Fed Speak Lift-off: Fast hikes coming fast!

Chair Powell recognised inflation is "substantially higher than 2%". It is 7%... Good spot.

Good morning,

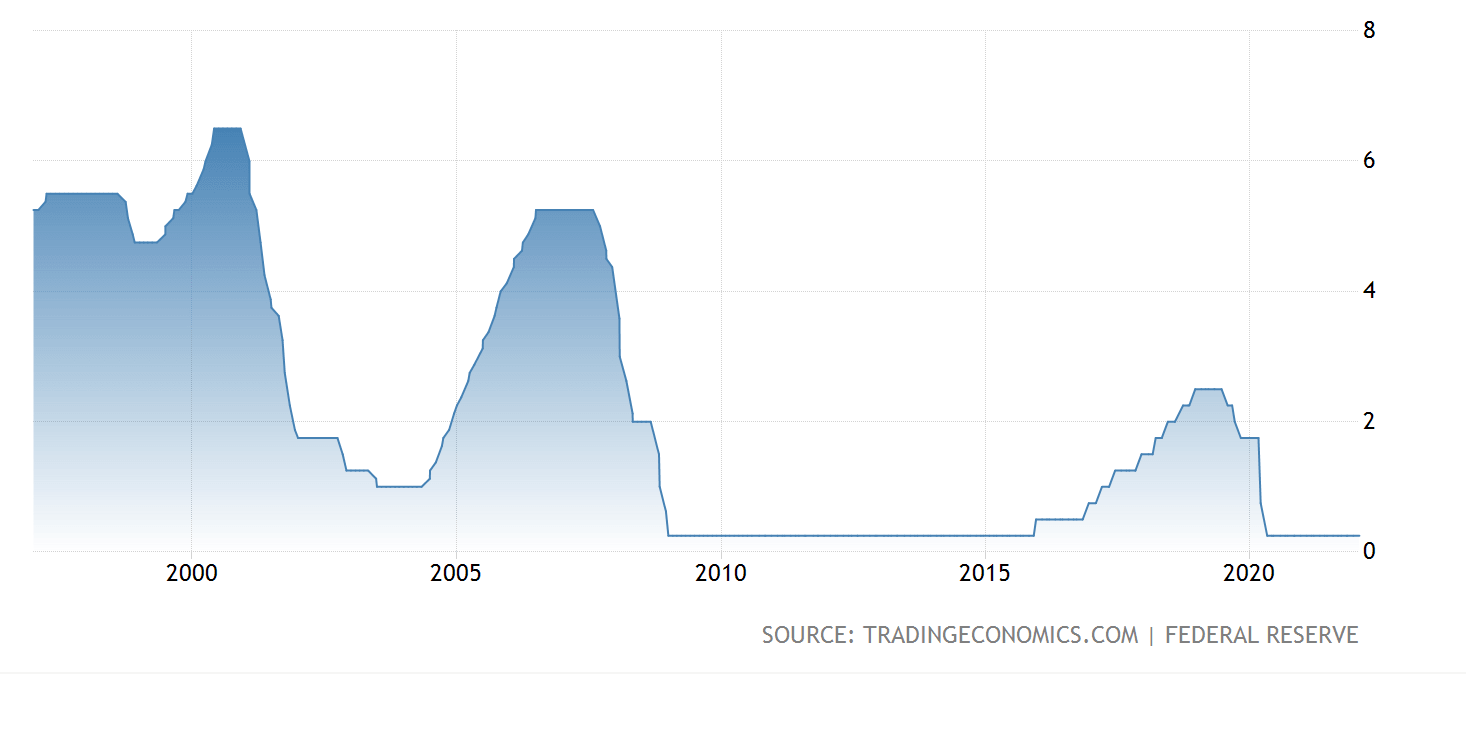

Federal Reserve Chairman Powell went out of his way during question time to continually highlight that there is immense room for interest rates to go up quickly without any negative impact on the labor market or the economy.

Chairman Powell reasserted, as I am often telling people, that the maintenance of stock market levels is NOT the role of the Federal Reserve. Their role is supporting the economy and maintaining a strong labor market.

Chairman Powell said they will be looking at the Fed Funds Rate as the number one vehicle to adjust monetary policy and fight inflation.

When specifically asked if individual rate hikes could be as high as 50 points, he answered by saying there is a lot of room for significant increases in the Fed fund rates due to the historically tight labor market?

On inflation, the Fed continues to appear to lack an accurate understanding of the forces involved and where they are coming from. "Freedom of pricing" driving simultaneous increases in earnings and inflation is a discovery yet to be made at the Fed.

This means what we are facing is exactly as forecast last June that the Federal Reserve will be hiking rates increasingly aggressively. Yet, remain far behind the inflation curve. The risk becomes an intensifying pursuit of inflation later in the year. I believe inflation will remain stubbornly elevated.

Powell is still talking about supply chains becoming better functioning which will alleviate inflationary pressures. This is the exact same argument as existed when inflation was at 3%.

Conclusion: The takeaway for me is that the core issue and problem, that of inflation, will remain unbridled. Even with my forecast that the Fed Funds Rate will be 1.75% to 2.25% this year.

High stock valuations are going to be increasingly confronted with a deteriorating economic outlook and ever higher interest rates.

Hence my continued bearishness on equities.

US Inflation

Fed Funds Rate

Plenty of room for very big gains.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a