EUR/USD Weekly Forecast: Fed to remain on hold, Trump to keep battling the world

- Tensions in the Middle East and trade war uncertainty weighed on sentiment.

- The Federal Reserve will announce its decision on monetary policy on Wednesday.

- EUR/USD bullish trend remains firm in place, with downward corrections attracting buyers.

EUR/USD peaked at 1.1631 in the second week of June, shedding roughly 100 pips on Friday to settle at around 1.1540. The news feed was packed with trade war and geopolitical headlines that shaped the market’s sentiment. Trade talks between the United States (US) and China retained the spotlight throughout the first half of the week, while by the end of it, escalating tensions in the Middle East stole the show.

European Central Bank paving the way to an on-hold stance

In the meantime, European Central Bank (ECB) officials delivered some hawkish comments that provided support to the Euro (EUR). ECB board member Isabel Schnabel said interest rates are now at a neutral level, adding policymakers can now take their time, which suggests a pause in interest rate cuts. She also noted that the current monetary policy cycle is coming to an end. Governing Council member Joachim Nagel delivered a similar speech, saying, “We are no longer restrictive. I believe that we can now take the time to look at the situation first.”

Other officials delivered comments in the same direction, also repeating the ECB’s message that decisions will be made meeting by meeting, yet hinting at a much slower pace of rate cuts coming forward. It is worth remembering that the ECB trimmed interest rates in the last eight monetary policy meetings, leaving the deposit facility rate at 2%, halving it from the peak at 4% reached by the end of 2023.

Trade war and the Middle East

Back to US woes, top US and Chinese representatives spent two days discussing conditions to resume trade talks in London, keeping majors confined to familiar levels and investors on their toes. Finally, officials reported that Beijing and Washington agreed on a framework to put the trade truce back on track. US President Donald Trump claimed the deal was “done” but subject to Chinese leader Xi Jinping's final approval.

The headlines came alongside the release of the US Consumer Price Index (CPI). Inflation, as measured by the CPI, was softer than anticipated, posting a modest 0.1% monthly advance in May. The combined news sent the US Dollar (USD) sharply lower as markets welcomed easing trade tensions while assuming the Federal Reserve (Fed) has no reason to rush into additional interest rate cuts.

By the end of the week, however, attention shifted to the Middle East, with the focus on the Iranian nuclear program.

Tensions arose after the International Atomic Energy Agency condemned Iran as it said the country had continued to enrich uranium to near weapons-grade levels and had failed to comply with its nuclear nonproliferation obligations. As a result, Israel announced a preventive strike on Wednesday, with US President Trump warning of a massive conflict in the region, should Iran persist with its nuclear program.

Donald Trump has warned that a “massive conflict” could break out in the Middle East soon if talks over an Iranian nuclear deal break down, amid concerns over a possible Israeli strike against Tehran.

Israel finally struck Iran on Thursday, targeting not only the nuclear program but also military leaders. The “Operation Rising Lion,” as Israeli Prime Minister Benjamin Netanyahu called it, focused on Iran's main enrichment facility in Natanz. The US quickly announced it had nothing to do with the attack, but Iranian leaders blamed the world’s largest nation for helping Israel. Retaliatory and back-and-forth strikes are ongoing and are likely to extend over the weekend.

Disappointing US data ahead of Fed’s decision

On the data front, and besides the aforementioned CPI data, there was little to take care of. The US also released weekly unemployment claims, which were worse than anticipated, rising by 248K in the week ended June 7, and the May Producer Price Index (PPI), with the core annual PPI up by 3%, better than the 3.1% expected and the previous 3.2%.

Finally, on Friday, the US published the preliminary estimate of the June University of Michigan (UoM) Consumer Sentiment Index, which came in much better than anticipated, surging to 60.5 from the 52.2 posted in May. Market players were anticipating the index coming in at 53.5. "Year-ahead inflation expectations plunged from 6.6% last month to 5.1% this month. Long-run inflation expectations fell for the second straight month, stepping down from 4.2% in May to 4.1% in June," according to the official report. The news provided a modest boost to the market’s mood, which, anyway, remained sour amid the mentioned Middle East tensions.

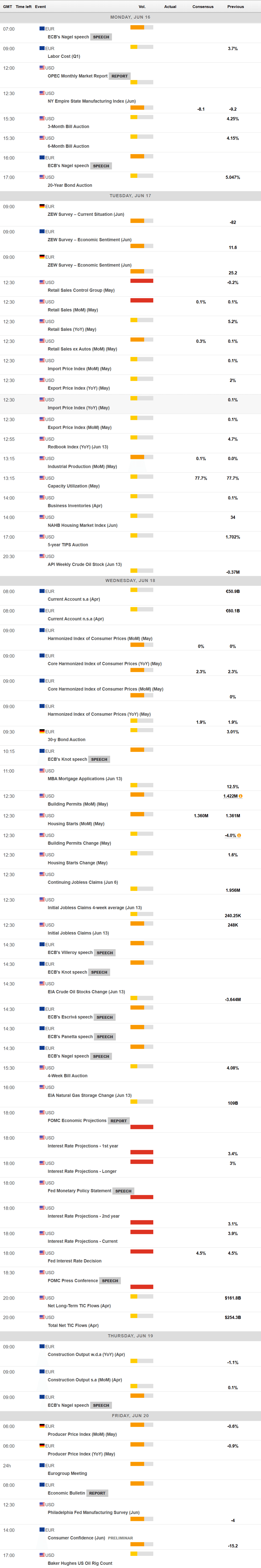

The Eurozone macroeconomic calendar includes some interesting data in the upcoming days, while the US will offer some first-tier figures. Germany will publish the June ZEW Survey on Economic Sentiment on Tuesday, while the Eurozone will offer the final estimate of the May Harmonized Index of Consumer Prices (HICP) on Wednesday.

Across the ocean, the US will release May Retail Sales on Tuesday, while the Federal Reserve will announce its decision on monetary policy meeting after a two-day meeting on Wednesday.

The Fed is widely anticipated to keep the benchmark interest rate on hold in its June meeting, while maintaining the planned two rate cuts in 2025. Fed officials are under pressure from US President Trump who called Chair Jerome Powell numbskull in its latest comments claiming that he may “force something” on Fed.

Alongside the rate decision, officials will present the Summary of Economic Projections (SEP), which provides policymakers’ perspectives on growth, employment and inflation.

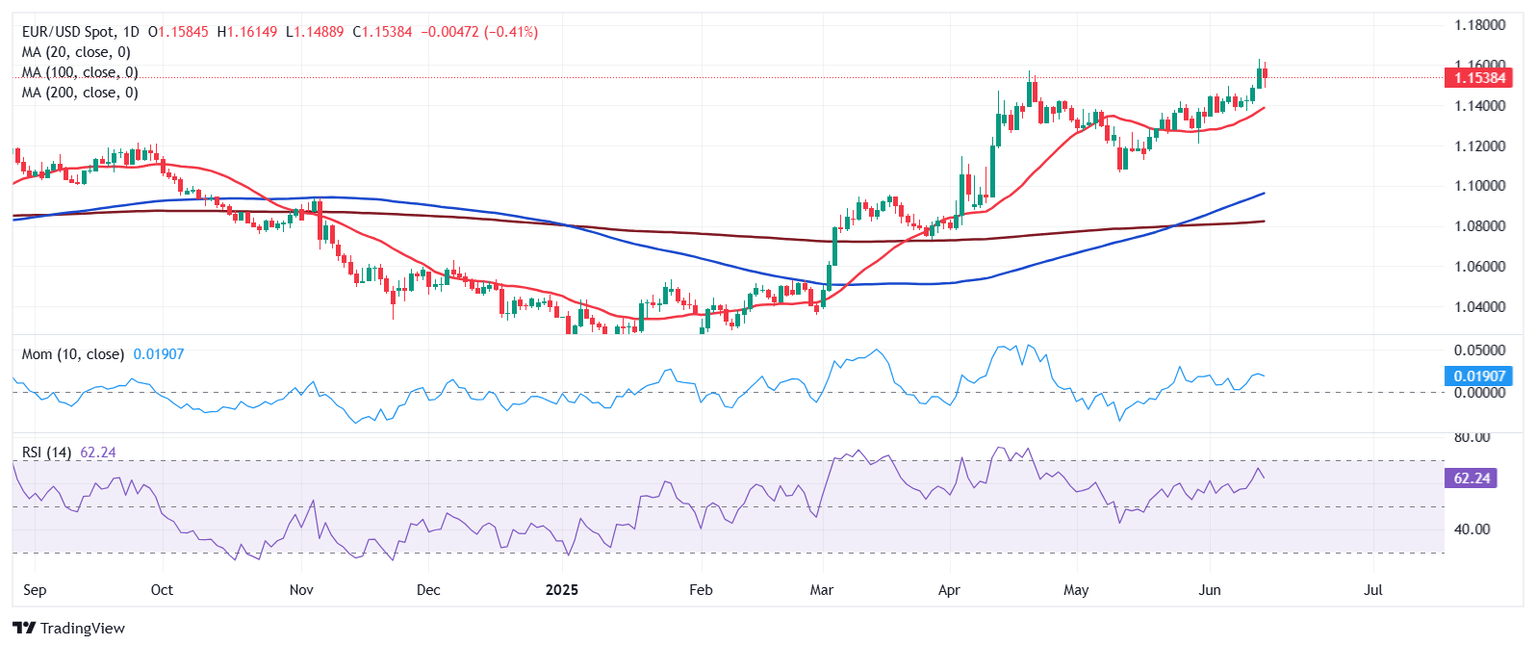

EUR/USD technical outlook

The long-term technical perspective hints at higher highs for EUR/USD despite the ongoing retracement. In the weekly chart, the pair develops far above all its moving averages. The 20 Simple Moving Average (SMA) heads north almost vertically above flat and converging 100 and 200 SMAs. The shorter one stands at around 1.1000, with the gap between it and the current price clearly reflecting bulls’ dominance. At the same time, technical indicators remain near overbought readings, also indicating buyers hold grip, although with uneven directional strength.

On a daily basis, the bullish trend remains firm in place, with a corrective decline likely, yet with buyers willing to add on dips. Technical indicators turned marginally lower, but remain above their midlines, reflecting the latest lower high and the soft intraday tone. At the same time, the EUR/USD pair is developing above all bullish moving averages, with the 20 SMA providing relevant near-term support at around 1.1380.

Immediate support comes at the 1.1470 price zone, followed by the mentioned 1.1380 region. South of here, the pair could test the 1.1300 mark before being able to bounce. The 1.1630 area provides resistance ahead of the 1.1700 threshold.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.