FOMC Meeting Preview: Powell to keep every door open, surprises not out of the table after RBA

- The Federal Reserve is expected to hike rates by 25 bps and end the tightening cycle.

- The Reserve Bank of Australia hiked the cash rate by more than anticipated in a surprise move.

- US Dollar heads into the event with a weak tone, as tepid data hints at a recession.

The Federal Open Market Committee (FOMC) will kick-start its monetary policy meeting on Tuesday and announce its decision on Wednesday. The United States Federal Reserve (Fed) has anticipated a third consecutive 25 basis points (bps) rate hike and also hinted at a pause afterwards. After over a year of aggressive monetary tightening, the Fed has decided that the risk of an economic setback is not worth paying in their fight against inflation.

End of the tightening cycle

The end of the interest rate increase cycle was sped up by a banking crisis that surfaced in mid-March. The United States central bank policy, as well as that of its major counterparts around the world, has made credit conditions much rougher for companies, who have faced higher lending costs alongside rising prices and a still-tight labour market for over a year now.

There are multiple indications that a recession is coming to the United States, such as an inverted yield curve, soft manufacturing output extending in time, and depressed confidence among consumers. How hard the landing could be, partially depends on how the Federal Reserve will work from now on.

It is worth remembering that the Fed is also working on shrinking a record balance sheet by allowing assets to roll off, up to $60 billion in maturing US Treasury securities and up to $17.5 billion in maturing agency mortgage-backed securities per month.

A surprise on the table

Federal Reserve Chairman Jerome Powell will likely maintain the door open to different scenarios. Inflation has been easing at a slower-than-anticipated pace, so it is possible that Powell & co decide to condition additional tightening to data. But caution should prevail. Another American bank collapsed between the March meeting and this one, and the Fed could not ignore the fact that the problem is far from over.

Chances of a 25 bps rate hike stand above 85%, which means such action will hardly affect the US Dollar, as it has already been priced in. Should the central bank decide differently, hell could break loose across the FX board. It could sound crazy even to consider it, but the Reserve Bank of Australia (RBA) did so on Tuesday, surprising financial markets with a 50 bps hike. Indeed, Australian and American conditions are quite different, but well, the Australian central bank showed market players that every option is on the table in a central bank meeting.

Anyway, with the expected hike, the focus will shift to whatever Chairman Powell has to say on the future of monetary policy and how concerned policymakers are about the financial situation. It will be quite difficult to calm down markets, but if someone can do it, it is Powell.

US Dollar possible scenarios

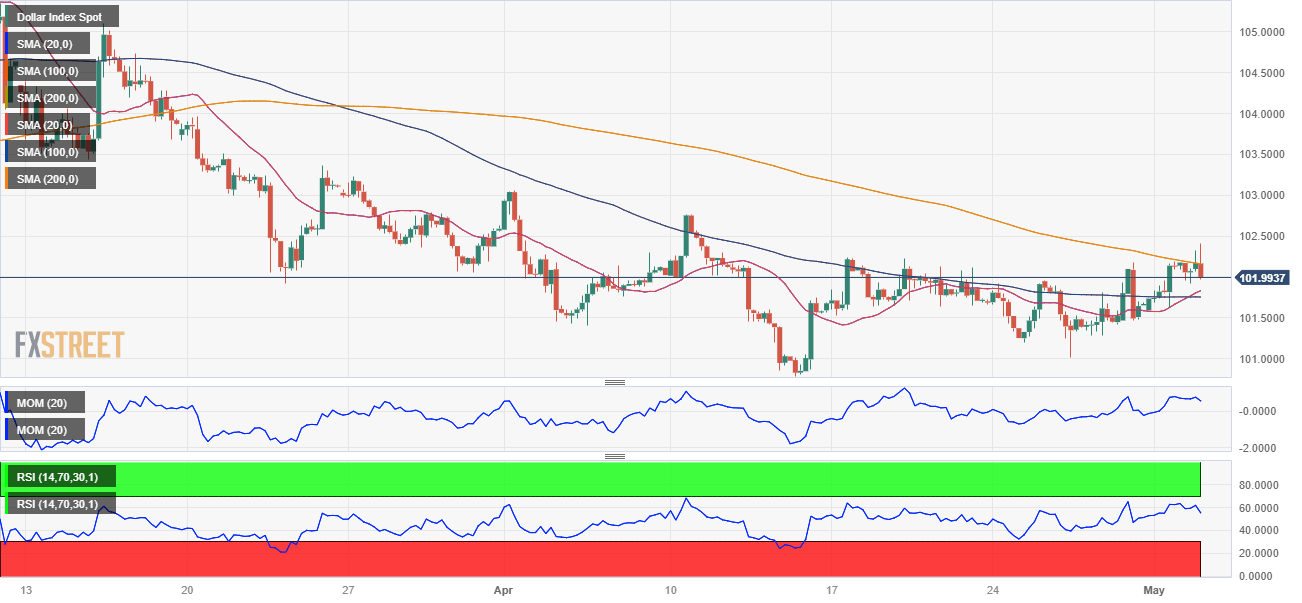

The American dollar heads into the event with a weak tone. The US Dollar Index (DXY) peaked at 103.25 on Tuesday, its highest since mid-April, but trimmed gains amid a worsening market mood and is currently battling to retain 102.00. Technical readings in the daily chart indicate that the DXY is in a consolidative stage within a bearish trend, trading not far above a multi-month low of 100.80 posted in February.

Also, DXY is retreating sharply after failing to overcome a bearish 200 Simple Moving Average (SMA), although the 20 SMA maintains its bullish slope and crosses above the 100 SMA in the 101.70/80 region, making the price zone a strong support area. Technical indicators, in the meantime, have turned lower but remain within positive levels, in line with the dominant trend. Finally, the aforementioned 200 SMA provides resistance at around 102.20 en route to the weekly high at 103.25.

The more dovish the Fed, the higher the chances of a DXY bearish breakout toward 101.00, while a spike towards the recent high on a hawkish stance will fall short of anticipating a change in the dominant downward trend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.