EUR/USD Weekly Forecast: Hopes boost high-yielding assets, but dollar may soon change course

- The ECB held a cautious stance on economic progress, maintaining the monetary policy unchanged.

- The US Federal Reserve is not expected to surprise market participants next week.

- EUR/USD is technically bullish, but investors may soon return to dollar buying.

The EUR/USD pair has advanced for a third consecutive week, now firmly anchored above the 1.2000 threshold and not far from an over one-month high of 1.2079. The shared currency surged on risk-appetite, triggered by upbeat US data released these days, as the market is not ready to resume self-strength trading.

US tax hikes overshadow upbeat data

In fact, the American currency attempted to overcome sentiment-related trading and advanced against the shared currency mid-week, but dollar bulls gave up on Thursday after speculative interest negatively reacted to news indicating that US President Joe Biden is planning a tax hike of up to 39.6% on investment gains for Americans making more than $ 1 million. The aim is to fund education spending and child care.

Stocks were sharply down following the news, while US Treasury yields held on to their recent lows. The greenback lost the little ground it was able to recover in the previous days, resuming its decline, with EUR/USD advancing further on Friday after the release of encouraging EU data.

ECB, covid and hopes

The European Central Bank had a monetary policy meeting on Thursday. Policymakers maintained rates unchanged as widely estimated, while President Lagarde repeated well-known concepts. European policymakers acknowledged signs of economic improvement but conditioned further progress to the pandemic developments. She also noted that the central bank did not discuss reducing the PEPP and that they will continue buying bonds at a faster pace. The near-term outlook is “clouded,” according to Lagarde, and risks are on the downside.

The global battle against the coronavirus continues. When looking into each economy´s progress, no doubts the US is in much better shape than the EU. The first has vaccinated with at least one shot over 34% of the population, while in the EU, the same measure is just 13.6%. The US has hardly appealed to lockdowns in the last year, while in the EU restrictions continue, with leaders concerned about the latest rise in new cases despite the fact that the Northern Hemisphere is heading into summer.

Nevertheless, data released on Friday showed that the most battered sector, services, may be recovering at a faster-than-anticipated pace. The April preliminary Markit Services PMI re-entered expansion territory by printing at 50.3, its highest in eight months. The manufacturing index came in at 63.3, a record high, pushing the Composite PMI to 53.7.

Mixed data still indicates growth

Other macroeconomic figures released this week, on the other hand, suggest that the Union is heading in the right direction, but also that there is a long path ahead. Construction Output contracted in February, while the Current Account surplus posted a seasonally adjusted balance of €25.9 billion, well below the previous €34.7 billion. Consumer Confidence in the EU improved in April but held within negative levels, printing at -8.1 from -10.8 in March.

US macroeconomic figures were also mixed, as Existing Home Sales plummeted in March, down by 3.7%. However, investors cheered a second consecutive decline in weekly unemployment claims, which contracted to 547K in the week ended April 16. Markit published the preliminary estimates of April PMIs, with the Manufacturing PMI printing at 60.60 and the Services PMI soaring to 63.1.

The next week will start with Germany publishing the April IFO survey and the US releasing March Durable Goods Orders, foreseen up 1.8% after falling by 1.2% in the previous month. The next relevant event will be the US Federal Reserve monetary policy meeting. The US central bank is widely anticipated to maintain rates and QE on hold. While things seem to be improving nicely in the world’s largest economy, it seems too early to expect changes even in policymakers´ rhetoric.

On Thursday, the focus will cross the Atlantic, as the EU will publish the April Economic Sentiment Indicator, while Germany will unveil the preliminary estimates of April inflation figures. As for the US, the country will publish the preliminary estimate of the Q1 Gross Domestic Product, foreseen at 6.3% from 4.3% in Q4 2020. On Friday, it will be the turn of Germany and the EU of releasing the preliminary estimates of Q1 growth data.

The market is hardly reacting to coronavirus news, nor showing much interest in macroeconomic releases either. Growth data scheduled for the next week, however, could be the so-needed game-changer.

