Everyone is satisfied that the inflation data came in as forecast – Critics to start complaining soon

Outlook: Today we get import/export prices and consumer confidence, with a couple more Feds to speak. Consumer confidence may have been trumped by yesterday’s inflation seeming tamer.

Everyone is satisfied that the inflation data came in as forecast, but it will take only a short while for critics to start complaining the numbers should have been lower and what’s wrong with economists, anyway? The Cleveland Fed has 5.87% y/y for Dec core CPI but the forecast was for 5.7%. The Cleveland Fed must be biased. So is the Atlanta Fed, whose sticky-price core is 6.6%.

Let’s all use the q/q annualized, because that appears so much better! Q4 CPI annualized is a mere 1.6%, better than 2% in Q3. The core version is only 3.2% from 6% in Q3. Core services were up but core goods prices fell by 4.8% in this version. Housing is on the way down, too, so after leaving it out entirely this time, let’s put it back next time. Therefore, the Fed will definitely be cutting rates before year-end and maybe even in Q3!

This is normal exaggeration and standard undue extrapolation. Just because it’s normal doesn’t mean it’s right. Granted, the Fed will be happy to change its mind and not see a pause/cut as premature if it can be satisfied some lag or another is not going to jump up and bite it on the rear. That will have to include suppressed wage growth and energy costs staying tame.

We are inclined to doubt that giant rate hikes can tame inflation that fast, and we worry that once it sinks in that inflation will be higher for longer, too, traders will throw a tantrum.

Goldman has a cute estimate of the probability of recession–45-55%. This is funny in its own way. It also says if we do get a recession, it will be mild and short-lived. And it won’t stop US equities from performing well. The S&P will close this year up 12% y/y, following the 19.4% drop in 2022, the worst performance since 2008. That’s even if the S&P falls in Q1.

Bottom line, we have a revised likelihood of only a mild recession in the UK and Europe coupled with no recession at all in the US. But inflation is higher over there and the BoE and ECB are playing catch-up with the Fed. They are still hiking, and by the bigger 50 bp than the Fed’s newly measly 25 bp. The FX market wants to buy sterling and euros. Separately, the BoJ might be changing its tune next week and pressure against the 10-year is already driving the yen.

We agree with the yen story, but the UK/eurozone story is excessively optimistic. It neglects the war, for example, not to mention the relatively stronger capability of unions to get wage-push inflation and their relatively higher starting point.

Take a look at the weekly euro/dollar chart. The Schaff cycle indicator is already topping out, implying the max gain for the euro is 1.0942 (the 50% retracement) or 1.1272 (the 62%). Yes, the dollar got seriously overbought last year. But for good reasons, and those reasons can return. By mid-year, the US will still have decent growth, still-falling inflation and the highest rates anywhere. In the absence of a crisis, risk-on can still drag it down, but the minute some serious risk appears–N. Korea, Russia’s nuclear, climate crisis or an unknown unknown, the dollar becomes not only the safe haven, but a darn good one.

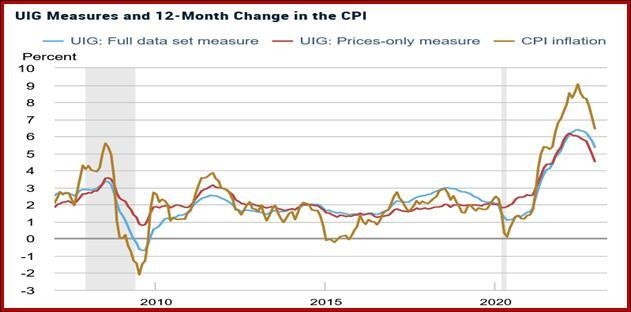

More about inflation: The NY Fed’s Underlying Inflation Gauge (UIG) doe Dec has the full price version down 0.3% from Nov at 5.4% and the prices-only version down 0.5% at 4.5%. So, prices-only is a mere 4.5% vs. 6.5% for standard CPI. Include a bunch of other factors, “underlying” is 5.4% vs. 6.5% for the standard CPI.

Meanwhile, the Atlanta Fed offers the sticky price inflation rate for Dec at 6.7% y/y, while the core sticky-price index rose 6.6%. Both fell at a hefty pace, if slightly less than the month before..

Both charts show convincing moderation in inflation. It’s certainly true that inflation is falling, but it’s still at a high level and a level far above what the Fed wants on the PCE basis. It’s unreasonable to imagine inflation by any measure can fell enough in two or three quarters to have the Fed ready to cut rates. The Fed is far more likely to stand firm on what it will have already done.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat