EUR/USD Weekly Forecast: US CPI, the Fed and the ECB grant action next week

- The Federal Reserve and the European Central Bank will announce their monetary policy decisions.

- The US core Consumer Price Index is foreseen to tick higher in May, affecting Fed’s tone.

- EUR/USD consolidates ahead of first-tier data set to provide directional clues.

The EUR/USD pair managed to post modest weekly gains, settling in the 1.0760 price zone after being unable to advance for five weeks in a row. US Dollar strength receded on the back of renewed doubts about the Federal Reserve's (Fed) upcoming monetary policy decision. The United States (US) central bank is mostly expected to keep rates on hold when policymakers meet next week, although odds of another interest-rate hike increased following hawkish surprises from the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC), which unexpectedly hiked rates by 25 basis points (bps) each, against expectations of a no-move.

The USD dived on Thursday following the latest BoC decision, as odds for a pause in the Fed’s interest-rate hiking cycle next week declined from 75% to 63%, although they quickly returned to above 70% following a discouraging US employment-related report. Initial Jobless Claims rose by more than anticipated in the week ended June 2 to 261K. The figure suggested the job market is cooling, backing a pause in the rate hikes.

However, employment-related figures released earlier in the month were far from suggesting so. On the contrary, the Nonfarm Payrolls (NFP) released on June 2 came in much better than anticipated, while the weekly jobless claims report indicated that, despite the surge in applications, claims remain at levels consistent with a tight market.

A tight labor market, alongside signs central banks are not done with the tightening cycle, are keeping investors on their toes ahead of upcoming first-tier events.

Critical week ahead

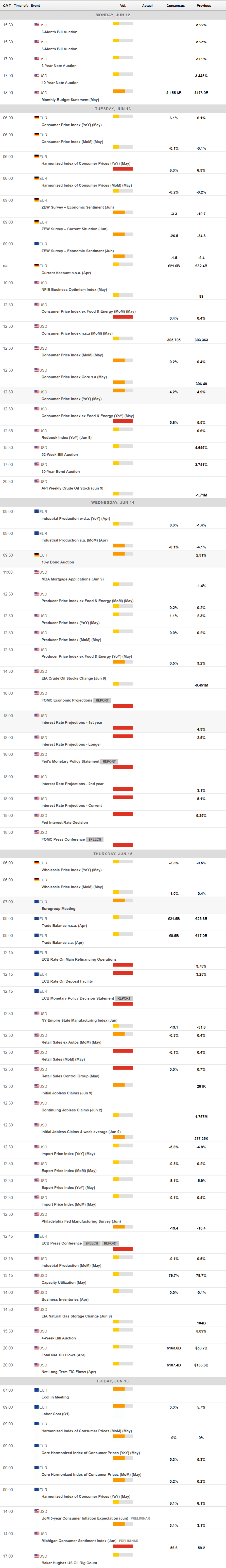

Next Tuesday, and ahead of the Fed’s monetary policy decision, the US will release May inflation figures. The Consumer Price Index (CPI) is foreseen up by 4.2% YoY, while the core annual CPI is expected at 5.6%, higher than the previous 5.5%. The figure will likely boost bets of a rate hike ahead of the Fed’s announcement on Wednesday and could trigger some wild volatility across the FX board, particularly if the outcome surpasses expectations.

The Federal Reserve will also introduce noise when it announces its decision. The most likely scenario seems to be a pause combined with a hawkish message that leaves the door open for another rate hike in the near future. If somehow the Fed confirms that monetary tightening remains on the table, stock markets could collapse while the USD could rally on the back of fears.

Finally, on Thursday it will be the turn of the European Central Bank (ECB) to decide on monetary policy. The market view is less blurry, as speculative interest is certain European policymakers will pull the trigger. Financial markets anticipate a 25 bps hike and a hawkish message of additional increases in the upcoming meetings.

The bottom line is that US CPI and the Fed’s announcement have the most chances of setting the market tone for the following weeks. If the CPI comes in below expectations and the central bank skews to the dovish side, then risk appetite will likely take over sentiment and lead to substantial USD losses, with EUR/USD potentially overcoming the 1.1000 threshold.

More data in the docket

Beyond the aforementioned first-tier events, the macroeconomic calendar will include other interesting figures that could clarify the economic situation of both the US and the Eurozone. Germany will publish the final estimate of the May Harmonized Index of Consumer Prices (HICP) expected to be confirmed at 6.3% YoY. The country will also release the June ZEW Survey on Economic Sentiment. The Eurozone will also publish the final HICP estimate, while the US will publish May Retail Sales and the preliminary estimate of the June Michigan Consumer Sentiment Index. The latter expected to deteriorate to 56.6 from 59.2 in the previous month.

EUR/USD technical outlook

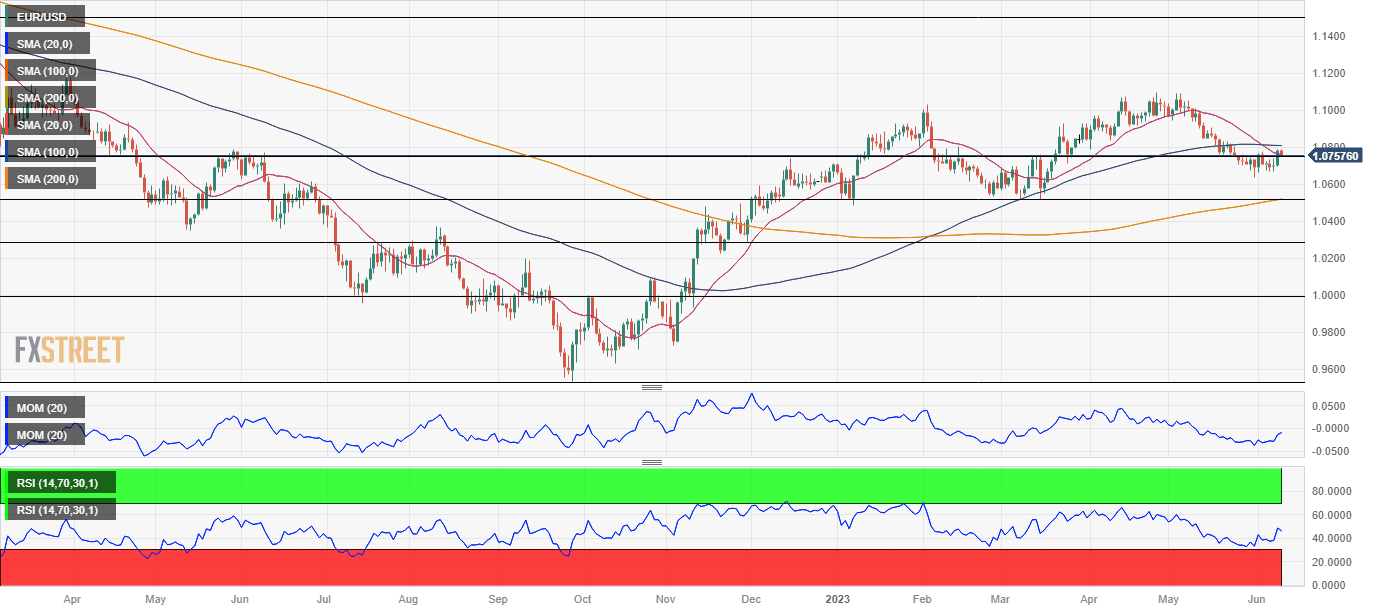

Bulls have become more courageous but remain unconvinced, according to technical readings in the weekly chart. EUR/USD trades just above 1.0745, the 61.8% Fibonacci retracement of its 2022 yearly slump, but for the last two weeks it met sellers around a flat 20 Simple Moving Average (SMA). The 100 SMA, in the meantime, extended its decline above the shorter one, suggesting sellers are still present.

At the same time, the Momentum indicator extends its consolidative phase, holding directionless just above its 100 line. Finally, the Relative Strength Index (RSI) indicator advances modestly, developing within neutral levels and falling short of suggesting sustained buying interest.

The daily chart shows that bulls turned cautious ahead of the weekly close. The pair is confined to a tight intraday range, struggling to overcome its weekly peak at 1.0785 posted on Thursday.. At the same time, the pair is barely holding above a still bearish 20 SMA, while the 100 SMA heads nowhere at around 1.0810. On a positive note, the 200 SMA maintains its bullish slope, converging with the 50% retracement of the 2022 yearly slump at 1.0507.

Nevertheless, technical indicators are starting to retreat from around their midlines after correcting oversold conditions achieved late in the previous week, somehow favoring another leg south without confirming it.

As said in the previous report, the pair needs to clear the 1.0810 price zone to gain upward traction, with room to extend gains initially towards the 1.0900 area and then en route to the 1.1000 psychological threshold.

Sellers have defended the downside in the 1.0660 area, although a relevant multi-week low stands at 1.0634. A break below the latter should lead to a test of the aforementioned Fibonacci support at 1.0507, a line in the sand for bulls.

EUR/USD sentiment poll

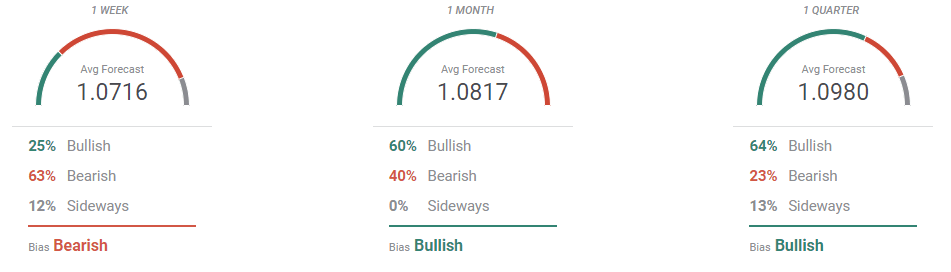

The FXStreet Forecast Poll shows that

that EUR/USD may retrace next week as 63% of the polled experts are betting for levels below the current one. On average, the pair is seen at 1.0716, although bulls return in the wider perspectives, with 60% of buyers in the monthly view, and 64% in the quarterly perspective. That’s quite a shift from the previous week's figures, where bulls stood above 80% in the last two time-frame under study. Indeed, US Dollar strength is linked to a potentially hawkish Fed and the subsequent risk-off scenario.

The Overview chart, in the meantime, shows that moving averages offer neutral-to-bearish slopes, despite the three-month average at 1.0980. The range of potential targets expands as time goes by, to reach 1.0400/1.1800 in the quarterly view, usually a sign of uncertainty. A clearer path may surge next week, in the aftermath of first-tier events.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.