European Central Bank Preview: Fresh forward guidance, old fears

- The ECB is expected to introduce changes to its forward guidance.

- Market participants anticipate a dovish tilt on the monetary policy stance.

- EUR/USD could break below March’s low at 1.1703 and enter a mid-term bearish trend.

The European Central Bank will announce its latest decision on monetary policy on Thursday. No changes are to be expected, as after revealing their latest Strategic Review Report, European policymakers made it clear that they won’t be tapering anytime soon.

Symmetrical 2% inflation target

Lagarde & Co revised their inflation target and decided to change the usual “below, but close to 2% target” to a “symmetrical” 2% inflation goal. That means moderate, temporary positive and negative deviations would be tolerated, although they are “equally undesirable,” according to the ECB’s statement.

At this point, the central bank is foreseen keeping the benchmark rate at the record low of 0%, and the PEPP (Pandemic emergency purchase program) unchanged at €1.85 trillion, set to continue until March 2022. The ECB may extend the duration of the program, which should be taken as a dovish shift.

President Christine Lagarde has also noted that they would make some changes to their forward guidance to include the latest changes. Additionally, the coronavirus Delta variant poses a risk to the economic comeback, and policymakers won’t refrain from mentioning it. Overall, market players anticipate a dovish tilt, but most of it has already been priced in. A hawkish stance, on the other hand, will be quite a surprise that will catch investors off guard.

EUR/USD possible reaction

The FX board is being dominated by sentiment, which means EUR/USD is moving on the dollar’s strength or weakness. The ECB could introduce some temporal noise, mainly with a too dovish or a hawkish stance, but could be short-lived. The market will quickly move away from trading the central bank’s decision and return to its previous stance.

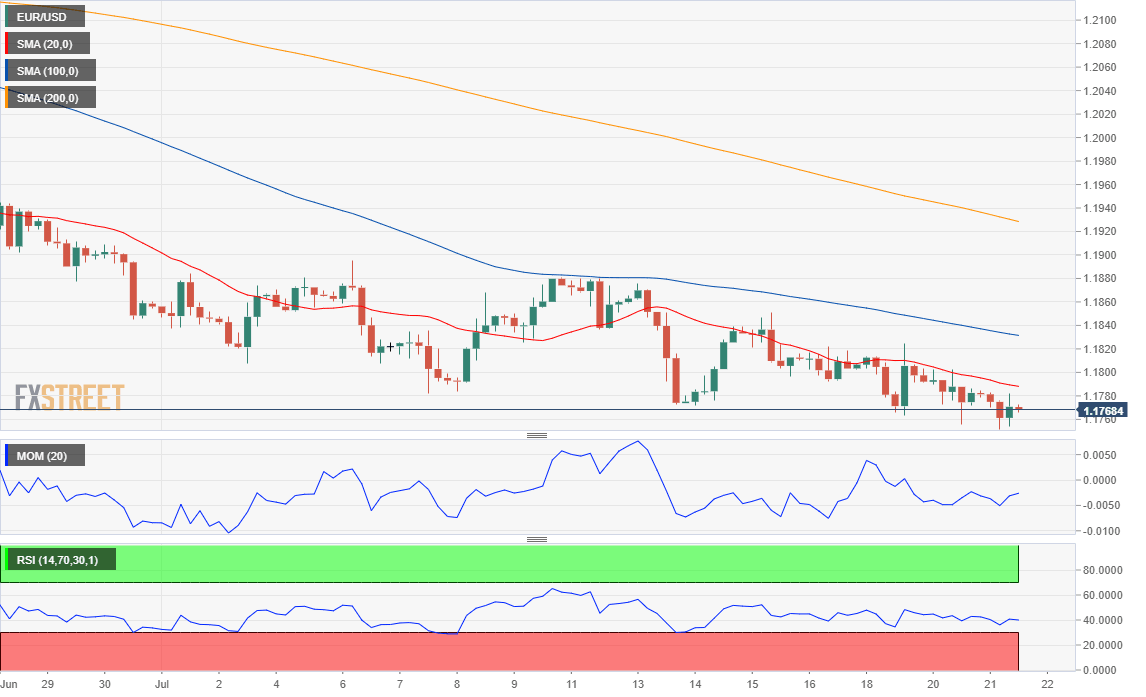

Ahead of the announcement, the EUR/USD pair is under strong selling pressure, trading at its lowest in three months. The pair is bearish and poised to retest the March monthly low at 1.1703. Once below the latter, the slump may extend toward the 1.1660 price zone, while reaffirming a mid-term bearish trend. To the upside, the level to watch is 1.1840, as a recovery above it could see the pair approaching the 1.1900 figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.