EUR/USD Price Forecast: Upside momentum remains unchanged

- EUR/USD came under pressure following two consecutive daily advances.

- The US Dollar rebounded sharply in response to firmer US PPI, weekly Claims.

- Next of note will be the release of US Retail Sales and the U-Mich survey.

The Euro (EUR) snapped its weekly winning streak on Thursday, with EUR/USD coming under fresh selling pressure after Wednesday’s monthly highs above 1.1700. Indeed, spot slipped back to retest the 1.1630 area, marking a two-day low.

The pair’s drop was driven by a sharp rebound in US Dollar (USD) demand, fuelled by hotter-than-expected US wholesale inflation data for July and firm weekly jobless claims. That surprise reading eased talk of a 50-basis-point rate cut from the Federal Reserve (Fed) in September, adding extra weight to the move lower.

Trade détente lifts sentiment

Monday brought a 90-day extension to the US–China trade truce, narrowly avoiding tariff hikes that were set to kick in within hours. President Trump signed an executive order pushing the pause through to November 10, with Beijing pledging to match the move. Under the deal, US tariffs on Chinese goods stay at 30%, while China keeps a 10% levy on American products.

The headlines came on the heels of a freshly signed US–EU trade accord, which slashes most European export tariffs to 15% from a threatened 30%. The aerospace, semiconductor, and agricultural sectors escaped new duties, while steel and aluminium remain taxed at 50%. In return, Europe pledged $750 billion in US energy purchases, more defence orders, and more than $600 billion in US investments.

Not everyone was convinced: German Chancellor Friedrich Merz warned the deal could hurt a fragile manufacturing base, while France’s Emmanuel Macron called it a “dark day” for the Continent.

Central banks tread carefully

The Fed kept rates on hold at its latest meeting, with Chair Jerome Powell striking a cautious note despite pushback from Governors Waller and Bowman.

Over in Frankfurt, European Central Bank (ECB) President Christine Lagarde described growth as “solid, if a little better”, even as money markets pushed expectations for the first rate cut out to spring 2026.

Positioning shifts

Commodity Futures Trading Commission (CFTC) data to August 5 showed speculators trimming net long EUR positions to a five-week low near 116K contracts, while commercial players cut net shorts to around 163.5K contracts — also multi-week lows. Additionally, open interest slid to a four-week trough at roughly 828.3K.

Levels to watch

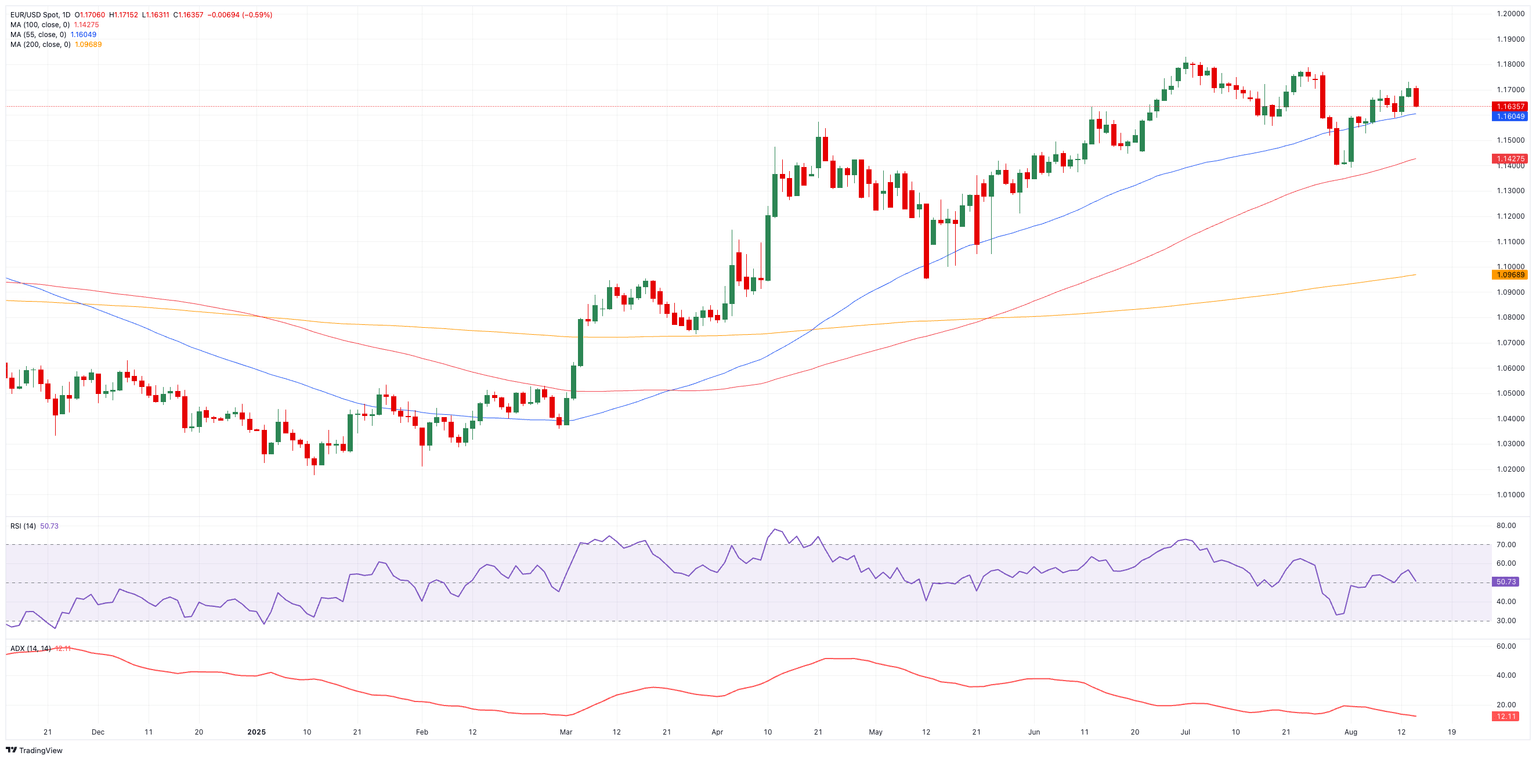

Resistance sits at the weekly high of 1.1788 (July 24), prior to the 2025 ceiling at 1.1830 (July 1). Beyond that, the September 2021 peak at 1.1909 (September 3) looms just shy of the key 1.2000 level.

On the other hand, there is initial contention at the August low of 1.1391 (August 1), reinforced by the interim 100-day Simple Moving Average (SMA), and ahead of the weekly floor at 1.1210 (May 29).

Momentum signals are mixed: the Relative Strength Index (RSI) has dropped to nearly the 50 threshold, hinting at some loss of momentum from the upside impulse, but the Average Directional Index (ADX), near 14, still points to a trend lacking conviction.

EUR/USD daily chart

Looking at the bic picture

For now, consolidation looks the most likely outcome unless the Fed surprises or trade tensions ease significantly. In addition, US Dollar moves should remain the dominant driver of EUR/USD direction for now.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.