EUR/USD Price Forecast: Too high, too fast?

- EUR/USD advanced further and reached new highs near 1.1780.

- The US Dollar’s sell-off sent the currency to new multi-year troughs.

- Investors should shift their focus to the ECB Forum in Sintra.

The Euro (EUR) stretched its winning streak to a seventh session on Monday, encouraging EUR/USD to clinch fresh YTD highs around 1.1780 as traders embraced a potent mix of geopolitical relief, improvement on the trade front, and speculation of rate cuts by the Federal Reserve (Fed).

Adding to the Dollar's woes, President Trump escalated his conflict with Fed Chair Jerome Powell, accusing Powell and members of the Federal Reserve Board of Governors of failing to fulfil their responsibilities.

Ceasefire lifts risk appetite

Sentiment toward riskier assets brightened after Washington brokered a ceasefire in the Middle East last week. Though fragile, the truce has been enough to entice investors back into higher-beta assets, such as the European currency, reinforcing its ongoing upward momentum.

Trade deadlines and transatlantic talks

With a July 8 deadline for the current US tariff pause approaching, traders remain on edge for any shift in Washington’s stance. Brussels, for its part, continues to press forward on a range of trade files, including slow-moving negotiations with the United Kingdom.

Policy gap remains wide

The Fed left its target range unchanged at 4.25%–4.50% in June but raised inflation and unemployment projections to account for higher tariff costs. Its latest dot-plot still implies 50 basis points of cuts this year, although individual projections span from none to 75 basis points.

In his latest remarks, Chief Powell has warned lawmakers that steeper tariffs could reignite price pressures over the summer.

Across the Atlantic, the European Central Bank (ECB) lowered its deposit rate to 2.00% this month. President Christine Lagarde has tied any additional easing to a clear downturn in external demand, leaving the policy gap between Frankfurt and Washington firmly in place.

Bullish bets on EUR continued to increase

The CFTC data for the week ending June 24 shows that speculative net longs in the Euro (EUR) have gone up a lot, hitting levels not seen since January 2024 and going above 111.1K contracts. Commercial players, mostly hedge funds, have increased their net short holdings to around 164.3K contracts, which is the largest level since mid-December 2023. Also, open interest rose to its highest level in two weeks, with over 762.6K contracts.

Technical picture

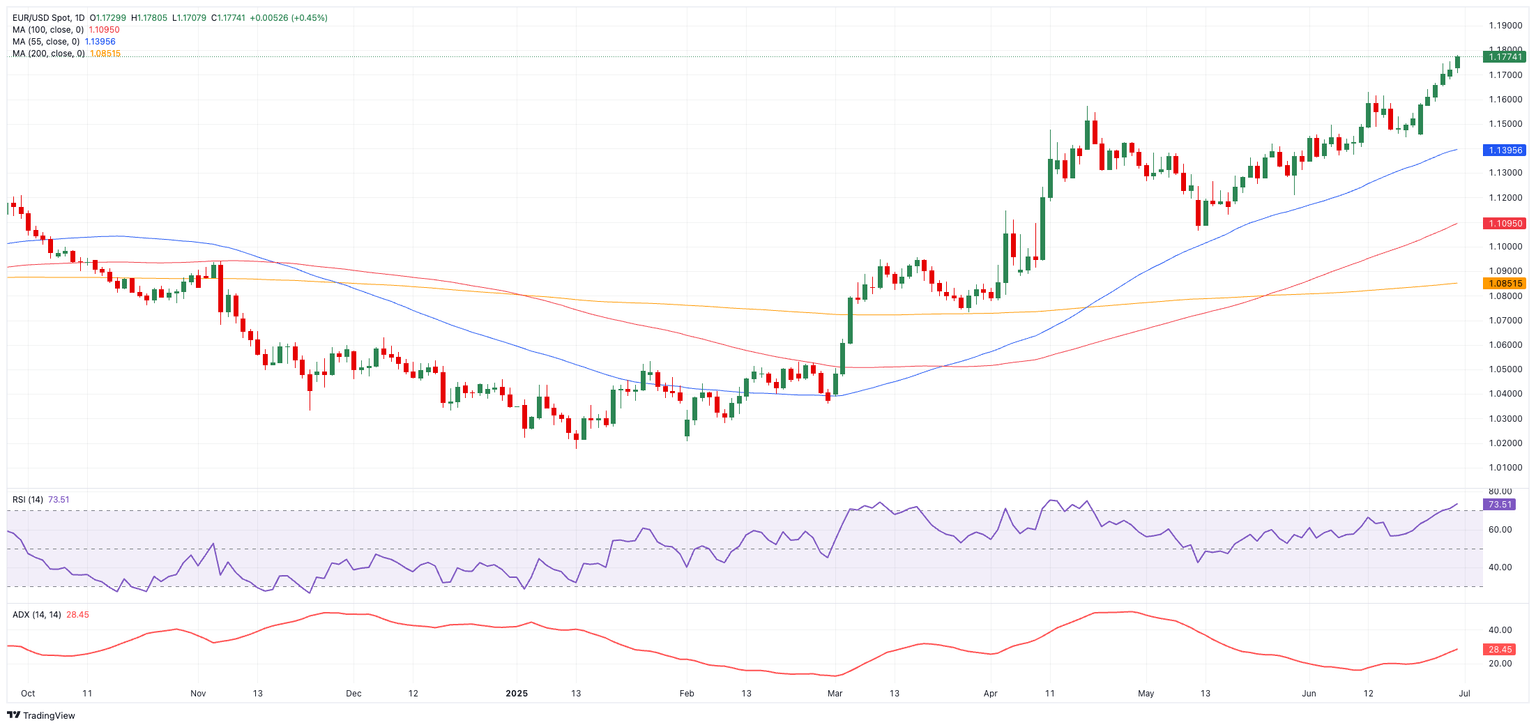

The 2025 ceiling of 1.1779 (June 30) serves as fresh resistance. If that gives way, the door opens to the September 2018 peak of 1.1815 (September 24) and the June 2018 high at 1.1852 (June 14).

Should the rally falter, initial support lies near the 55-day simple moving average (SMA) at 1.1393, followed by the weekly trough at 1.1210 (May 29) and the May floor at 1.1064 (May 12). A decisive break below 1.1000 would signal a deeper correction.

Momentum gauges still lean bullish. The Relative Strength Index (RSI) approached 74, flagging overbought conditions that could invite short-term pullbacks, while an Average Directional Index (ADX) near 29 confirms a strengthening trend.

Outlook

Absent a fresh shock, the Euro’s advance looks poised to continue, powered by fading geopolitical risk and a widening perception that US monetary policy may be forced into a looser stance. A prolonged challenge to the Fed's autonomy or an escalation in tariff rhetoric would likely keep the single currency in the lead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.