EUR/USD Weekly Forecast: Central banks and fears halt the advance

- A “vigilant” ECB and a mildly dovish Federal Reserve weighed on investors mood.

- Eyes turn to US employment-related data next week, NFP in the spotlight.

- EUR/USD is technically neutral in the mid-term, bears will have to wait.

The EUR/USD pair has fallen in range this week but finished it above the 1.2100 level. The greenback appreciated on risk aversion generated by turmoil in equities markets. Traders looked beyond US first-tier data, instead focused on the individuals’ investors craze that stole headlines these days.

Gathered on social media, investor pushed some particular equities to unexplored highs. Gamestop and Blackberry are some of the companies that were on focus. Silver also fell in their radar on Thursday, with the metal jumping roughly 6% in the day. Trading apps such as Robinhood halted trading, spurring fears and putting Wall Street in sell-off mode. The sitcom continues, and will likely keep investors on their toes next week.

Pandemic still dictating economic progress

On the pandemic front, the number of new contagions is decreasing in Europe and the US, but they are still high. Vaccines distribution is delayed globally, also fueling the dismal mood, as shortfalls are directly linked to a delay in a possible economic comeback.

Data wise, European figures were generally discouraging. German published the IFO Business Climate, which contracted to 90.1 in January, while the GFK Consumer Confidence Survey resulted at -15.6 in February, much worse than anticipated. Inflation in the country picked up modestly in January, as it printed at 1.0% YoY, according to preliminary estimates. Also, the economy grew 0.1% QoQ in the last quarter of the year, better than anticipated but way below the previous 8.5%.

On the other hand, US data was mostly upbeat. Durable Goods Orders were the only down note, as they rose by a modest 0.2% in January. However, Q4 Gross Domestic Product resulted at 4.0%, beating expectations, while weekly unemployment claims continued shrinking, down to 875K in the week ended January 22.

Still, macroeconomic figures indicate shy economic progress. It seems that investors still believe that growth will return in the second half of the year.

Central bankers are worried

Another critical development this week was central banks hinting on possible interventions. The Bank of Japan and the European Central Bank, both expressed concerns about the exchange rate. ECB’s Government Council member, Klass Knot said that the central bank could decide to cut its deposit rate further below zero if that proved necessary to keep its inflation target in sight, adding that the ECB has tools to counter the EUR’s appreciation if needed, in an interview with Bloomberg TV.

The Federal Reserve announced its latest decision on monetary policy, and as widely estimated, they left rates and bond-buying programs unchanged. The central bank reiterated that the “path of the economy would depend significantly on the course of the virus, including progress on vaccinations,” while adding that the pace of the recovery in economic activity and employment has moderated in recent months. A generally dovish statement maintained markets in risk-off mode.

US employment taking center stage

On Monday, Germany will publish December Retail Sales, while the US will release the January official ISM Manufacturing PMI, foreseen at 60 from 60.7 in the previous month. Later in the week, the EU will publish the preliminary estimate of Q4 GDP, foreseen at -1.8%. The Union will also offer the preliminary estimate of January’s inflation. By the end of the week, the focus will shift to US employment data, as the country will publish on Friday the Nonfarm Payrolls report. The country is expected to have added 85K new jobs in January, after losing 145K positions in December.

