Federal Reserve puts rate cuts on pause

As usual, the Federal Reserve did exactly what everybody expected at its January meeting.

The central bank put interest rate hikes on pause and delivered a generally sanguine view of the economy.

After three consecutive rate cuts, the FOMC held rates between 3.5 and 3.75 percent. Two governors broke ranks with the others, with Trump appointees Stephen Miran and Christopher Waller voting for another quarter percentage point cut.

The official FOMC statement painted a rosy economic picture, stating, “Available indicators suggest that economic activity has been expanding at a solid pace.” And while “job gains have remained low,” the FOMC said “the unemployment rate has shown some signs of stabilization.”

On the downside, the committee acknowledged “inflation remains somewhat elevated.”

Powell reiterated the rosy economic evaluation during his post-meeting press conference.

“If you look at the incoming data since the last meeting, [there is] clear improvement in the outlook for growth. Inflation performed about as expected, and, as I mentioned, some of the labor market data came in suggesting evidence of stabilization. So, it’s overall, a stronger forecast, really.”

Powell said he thought the federal funds rate is “loosely neutral,” and the committee broadly agreed.

“Many of my colleagues think it’s hard to look at the incoming data and say that policy is significantly restrictive at this time.”

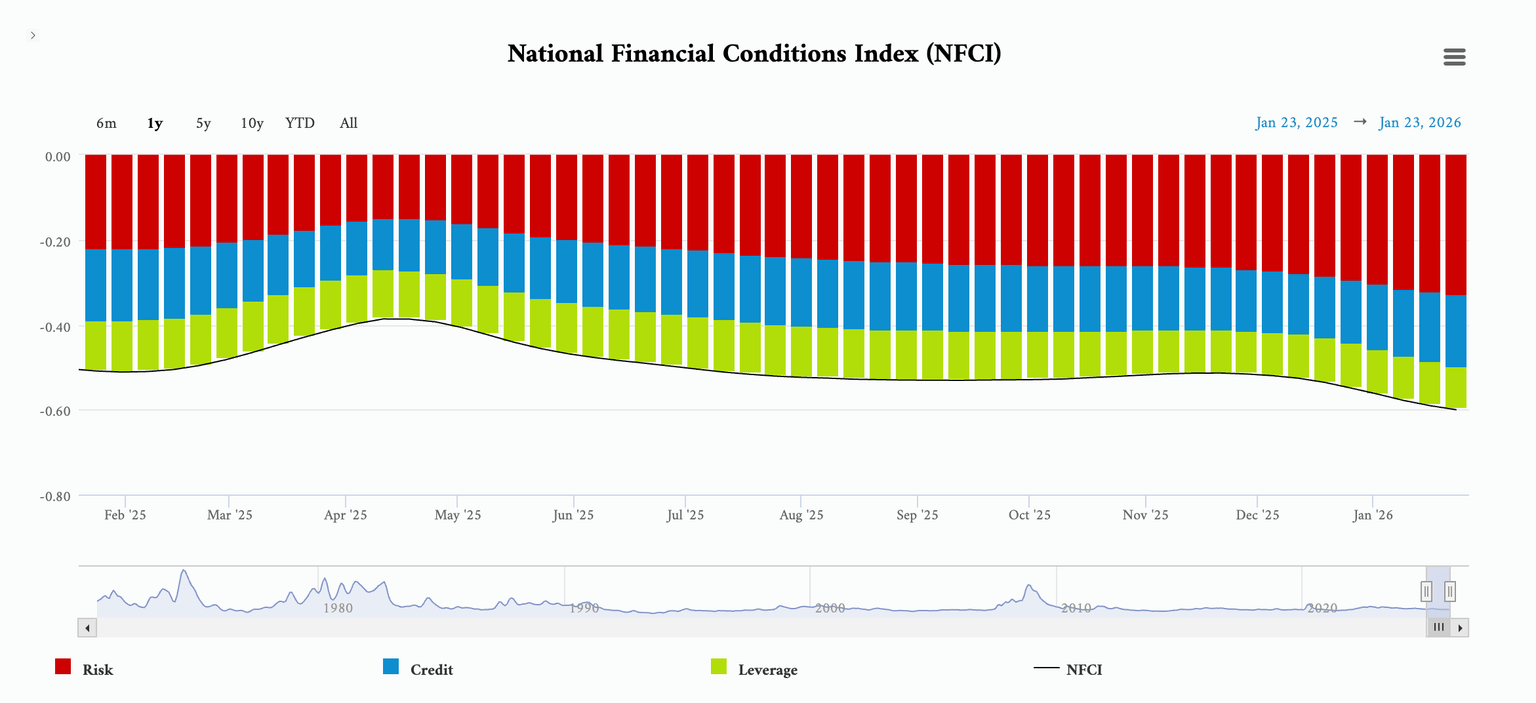

In fact, monetary policy remains loose from a historical standpoint. The Chicago Fed’s Financial Conditions Index was -0.60 as of the week of Jan. 23. A negative number indicates historically loose financial conditions. Based on the NFCI, financial conditions have become progressively looser since early December.