EUR/USD technical outlook

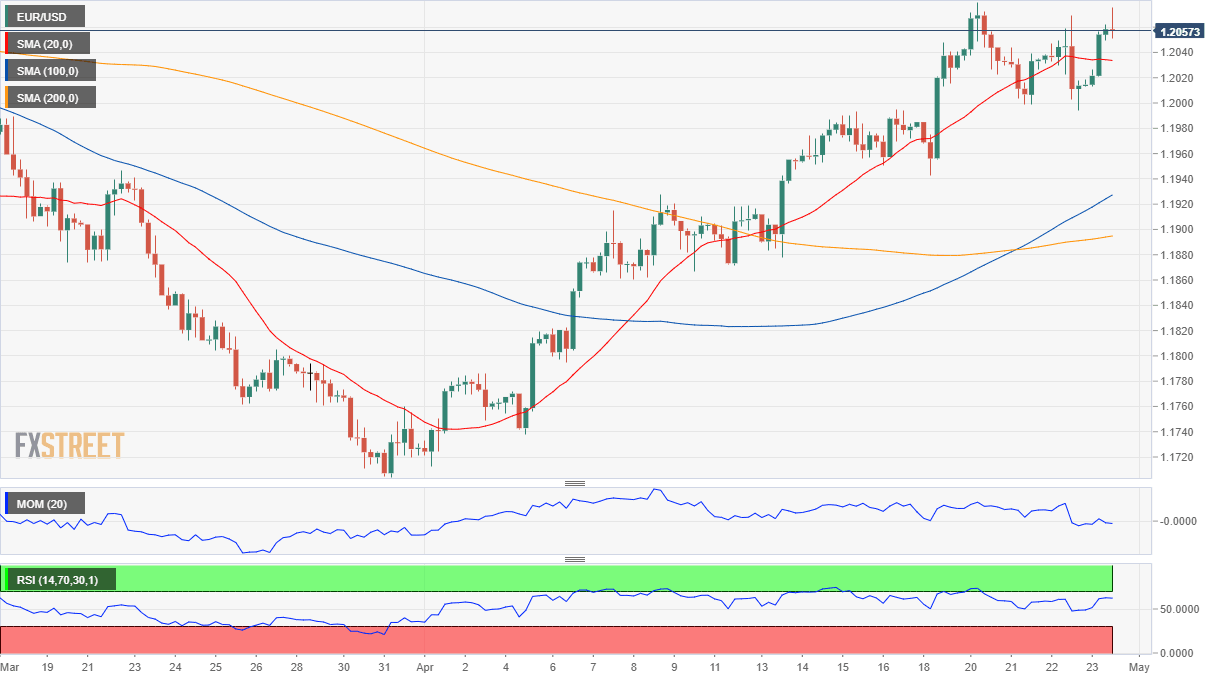

The EUR/USD recovered its long-term bullish potential, although market players may need to consider that at some point the dollar could rally alongside growing optimism. In the weekly chart, the pair is a handful of pips above a directionless 20 SMA, while well above the longer ones. Technical indicators have extended their advances, with the RSI at around 56 and the Momentum about to enter positive territory.

The daily chart indicates that bulls are in charge. The pair is still battling with its 100 DMA, but well above the 20 and 200 SMAs, as technical indicators consolidate weekly gains. The next leg north will come with a break above the 1.2110 price zone, heading into the 1.2170/80 price zone. Beyond it, the next relevant resistance level and the possible bullish target is 1.2242, this year’s high.

Buyers are defending the downside at around 1.2000. Below it, the retracement could reach 1.1920, but it will take a steeper decline, quite unlikely in the time being, for the pair to lose its bullish stance.

EUR/USD sentiment poll

The FXStreet Forecast Poll indicates that bulls reign my shorty come to an end. The pair is seen advancing next week amid buyers accounting for the 55% of the polled experts. Bears, however, soar to 72% in the monthly view, with the pair seen on average at 1.1917. In the quarterly perspective, bears retain the lead with 53% and the average target below 1.2000.

The Overview chart shows a sharp increase of possible targets below the current level, somehow supporting the idea that the dollar may finally react higher to substantial data improvement. Most targets accumulate around 1.1800, but the pair is seen as low as 1.1600 in the upcoming weeks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.