EUR/USD Weekly Forecast: Last tango for the ECB?

- EUR/USD clocked weekly losses, with gains capped by 1.1400 so far.

- The US Dollar managed to rebound slightly on the weekly chart.

- The ECB could lower its policy rate for the last time this year next week.

The Euro (EUR) traded in a choppy fashion throughout the week, prompting EUR/USD to end slightly on the defensive on the weekly chart.

The pair’s price action came in response to an equally erratic performance in the US Dollar (USD). Unlike EUR/USD, the US Dollar Index (DXY) managed to clock a humble advance over the last five days, although quite southwards of its weekly peaks around 100.50.

Looking at the money markets on both sides of the ocean, US yields seem to have embarked on a consolidative phase at the upper end of the monthly range. Meanwhile, in Germany, 10-year bund yields traded on a downward path, managing to meet decent contention around the key 2.50% zone for the time being.

Once again, the debate among market participants gyrated around the US trade policy, although this time with a slight tweak.

“Optimism vs. scepticism” is the name of the game on the trade front

Most of President Donald Trump's tariffs were barred by a US trade court judgement on Wednesday, which declared the president had overreached his power by placing uniform taxes on imports from American trading partners.

Indeed, the US Constitution grants Congress sole jurisdiction to control trade with other nations, a power that is not superseded by the president's emergency powers to defend the US economy, according to the Court of International Trade (CIT).

However, on Thursday, a federal appeals court temporarily restored the most broad of his tariffs.

Ordering the plaintiffs in the cases to respond by June 5 and the government by June 9, the United States Court of Appeals for the Federal Circuit in Washington said it was halting the lower court's ruling to consider the government's appeal.

All in all, the news did nothing but add to the lack of clear direction in the White House’s trade policies that has been prevailing since practically “Inauguration Day”.

Let’s recall that nothing else, neither progress nor deterioration, has been heard after the United States recently clinched trade agreements with both China and the United Kingdom.

From a more macro viewpoint, the still ongoing trade tensions between the world’s two largest economies, alongside President Trump’s decision to impose tariffs on several other countries, have disrupted global supply chains, rattled financial markets and raised concerns over a potential slowdown in global economic growth.

Policy divergence puts Euro on the defensive

The Federal Reserve (Fed) opted to maintain interest rates at their current level in May, despite the backdrop of decreasing inflation and ongoing trade uncertainties. Two cuts are anticipated by year’s end, with implementation expected to begin in September.

The latest Minutes have disclosed that the Fed is confronting "difficult trade-offs" amid rising inflation and unemployment, alongside estimates indicating an increased risk of recession. The interplay between inflation and unemployment presents a critical challenge for central bank authorities, who must weigh the decision of implementing tighter monetary policy to address inflation against the option of lowering interest rates to stimulate growth and enhance employment opportunities.

On the opposite side of the road, the European Central Bank (ECB) lowered its deposit rate by 25 basis points to 2.25% at its May event.

Market consensus is anticipating a further quarter-point rate cut as soon as next week, driven by persistently low inflation and growing concerns regarding US tariffs.

