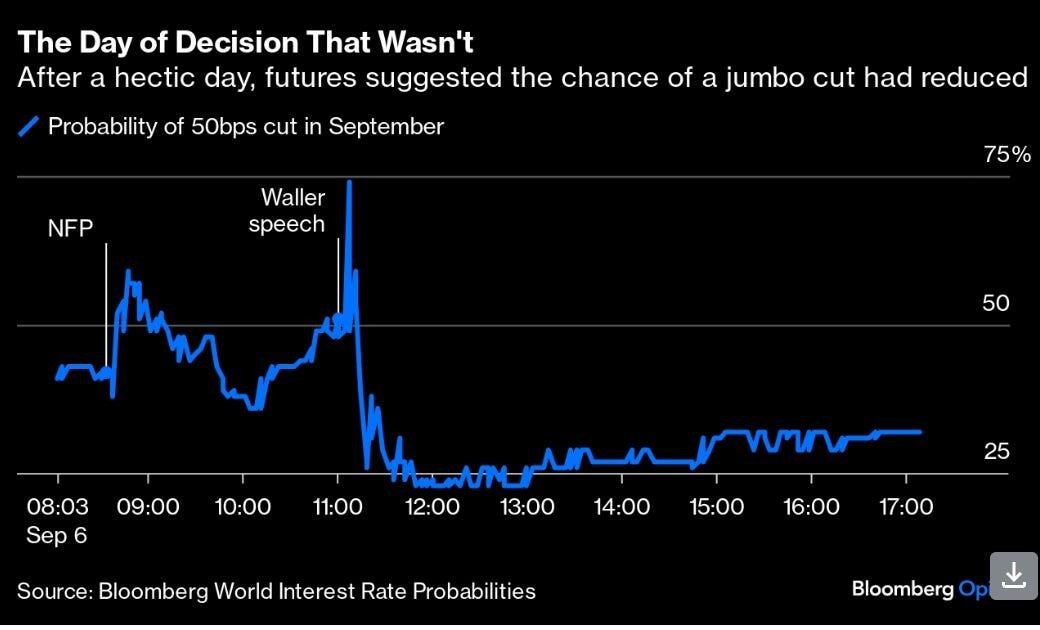

Fed Governor Waller dealt the final blow to any hopes of a 50bp cut. Waller confirmed what the market expected by committing to a September cut (which was already priced in) and implying the data don’t support a larger cut. His suggestion of deeper cuts down the line, if needed, shows that he's not in a rush. So, investors are back where they started—your outlook on Fed policy hinges on how you view the economy, and right now, the evidence is hazy at best.

Trading in the two-year yield suggests that many think the economy’s weak enough to push the Fed into more drastic measures eventually. For the best insights into where the Fed’s heading, follow Nick Timiraos from WSJ, who’s often seen as the Fed’s go-to whisperer.

