EUR/USD Price Forecast: US political and fiscal tensions keep the US Dollar pressured

EUR/USD Current price: 1.1693

- Tensions between US President Trump and Fed Chair Jerome Powell weigh on the US Dollar.

- US Treasury Secretary Scott Bessent anticipated trade deal announcements coming soon.

- EUR/USD consolidates around 1.1700, with bulls pausing but not giving up.

The EUR/USD pair trades near 1.1700 early in the American session, consolidating Monday’s gains. The pair peaked at 1.1718 at the beginning of the week on broad US Dollar (USD) weakness. The USD fell on mounting tensions between the United States (US) President Donald Trump and the Federal Reserve (Fed) Chairman Jerome Powell.

Trump demands that the central bank lower the benchmark interest rate and seems determined to fire Powell before the end of his term in May 2026, despite not having the authority to do so. Instead, Trump has been constantly pressuring and attacking the Fed’s head, while the latest on the matter shows a Rep House member, Anna Paulina Luna, has referred Fed Powell to the Department of Justice for criminal charges, accusing him of perjury on two occasions.

Meanwhile, US Treasury Secretary Scott Bessent proposed an “exhaustive” review of the Fed and its non-monetary policy operations, adding pressure on the central bank. Bessent also announced early on Tuesday that the US is about to announce a “rash” of trade deals in the upcoming days.

Data-wise, the macroeconomic calendar remains scarce. Fed Chair Powell delivered opening remarks at the Integrated Review of the Capital Framework for Large Banks Conference hosted by the Federal Reserve in Washington, DC, but ahead of the Fed’s monetary policy meeting next week, he did not discuss anything monetary policy-related. The US will publish the July Richmond Fed Manufacturing Index, previously at -7.

EUR/USD short-term technical outlook

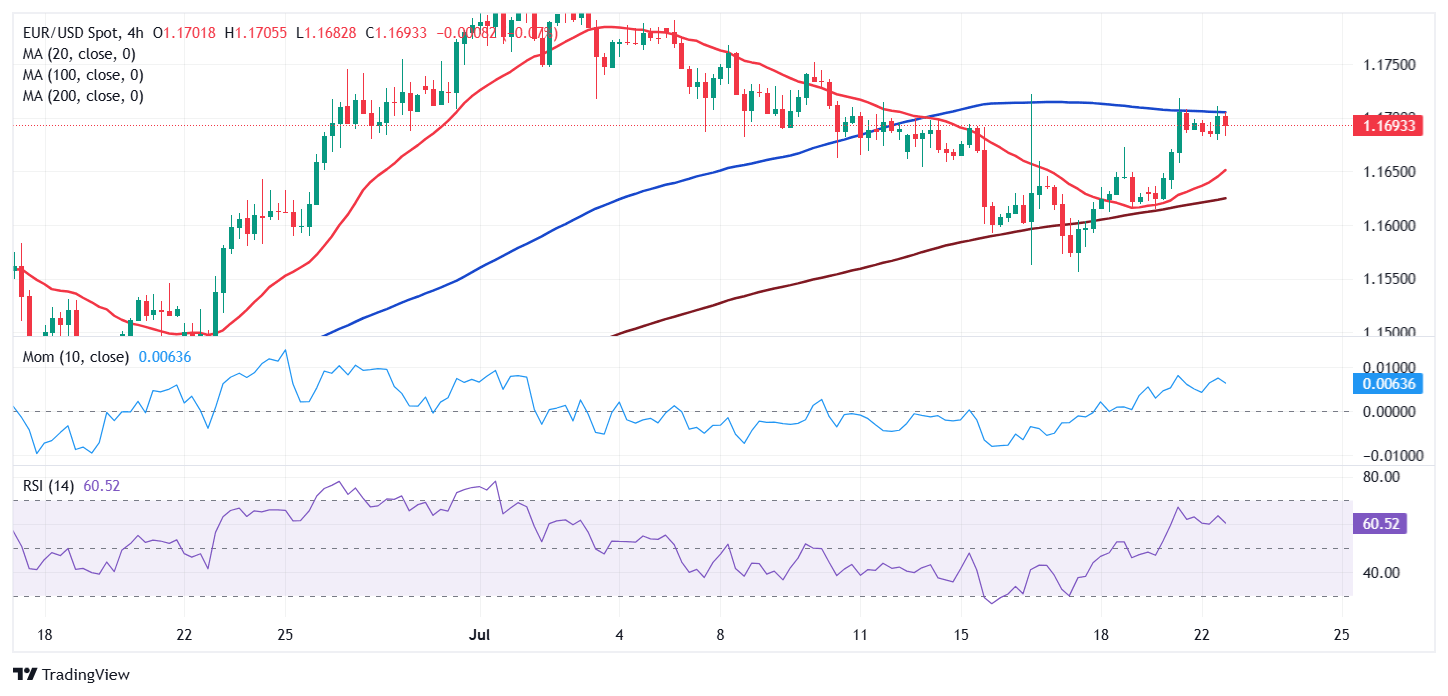

From a technical point of view, the daily chart for the EUR/USD pair shows its holding right below a flat 20 Simple Moving Average (SMA) at around 1.1705, unable to extend gains beyond it. At the same time, technical indicators remain directionless, the Momentum indicator below its 100 line and the Relative Strength Index (RSI) indicator at around 56. Finally, the 100 and 200 SMAs keep heading north far below the current level, in line with the dominant bullish strength.

The 4-hour chart shows a directionless 100 SMA acts as dynamic resistance around the 1.1710 area, while the 20 SMA grinds north at around 1.1640, providing near-term support. Technical indicators, in the meantime, have turned marginally lower within positive levels, reflecting easing upward conviction. EUR/USD needs to run past 1.1710 to be able to extend its gains in the upcoming sessions.

Support levels: 1.1635 1.1600 1.1560

Resistance levels: 1.1710 1.1755 1.1790

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.