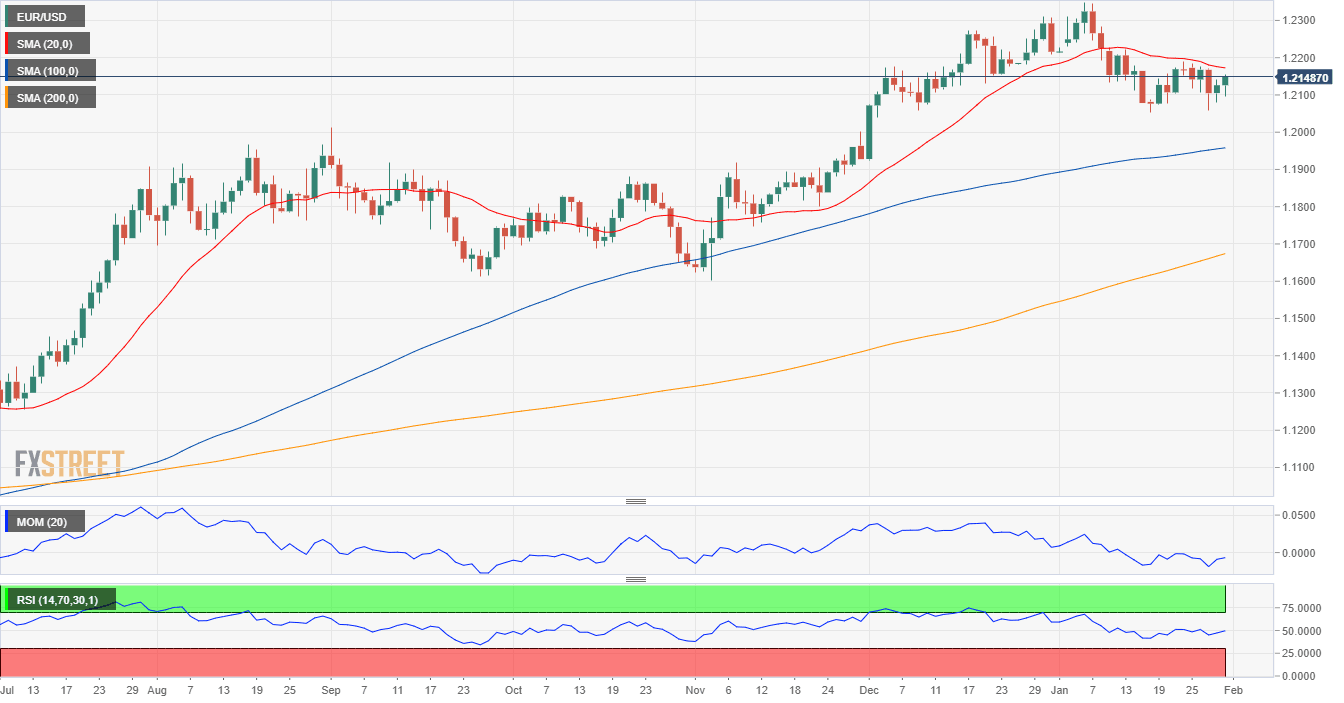

EUR/USD technical outlook

The EUR/USD pair has spent the week trading between Fibonacci levels. It found support around the 38.2% retracement of the November/January rally at 1.2060, while sellers defended the 23.6% retracement of the same advance at around 1.2175.

The weekly chart indicates that bulls retain the lead, but are beginning to doubt. Technical indicators eased within positive levels, maintaining their bearish slopes. Moving averages continue to advance well below the current level, with the 20 SMA hovering a handful of pips below the 50% retracement of the mentioned rally at 1.1970.

In the daily chart, the bearish case gains strength. A bearish 20 SMA keeps capping the upside, now converging with a Fibonacci resistance. The Momentum indicator recovered from its recent lows but remain below its 100 line, while the RSI indicator consolidates sub-50.

The mentioned Fibonacci levels are the ones to watch for a directional breakout. 1.2060 and 1.1970 provide support. Beyond the 1.2170/80 area, on the other hand, the pair has room to recover towards the 1.2260 price zone.

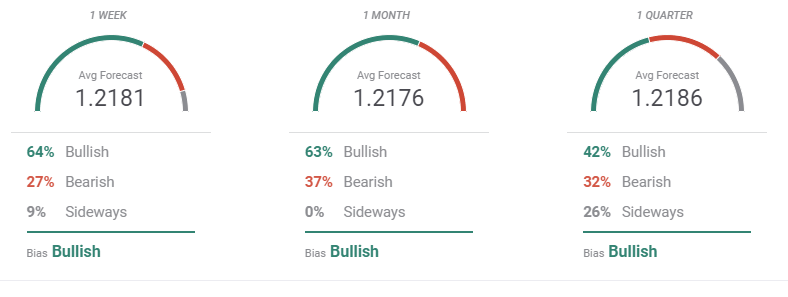

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the sentiment towards the EUR/USD pair is bullish, as those betting for higher levels are a majority in the three time-frame under study. On average, the pair is seen holding above the 1.21 threshold and closer to the 1.2200 level. Follow-through is out of the picture for now.

The Overview chart shows that moving averages are now directionless. Investors are not willing to risk in the current uncertain scenario. Still, and with some exception, the pair is seen holding above the 1.2000 mark for the next few weeks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.