EUR/USD Price Forecast: The positive outlook remains unchallenged

- EUR/USD revisited once again the area of YTD peaks around 1.1200.

- The Dollar staged a lacklustre bounce following Powell-led sharp pullback.

- Business Climate in Germany eased slightly to 86.6 in August.

EUR/USD paused its multi-week upward momentum and faced some downward pressure after reaching fresh highs just above 1.1200 at the beginning of the week. This small corrective move occurred amidst a tepid resurgence of buying interest in the US Dollar (USD).

That said, the Greenback bounced back from its recent 2024 lows near 100.50 (August 26), as reflected by the US Dollar Index (DXY). This rebound was driven by a decline in risk appetite following Friday’s strong advance in response to the dovish message from Chair Jerome Powell at the Jackson Hole Symposium

It is worth recalling that Powell suggested that “it is time” to shift the monetary policy stance, opening the door to an interest rate cut at the September 18 meeting. Powell argued that it seems unlikely the labour market will contribute to heightened inflationary pressures in the near future, adding that the Fed does not seek or welcome any further cooling in labour market conditions.

Still around the labour market, Richmond Federal Reserve President Thomas Barkin indicated earlier on Monday that the "low-hiring, low-firing" strategy currently adopted by US businesses in their employment decisions is unlikely to endure, highlighting the risk that companies may resort to layoffs if the economy weakens. He noted that concerns about the job market have escalated at the Fed in recent weeks, which is a key reason why Powell remarked in a speech on Friday that interest rate cuts were necessary to prevent further, undesired increases in unemployment.

In line with these potential rate cuts, the CME Group’s FedWatch Tool indicates nearly a 70% chance of a 25 bps reduction at the September 18 meeting.

Adding to the Dollar’s daily recovery, US yields gained some traction across various maturities.

Shifting the focus to the European Central Bank (ECB), its Accounts published last week revealed that while policymakers saw no immediate need to lower interest rates last month, they cautioned that the issue might be revisited in September, given the ongoing impact of high rates on economic growth.

Still around the bank, Governing Council member Robert Holzmann suggested that a rate cut in September is not certain. He noted that if the Fed decides to lower rates, it could facilitate further rate cuts by the ECB. He also pointed out that inflation remains stubborn in certain areas and cautioned that the services sector could obstruct the achievement of the inflation target. Meanwhile, ECB Chief Economist Philip Lane struck a more cautious tone compared to the Fed, remarking that the central bank is making "good progress" in bringing inflation down to its 2% target but may still require a restrictive monetary policy.

In addition to the ECB's attention, a new poll released last Thursday showed a steep slowdown in the increase of negotiated pay during the second quarter, a critical component in anticipating future inflationary pressures.

If the Fed opts for an additional or greater rate reduction, the policy gap between the Fed and the ECB may narrow in the medium to long term, potentially sending EUR/USD higher, especially because markets expect the ECB to lower rates twice more this year.

However, in the longer term, the US economy is expected to outperform Europe, suggesting that any extended weakness in the dollar may be temporary.

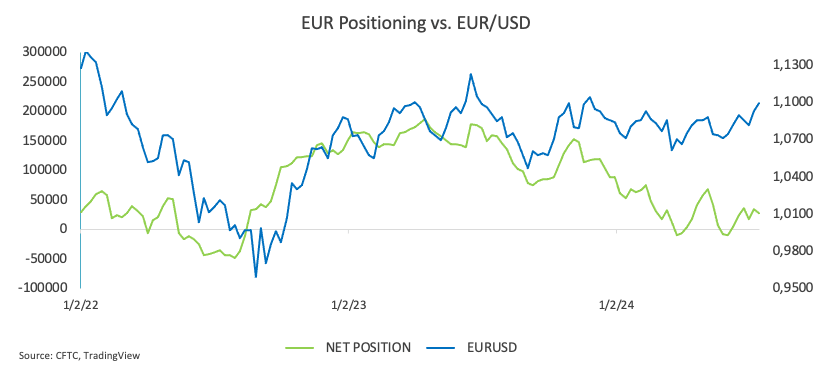

On another front, further gains in the single currency looked propped up by positioning. Indeed, net long positions in the EUR have risen to levels not seen since early June, according to the latest CFTC report, signaling continued bullish sentiment among speculators. Meanwhile, commercial traders (hedge funds) maintained their net short positions, with contracts reaching multi-week highs. EUR/USD began a strong rebound during the period under scrutiny, decisively breaking past the psychological 1.1000 barrier and setting new yearly highs, driven by the renewed and significant decline in the Greenback.

Looking ahead, Germany will take centre stage on this week’s calendar, featuring the release of the final Q2 GDP Growth Rate, Retail Sales, preliminary Inflation Rate, and the labour market report. In the broader Euroland, the advanced Inflation Rate will also attract attention.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, EUR/USD is expected to challenge its 2024 high of 1.1201 (August 26), ahead of the 2023 top of 1.1275 (July 18).

The pair's next downside target is the weekly low of 1.0881 (August 8), which comes before the key 200-day SMA at 1.0848 and the weekly low of 1.0777 (August 1). From here, the low of 1.0666 (June 26) comes before the May bottom of 1.0649 (May 1).

Looking at the broader picture, the pair's upward trend should continue as long as it remains above the key 200-day SMA.

So far, the four-hour chart shows a slight slowdown in the upward bias. The initial resistance level, 1.1201, precedes 1.1275. However, there is quick support at 1.1098, seconded by the 55-SMA of 1.1078, and then 1.0949. The relative strength index (RSI) decreased to about 62.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.