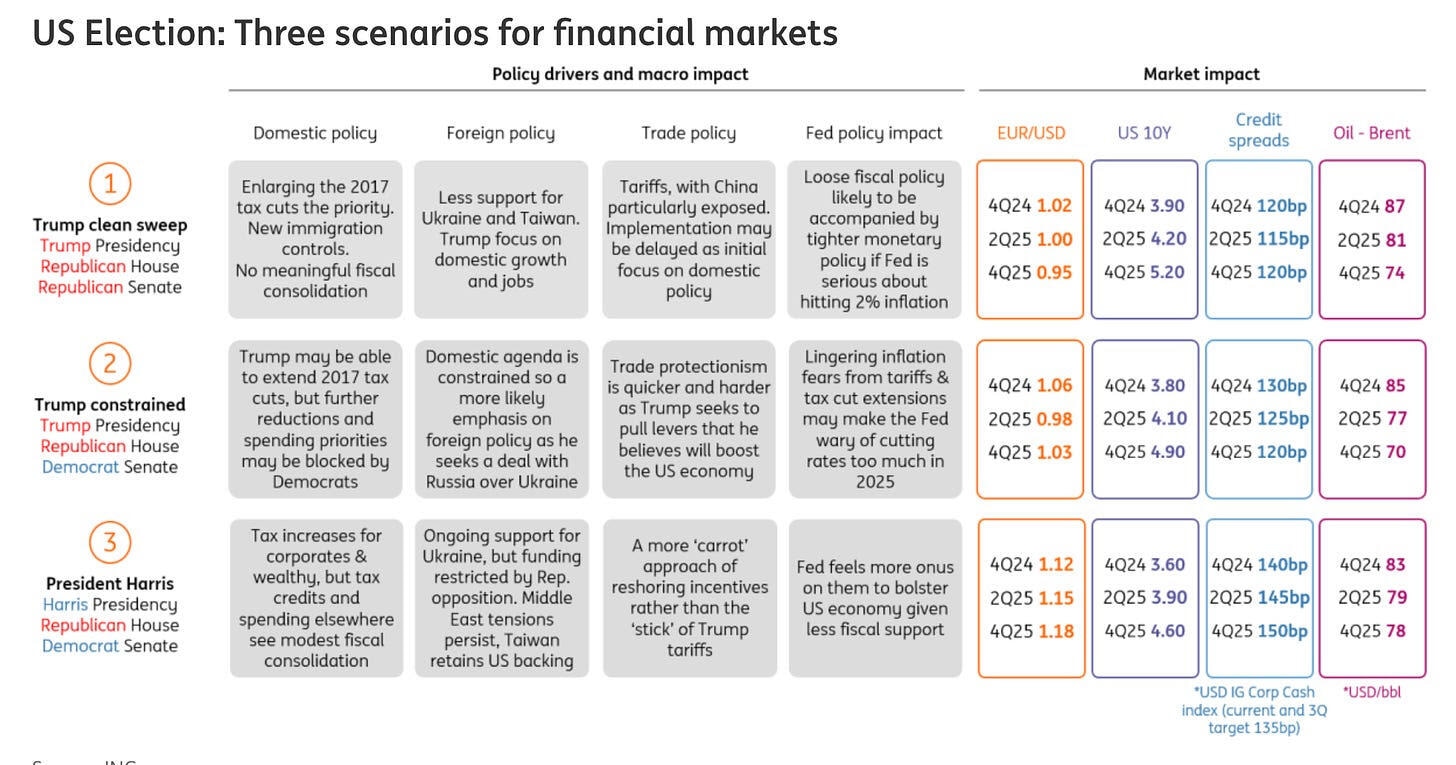

As for FX markets, the US jobs data and Waller’s speech sparked quite the stir—USD/JPY was a prime example. This week's big focus will be on US CPI data and Thursday’s ECB decision. But tomorrow’s first Harris-Trump debate might also stir things up. Some think Trump could throw a wrench into the Harris campaign, but it’s unclear whether this will shift markets into a precise Trump takes-all scenario.

EUR/USD couldn’t hold on to gains Friday, as investors kept flip-flopping on whether the Fed will opt for 25 or 50bps. This week’s spotlight is on Thursday’s ECB meeting, where a 25bp cut seems baked in. The big takeaway will be the quarterly forecast update—if back-year inflation gets a significant downgrade, it could weigh on the euro as rate cuts tend to, but more so with the Fed only moving 25 bp in September .

USD/JPY finally hit the brakes on its four-day slide, hovering around 143.30 at the time of writing. The recovery can be partially chalked up to Japan’s weaker-than-expected GDP data, but let's be honest—it's likely more about US risk markets finding some footing. After a weekend of reflection, FX traders seem to have ditched the 50bps rate cut fantasies for September, which has helped ease some of those heavy risk-off bets weighing down the pair.

As we wrote about last week, this was going to be a dollar-bid week for us anyway, as we expected US rates to move higher as the market prices outhope for a 50 bp cut in September, and the NFP data did little to change our view of that. It’s Monday, and trading momentum with no reversion trades set in stone until we get past the Fed and the Harris-Trump debate.

The August rally in Asian currencies, with the renminbi leading the charge, was a significant driver behind the broad dollar sell-off. But let’s be real—those gains were likely more about short-covering in the currency and local Chinese equities than anything else. Meanwhile, whispers were circulating that Chinese exporters were getting spooked into hedging export proceeds, having previously assumed the renminbi was on a one-way ticket to the basement.

However, the road to a stronger renminbi is anything but smooth. August CPI and PPI data out of China came in soft—again—and the local stock market (CSI 300) is back under pressure, sinking to February lows. Unless Chinese policymakers pull some serious stimulus out of their hat, it’s hard to see a lot of upside for the renminbi from here with the election odds pendulum swinging back to Tariff Man Trump.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.