Technical outlook: Heavy resistance looms

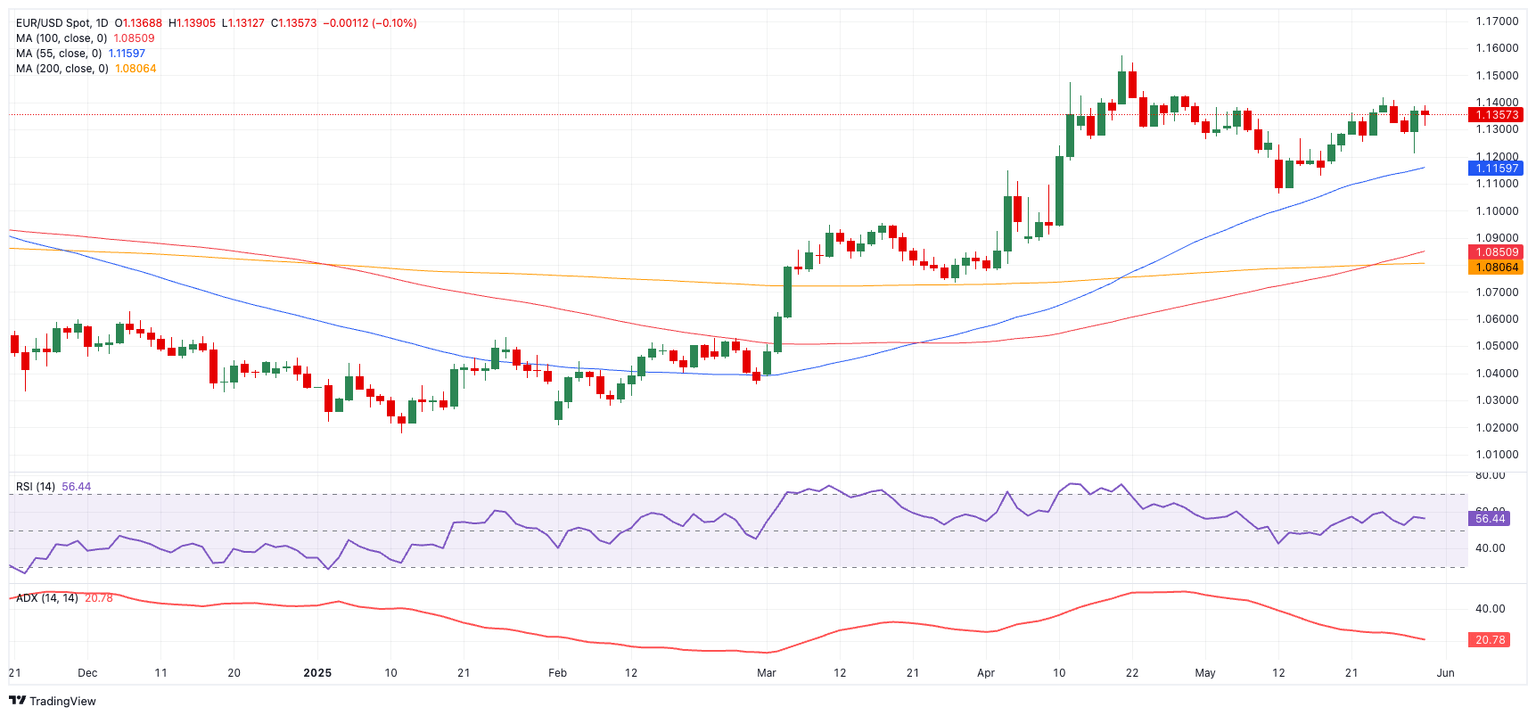

EUR/USD remains capped beneath its 2025 high of 1.1572 (April 21). Beyond that, key resistance lies at the 1.1600 limestone, ahead of the October 2021 top of 1.1692.

On the downside, interim contention sits at the 55-day simple moving average (SMA) at 1.1165, with deeper cushions at the more significant 200-day SMA at 1.0813 and the weekly trough at 1.0732 (March 27).

Momentum indicators suggest some consolidation might be in store. The Relative Strength Index (RSI) has eased to the vicinity of 54, while the Average Directional Index (ADX) is near 21 points, indicating a modest and possibly shrinking trend momentum.

EUR/USD daily chart

Outlook: It is all about trade

The Euro's future remains clouded by competing forces. While the widening Fed-ECB policy gap and USD resilience may continue to weigh on the single currency, the prospect of lower trade tensions and an improvement in the geopolitical landscape should support the EUR. Against this, further consolidation is in the cards, at least until some clarity on the trade path emerges and both the Fed and the ECB provide more information on their plans for the coming months.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.