The FOMC provided little guidance on what might come next. The official statement said, “In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

It’s pretty clear the FOMC is still trying to walk a tightrope, balancing inflation concerns with the impact of higher rates in an economy dominated by a Debt Black Hole.

I have argued for more than a year that the central bank is in a Catch-22. It simultaneously needs to raise rates to battle persistent inflation and cut rates because this debt-riddled bubble economy can’t function in a normal rate environment.

Powell carefully framed his comments so the Fed could plausibly move in either direction. He insisted “monetary policy is not on a preset course,” and indicated the FOMC will make future decisions on “a meeting-by-meeting basis.”

“After the three recent rate cuts, we’re well-positioned to address the risks that we face on both sides of our dual mandate. [We] haven’t made any decisions about future meetings, but the economy is growing a solid pace. The unemployment rate has been broadly stable, and inflation remains somewhat elevated. So, we’ll be looking to our goal variables and letting the data light the way for us.”

If you’ve been watching the employment data carefully, this will concern you. The Bureau of Labor Statistics has consistently revised job numbers downward. By reporting strong job growth and then erasing jobs with revisions down the road, the BLS creates the impression that the labor market is stronger than it is in reality.

When asked about the national debt, Powell conceded that it is on an “unsustainable” path. However, he insisted the current debt level is sustainable. Stubbornly high bond yields and $5,500 gold beg to differ.

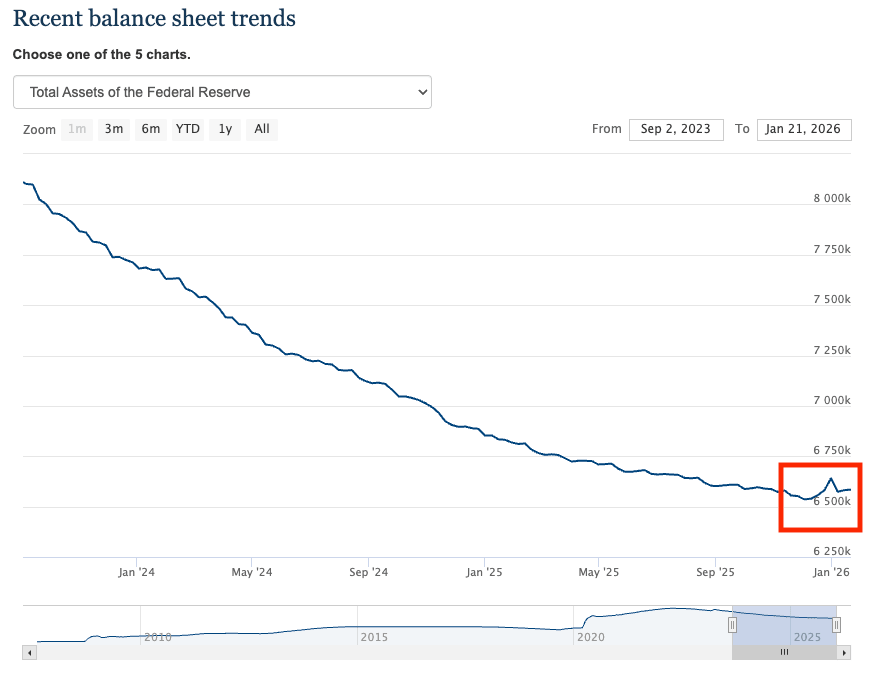

During the December meeting, the Fed announced it would relaunch quantitative easing (although it didn’t use that term). Since then, the Fed’s balance sheet has increased modestly by 48.4 million.

The FOMC statement didn’t address the balance sheet, and it remains unclear whether the central bankers intend to continue QE operations. Last month, the FOMC indicated it would increase the balance sheet by $40 million, and purchases would “remain elevated for a few months” before they are “significantly reduced.”

QE operations involve money creation. Expansion of the money supply is, by definition, inflation.

As for the rest of Powell’s presser, CNBC characterized it as “a snoozer,” noting the Fed chair delivered variations on the theme “I have nothing for you on that,” as reporters tried to get him to talk about various political issues swirling around the Fed and his chairmanship.

The markets barely reacted to what was a pretty ho-hum meeting. Stocks closed basically unchanged, while gold and silver continued their relentless climb higher. Typically, this more hawkish Fed messaging would create headwinds for precious metals. This may indicate that the world knows the central bank isn’t in control of the financial system to the extent that they would have you believe.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.