European Central Bank Preview: Lagarde set to create lose-lose situation for Euro

- The European Central Bank is set to leave interest rates unchanged in its September meeting.

- ECB President Christine Lagarde will likely leave the door open to increasing borrowing costs again.

- Investors are set to interpret any pause as a victory for doves, downing the Euro.

Stagflation is coming – after a scorching hot summer in the Mediterranean, winter is not the worst fear in the old continent. Policymakers at the European Central Bank (ECB) fear the toxic mix of sticky inflation and growth stagnating at best, and it is unclear how they will react in September. I expect any hesitance to be treated as weakness.

Here is a preview for the European Central Bank decision on Thursday at 12:15 GMT.

ECB in a conundrum as core inflation refuses to crumble

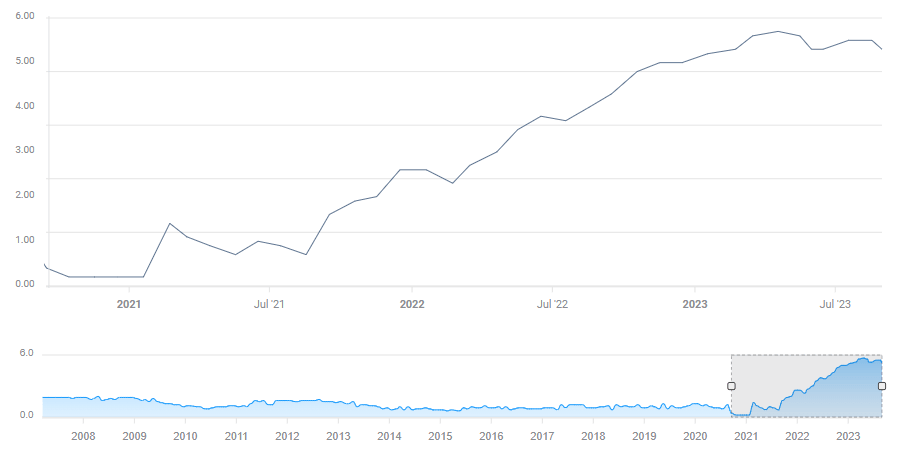

The ECB aims for a headline inflation rate of around 2% YoY. While the latest Consumer Price Index (CPI) read for August stood at 5.3%, it is a remarkable halving from 10.6% recorded in October 2022.

However, this is mostly a result of tumbling energy prices, and bringing price rises from 5.3% to 2% is far harder. Core CPI, which excludes volatile prices of food and energy, is also at 5.3% YoY, and in this case, it is only 0.4% below the peak of 5.7% recorded in April this year.

Why is underlying inflation so sticky? Many European workers are unionized, with wages indexed to inflation. Collective bargaining is one part of the story, and another is labor shortages seen all over the world. Salary growth is harder to slow, contrary to goods inflation.

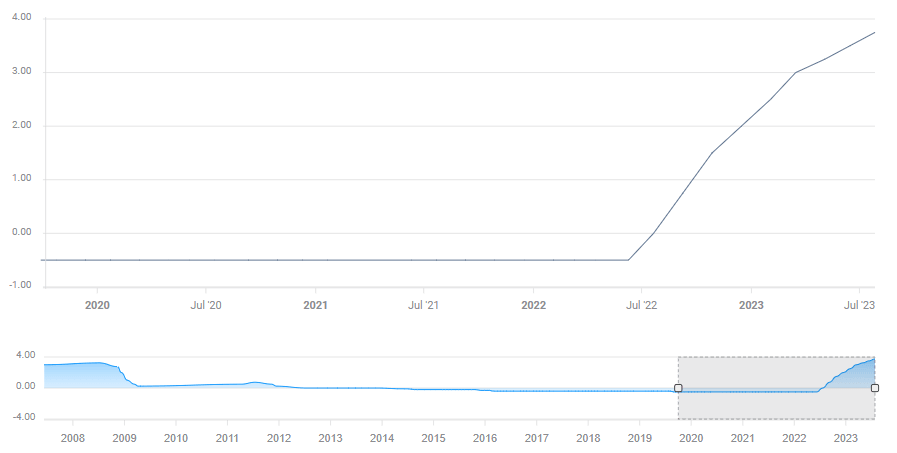

Sticky services inflation is a reason to raise rates, but what the Frankfurt-based institution has already done is a reason to halt. The main lending rate has risen from 0% to 4.25%, and the deposit rate from -0.50% to 3.75%. Some of this is still making its way to mortgages and lending.

Source: FXStreet

Policymakers are unsure about the time it takes for changes in interest rates to hit the real economy, and it is hard to separate the ECB's impact from weakening Chinese growth and other factors.

Nevertheless, there are signs of stagnation. The eurozone economy grew by only 0.1% in the second quarter of 2023, the same rate as in Q1 and after shrinking by a marginal 0.1% in Q4 2022. This is a far cry from the fast expansion after covid.

Moreover, prospects look grimmer by the day. The EU Commission has cut the area's Gross growth forecasts, and it sees Germany, its largest economy, in a recession.

This leaves the ECB, and especially its hawkish German members, in a conundrum. Further raise rates to battle inflation or pause to think? With 20 countries represented around the table, the result will likely be a "euro-fudge" of sorts, and it may turn into a lose-lose for the common currency.

ECB Scenario 1: Hawkish hold

In this outcome, the bank leaves borrowing costs unchanged for the first time since early 2022, citing slowing price rises and growing uncertainty. However, it strengthens its language about tightening its policy if needed, and refers to fighting inflation in a more furious tone.

I see such a compromise as the more likely scenario, as it would also be following other central banks. The US Federal Reserve (Fed) has already paused once and is likely to repeat the same feat in September.

The knee-jerk reaction would likely be a weaker Euro in response to the unchanged rate, with a quick bounce after algorithms and investors digest the hawkish language.

Nevertheless, I expect ECB President Christine Lagarde to fail to convince markets that another hike is on the cards, leading to a gradual decline in the Euro. Worries about a European recession as a part of a global slowdown, will likely prevail.

ECB Scenario 2: Dovish hike

In this outcome, hawks have their last hurrah, pushing the bank's Governing Council to setting the deposit rate at the round 4% level. Nevertheless, they would have to compromise for a softer language on future moves, basically sealing the deal on any further rate hikes.

The Euro would likely rise on the rate news, then fall on the softer language. Further down the line, worries that the ECB is adding to the recession risks by choking the economy would further push the common currency down.

I see this scenario as less likely, as hawks are unlikely to relinquish their optionality. Nevertheless, the outcome for the Euro after several hours is similar.

Additional considerations

The ECB also publishes its updated growth and inflation forecasts at this junction. The figures will likely show lower estimates on both economic gauges. With recession worries hanging in the air, a significant downgrade in growth would hurt the Euro more than any change in inflation projections. If the ECB surprises with optimism, there could be a small boost to the upside.

The timetable is also worth noting, especially for those who trade EUR/USD. The ECB announces its decision and forecasts at 12:15 GMT, and Lagarde meets the press at 12:45 GMT.

In between, the US releases weekly Initial Jobless Claims figures, which have had a greater impact in recent weeks. Claims data may distort any ECB-related EUR/USD trade..

Final thoughts

The old continent is at a sensitive spot, and the ECB is stuck between a rock and a hard place. I expect the bank to err on the side of caution, refraining from raising rates, and practically ending the tightening cycle, even without officials admitting it, sending the Euro down.

The event is complex and full of twists and turns. I urge trading with care around it.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.