Euro Falls as EU Industrial Production for August Declines

European stocks and US futures declined today as traders continued to watch the ongoing trade talks between the United States and China. On Friday, the two countries announced that they had reached a small deal that will see increased purchases from China. The deal will also see the US pause on additional tariffs on Chinese goods. Earlier today, data released by China showed that the country’s exports to the US had declined by more than one-fifth. This was steeper than August’s decline of 16%. This underscored Beijing’s urgency to resolve the trade crisis.

The sterling declined today as the queen opened the new session of parliament. In the speech, the queen reiterated that she will ensure that the country will continue having an important say on global issues. In a statement, Boris Johnson called on the members of parliament to end the gridlock and unite to ensure that the country leaves the EU well. This will be a crucial week for Johnson because he must make a deal with the EU. Failure to secure a deal will force him to ask for an extension from the European Union. He is opposed to seeking an extension.

The euro was little moved today after the EU released the industrial production data for August. The numbers showed that industrial production rose by 0.4% on a MoM basis. This was slightly higher than the consensus estimates of 0.3%. In July, industrial production declined by -0.4%. On an annualized basis, industrial production declined by -2.8%, which was lower than the expected decline of -2.5%. It was also worse than the July decline of -2.1%. Industrial and manufacturing data from the European Union has been a bit weak because of the ongoing gridlock on Brexit and the trade war.

XBR/USD

The XBR/USD pair declined today as traders doubted that the trade deal announced between the US and China will have much impact. The pair reached a low of 58.70, which was lower than the intraday high of 60.45. On the hourly chart, the price is along the 38.2% Fibonacci Retracement level while the price is below the 14-day and 28-day moving averages. The RSI has declined from a high of 75 to the current level of 42. The pair will likely decline to a low of 57.75 before proceeding with the upward trend.

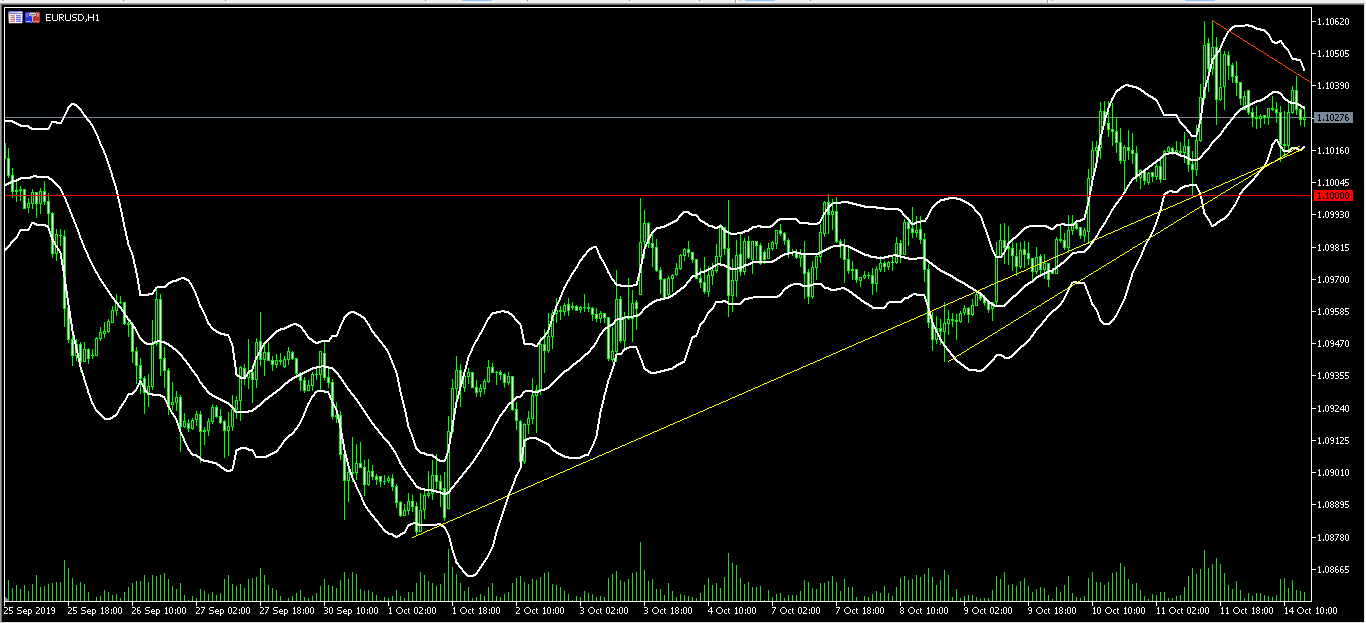

EUR/USD

The EUR/USD pair is trading at 1.1030, which is slightly higher than the intraday low of 1.1012. The current price is slightly lower than the middle line of the Bollinger Bands. The pair is also trading above the important support shown in yellow below. This has seen the pair create a symmetrical triangle pattern. There is a possibility that the pair will continue trading within the current triangle pattern before it makes a breakout in either direction.

GBP/USD

The GBP/USD pair declined today from an intraday high of 1.2705 to a low of 1.2515. On the hourly chart, the pair has moved below the 14-day and 28-day moving averages. The two averages appear to be having a bearish crossover. The RSI has moved much lower from the previous high of 91 to the current level of 42. The pair will likely continue moving lower. Still, there could be some volatility as more news on Brexit breaks.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.