EUR/USD Weekly Forecast: Calm before the next storm, Nonfarm Payrolls in the docket

- Easing concerns related to a financial crisis fueled demand for high-yielding assets.

- Receding inflationary pressures further fueled the buoyant market mood.

- EUR/USD could regain the 1.1000 threshold next week if optimism persists.

The EUR/USD pair marched higher for a second consecutive week, settling on Friday just ahead of 1.0900. The pair advanced for four days in a row, giving up some ground ahead of the weekly close amid profit-taking and a particular persistent caution after the latest banking turmoil.

Nevertheless, optimism reigned amid receding concerns of a widespread banking cataclysm. Eurozone and United States authorities rushed to pour cold water on the matter by announcing measures to prevent the situation from spreading. Financial markets welcomed the headlines and ran into high-yielding assets pushing EUR/USD to a weekly high of 1.0925.

Demand for the US Dollar remained subdued, helped by limited action among Treasury yields and encouraging inflation figures.

High inflation but no longer worrisome

On the one hand, Germany published the preliminary estimate of the March Harmonized Index of Consumer Prices (HICP), which rose by 7.8% YoY, easing from the previous 9.3%, although above the 7.5% expected. Spanish HICP in the same period was up by 3.3%, beating expectations, while France reported a 6.6% increase. Finally on Friday, the EU reported the regional HICP, which increased by 6.9% YoY.

On the other, the United States published the February Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's (Fed) favorite inflation measure. The core PCE Price Index rose at an annualized pace of 4.6%, easing from the previous 4.7%.

The figures also boosted the market’s optimism amid speculation central banks are pretty much done with monetary tightening. Just this week, the market knew the United States Federal Reserve was aiming for just one more rate hike, probably of 25 basis points (bps), before pausing. Once the pause is confirmed, the market focus will quickly shift to rate cuts and speculation about when the Fed will start trimming its benchmark rate. At this point, American policymakers foresee a first cut in 2024.

The market can see inflation is on a downward path following central banks’ decisions to move forward with aggressive monetary tightening. The consequences of the latter, however, are still to be seen, partially explaining the certain caution that persists among speculative interest.

Monetary tightening cools down inflation but also economic growth. It would not have been such an issue if it weren’t that such measures had been adopted in the aftermath of the world stalling amid the coronavirus pandemic. Growth bloomed through the end of 2021 and the beginning of 2022, but only because economies came back from record bottoms.

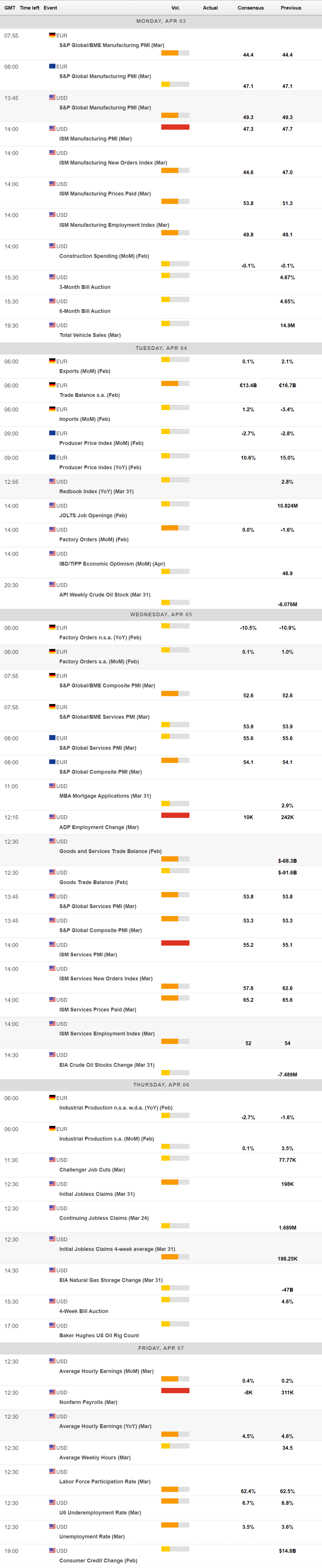

The upcoming week will bring the final estimates of the S&P Global PMIs for the EU and the US, while the latter will publish the official ISM Manufacturing PMI on Monday, and the ISM Services PMI on Wednesday. Mid-week, the focus will shift to US employment, as the country will publish the ADP survey on private job creation ahead of the Nonfarm Payrolls report to be out on Friday. Financial markets anticipate the US economy has lost 8,000 job positions in March and has an Unemployment Rate of 3.5%.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair shows it halted in the 1.0920 price zone for a second consecutive week. However, the pair remains near its high, suggesting prevalent buying interest. Technical indicators in the mentioned time frame offer upward slopes, with the Momentum barely bouncing from its midline but the Relative Strength Index (RSI) heading firmly north near overbought readings, also supporting a bullish continuation. At the same time, the 20 Simple Moving Average (SMA) leads the way higher with a solid upward slope, providing intraday support throughout the week. Finally, the 100 SMA acts as dynamic resistance, heading south at around 1.0970.

The bullish potential is fading in the daily chart, but there are no signs of an upcoming decline. Technical indicators have lost their upward strength and turned lower but still, stand above their midlines. At the same time, moving averages keep advancing below the current level, reflecting bulls are in control.

As long as the pair holds above 1.0745, the 61.8% Fibonacci retracement of the 2022 yearly decline, the mid-term perspective will remain bullish. Another leg north would need EUR/USD to advance beyond 1.0970, with the next relevant resistance level afterwards at 1.1060. Further gains should result in a test of the 1.1120/40 price zone.

An immediate support level comes at 1.0810, while a slide below the aforementioned 1.0745 level could lead to a steep decline towards 1.0660.

EUR/USD sentiment poll

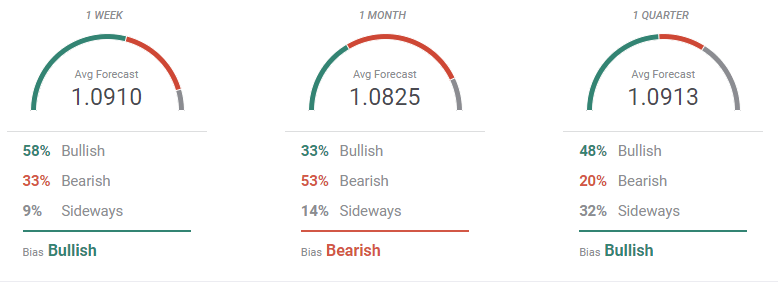

According to the FXStreet Forecast Poll, EUR/USD will extend its bullish route next week, as 58% of the polled experts are looking for higher highs, with an average target of 1.0910. Buying interest eases as time goes by, as, in the monthly perspective, bears stand at 53%, while bulls decrease to 33%. Still, the pair is seen holding above 1.0800. Finally, the quarterly view shows that most experts bet for an advance, with those looking for lower levels down to just 20%.

The Overview chart, however, indicates that the bullish case is alive and kicking. The three moving averages head firmly north and at fresh yearly highs, without signs of bullish exhaustion. Furthermore, the range of potential targets continues to increase. As of now, the pair is not seen below 1.0500 in the monthly view, while in the monthly perspective, the base has been lifted to 1.0700.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.