Euro starts week with gains

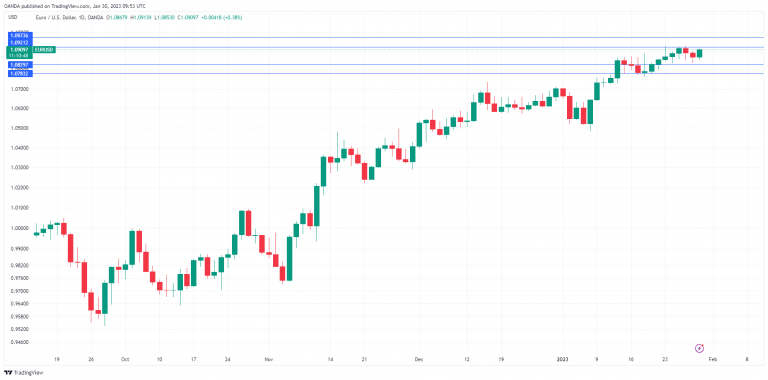

The euro is in positive territory on Monday. EUR/USD is trading at 1.0907 in the European session, up 0.36%.

It was a quiet week for the euro, which continues to hug the 1.09 line. I expect to see stronger volatility this week, as the eurozone releases GDP and inflation data, followed by the ECB rate announcement on Thursday.

German GDP declines in Q4

Germany’s economy posted a rare decline in the fourth quarter. GDP came in at -0.2% q/q, down from 0.4% in Q3 and shy of the forecast of zero. On an annualized basis, GDP slowed to 1.1%, down from the Q3 read of 1.3%, which was also the forecast. The markets are braced for more bad news out of the eurozone on Tuesday. German retail sales for November are expected to drop by 4.3% y/y, after a decline of 5.9% in November. Eurozone GDP is expected to slow to 1.8% y/y in Q4, compared to 2.3% in Q3.

The ECB will be keeping a close eye on this week’s GDP and inflation data, ahead of a key rate decision on Thursday. The central bank has adopted a hawkish stance but is still playing catch-up with inflation, which is currently at 9.2%. The markets are expecting 50-basis points at the upcoming and March rate meetings, but there is uncertainty as to what happens after that. The ECB would love to ease up on rates, but the paramount consideration is curbing high inflation. The cash rate stands at 2.50%, and the markets are forecasting a terminal rate in the range of 3.25%-3.75%, meaning that there is plenty of life left in the current rate-tightening cycle.

EUR/USD technical

-

EUR/USD is testing support at 1.0907. Below, there is support at 1.0837.

-

1.0958 and 1.1028 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.