EUR/USD Weekly Forecast: ECB monetary policy decision and US CPI coming up next

- Growth imbalances between the United States and the Euro Zone set the way.

- The European Central Bank can surprise market players with a rate hike.

- The United States Consumer Price Index is foreseen at 3.4% YoY in August.

- EUR/USD continued decline set to continue despite a possible bullish correction.

The EUR/USD pair extended its decline to sub-1.0700 this past week, as financial markets remained risk averse, while the US Dollar began showing signs of self-strength. Over the last few years, the USD direction was more linked to the sentiment, with the currency able to rally after the United States (US) discouraging data due to its safe-haven condition. Central banks and inflation led the way, and hints about future monetary policies set the path.

Yet, as inflation cools and central banks aim for more neutral stances, the whole picture is starting to change, and this week, upbeat US data proved the case. True, speculative interest is now looking ahead for rate cuts, but regardless of the market’s anxiety, it is too early to think about that.

Instead, EUR/USD direction seems to be now linked to which economy will bear better the consequences of the tight monetary policy, which landing will be softer, and what country will be able to grow at a faster pace.

Oppose to the US encouraging data, Euro Zone figures were weak, to say the least, highlighting the imbalance between the two major economies. In that sense, it’s easy to explain EUR/USD continued slide.

What data said

Investors were disappointed as EU macroeconomic figures suggested a steeper-than-anticipated economic setback. EZ Retail Sales declined by 0.2% in July, while Sentix Investor Confidence contracted to -21.5 in September. Still, the most worrisome figures came from Germany, as Factory Orders plummeted by 10.5% YoY in July, while Industrial Production contracted by 2.1% in the same period.

Finally, S&P Global downwardly revised the August Services and Composite PMIs. The German services index was confirmed at 47.3, but the Euro Zone one resulted at 47.9 vs. the previous estimate of 48.3. The EU Composite PMI was reported at 46.7, an almost three-year low. The official report indicated output fell in both the services and manufacturing sectors, adding that, excluding the pandemic period, activity dropped the most in any month since March 2013. Finally, the EU Q2 Gross Domestic Product (GDP) was revised to 0.1% QoQ against the 0.3% previously calculated. The EU is suffering stagnation and still facing high inflation risks.

On the other hand, the US labor market cooled in August, according to the Nonfarm Payrolls report, but the sector is still giving mixed signals. Initial Jobless Claims slid to 216K in the week ended September 1, the lowest level since February, suggesting the job market is still relatively tight. At the same time, Nonfarm Productivity rose 3.5% in the second quarter of the year, slightly below expectations but still the highest since the third quarter of 2020. Finally, Unit Labor Costs in the three months to June were up 2.2%, above expected, but the slowest advance so far this year.

The US also reported the ISM Services PMI, which unexpectedly surged to 54.5 in August, spooking the recession ghost and giving the USD an unexpected boost.

European Central Bank and US Consumer Price Index coming up next

Policymakers from both shores of the Atlantic hit the wires this week. Federal Reserve (Fed) officials were generally hawkish, which, coupled with upbeat US data, fueled speculation of at least one more rate hike from the central bank. Odds for a move in the upcoming September meeting are pretty much null, but market players have started considering a possible 25 basis points (bps) rate hike in November. Such odds cooled down on Friday after New York Federal Reserve President John Williams said that inflation is moving in the right direction, adding labor market imbalances are evening out and that demand is coming down.

European Central Bank (ECB) officials, on the other hand, maintained the door open for another rate hike despite bets against such a decision. The ECB will announce its decision next week, and at this point, investors expect an on-hold stance, although the chances of a 25 bps hike have been increasing lately. It is worth adding that inflation is also easing in the EU, although not as fast as in the US.

The EU Harmonised Index of Consumer Prices (HICP) rose 5.3% YoY in August, matching July’s reading, while the US Consumer Price Index (CPI) increased by 3.2% YoY in July. August readings will be out next week, and the annual CPI is expected to have ticked higher to 3.4%, still way below the European one.

A positive surprise from US CPI could be what the USD needs to enter a long-term bullish trend, despite the fact it could also flatten the odds for a conservative Fed.

The US will also unveil next week the August Producer Price Index (PPI) and the preliminary estimate of the September Michigan Consumer Sentiment Index.

EUR/USD technical outlook

The EUR/USD pair closed the eighth consecutive week in the red, which lifts the odds for a bullish correction in the next one. Nevertheless, that does not affect the dominant bearish trend, as, at this point, the pair would need to recover at least beyond 1.0950 to make sellers hesitate in the mid-term.

Technical readings in the weekly chart favor a continued decline, as EUR/USD is crossing below a bearish 100 Simple Moving Average (SMA), while the 20 SMA gains downward traction above the 1.0900 mark. At the same time, the Momentum indicator turned modestly lower but remains within neutral levels, as the pair holds above the May monthly low at 1.0634. The Relative Strength Index (RSI) indicator, on the other hand, heads firmly south at around 42, reflecting sellers’ strength.

In the daily chart, the EUR/USD pair is developing below all its moving averages, while the 20 SMA is about to cross the 200 SMA, both now at around 1.0820. At the same time, the 100 SMA turned marginally lower, far above the other two, in line with the latest steep decline. Finally, the Momentum indicator heads south within negative levels while the RSI consolidates around 35, all of which maintains the risk skewed to the downside.

The weekly low at 1.0685 is the immediate support level, ahead of the aforementioned May low at 1.0634. Once below the latter, market players will aim for a test of the 1.0515 March low. Resistance can be found at 1.0745, ahead of the 1.0820 price zone. A recovery beyond it could see the pair approaching the 1.0900 price zone.

EUR/USD sentiment poll

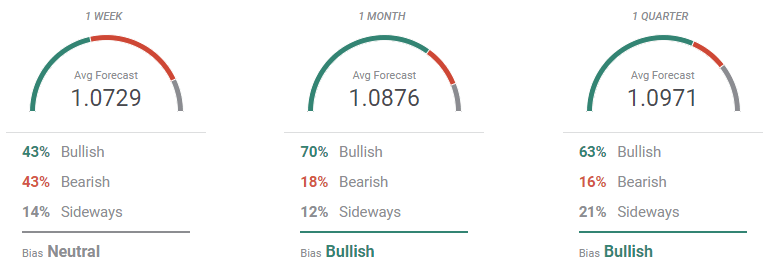

According to the FXStreet Forecast Poll, EUR/USD is set to consolidate next week, while market participants bet for a recovery afterwards. Sellers and buyers equally stand at 43% of the polled experts in the near term, although bulls jump to 70% in the monthly perspective and stand at 63% in the quarterly view. Nevertheless, EUR/USD is seen below 1.1000 on average in all the time frames under study.

The Overview chart, however, shows that the three moving averages offer bearish slopes, although the downward strength eases as time goes by. In the near term, the pair is foreseen in the 1.0600/1.0800 price zone, but the range widens as time goes by. The pair is seen between 1.0400 and 1.1400 in the monthly view, although the largest accumulation of potential targets is around the 1.0700 mark. Finally, in the quarterly perspective, the range moves to 1.0500/1.1500, with increased chances for the pair to trade around 1.1000.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.