Facebook – Q2 earnings expectations

Facebook (NASDAQ:FB), the social networking service that was created by current CEO Mark Zuckerberg, was planning to post its second-quarter earnings results today (July 29), but this was postponed in an announcement on Monday that Mark Zuckerberg will attend to testify before the House Judiciary Committee on the same day. So the results will be released on Thursday, July 30, 2020 after the market closes.

The company has faced what could be seen as the most adverse times in its history, due to the growing economic uncertainty related to the coronavirus, as well as the boycott suffered by more than 400 advertising companies causing a decrease in the sale of advertisements. In addition, several companies have announced plans to freeze ad spending on the platform during the year.

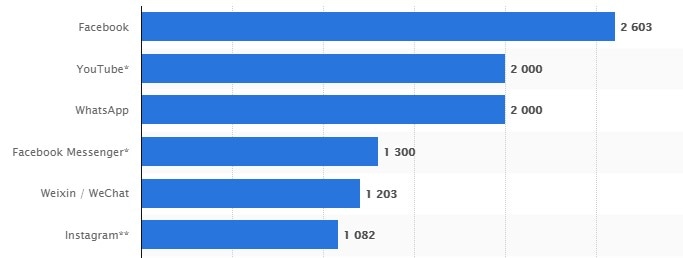

Facebook is the largest social network in the world; it currently has a cumulative total of 2,603 billion monthly users, which is expected to increase, although a drop in average revenue per user on a quarterly basis is expected at 6.66. – In the Q2 2019 it was at 7.05, and at 5.97 in Q2 2018. According to statista.com, the 6 networks with the highest users are Facebook, YouTube, WhatsApp, Messenger and Instagram. Facebook has had a sequential increase of 0.6% in its active users per month.

Facebook has an estimated revenue between $17.31 billion and $17.33 billion, which indicates an increase of 2.5% – 3% compared to the figure reported in the quarter of the previous year that was at 16.9k million and in 2018 at 13.2k million. In addition, EPS is expected to be at $1.44, indicating an increase of more than 58% from the figure reported in the quarter of the previous year that was at 1.99 and 2.09 in 2018.

Additionally, Facebook has developed multiple services, including Facebook Shop, a virtual store creation service, Novi, a digital wallet for managing its Libra digital currency and a new section called Businesses Nearby, which will allow you to see the latest posts from businesses within a certain geographic radius (you can adjust it to anything from 1 mile to 500 miles), view their current hours and pickup/delivery options and make a booking or send them a message. All this will allow to the public to show support to local small business and get the latest updates as those businesses deal with the fallout during the pandemic and into the future.

In a blog post, Facebook described this as a way to allow users to “more quickly find essential products and services” while also helping businesses get “more virtual foot traffic as they move online to stay open.”

Technical Analysis

Technically speaking, after the fall of the first quarter, in the second quarter FB share had an uptrend that ranged from the support of $150, to a quarterly maximum at $244.91 before falling to its support at $200-206. The bullish momentum continued in Q3, rising to the psychological level and new all-time high at $250. However OB conditions could seen a pullback. Medium term Support is set between the 100-DMA and January’s low at the $200-206.61 area. However a continuation of the 4-month bullish trend could retest $250. A break of that high could retests Fibonacci extension.

Support: 225/206-200/180/161-150/133.65

Resistance: 236.88/250/272.97-280.46/300/312-319