EUR/USD Price Forecast: The 1.1800 barrier is next on the upside

- EUR/USD retreated from multi-day highs near the 1.1700 barrier.

- The US Dollar printed modest gains amid trade uncertainty and Fed rumours.

- Reports seem to favour FOMC Governor C. Waller for succeeding Powell at the Fed.

The Euro (EUR) left behind part of its weekly rebound vs. the US Dollar (USD) on Thursday, with EUR/USD coming under renewed selling pressure soon after reaching new highs around 1.1700 the figure.

Speculation that FOMC Governor Christopher Waller could be the next Fed head led to a modestly firmer Greenback, and persistent uncertainty on the trade front also contributed to the US Dollar's rise.

Trade-framework relief already fading

Earlier optimism over the newly signed US–EU accord—under which most European exports now face a 15% levy rather than the 30% once threatened—has cooled fast. Aerospace, semiconductor and farm products escaped the new duties, but steel and aluminium remain taxed at 50%. In return, Europe pledged to buy $750 billion of US energy, expand its defence orders, and channel more than $600 billion into American investments.

Berlin and Paris were unimpressed: Germany’s Chancellor Friedrich Merz warned the deal squeezes an already fragile manufacturing base, while France’s President Emmanuel Macron called it a “dark day” for the Continent.

Tariff calendar: August 7 and August 12

Trade politics remain at the forefront. On August 7, President Trump’s “reciprocal” tariffs on imports from 69 partners kick in, raising duties to between 10% and 41% within a week and threatening tougher measures against Russia if the war in Ukraine drags on.

By August 12 he must also decide whether to prolong the truce with Beijing or let tariffs snap back to triple-digit levels—an outcome that could reignite a full-blown trade war.

Central banks stick to the sidelines

The Federal Reserve (Fed) kept policy unchanged at its latest meeting, with Chair Jerome Powell striking a cautious tone even as Governors Waller and Bowman dissented.

Across the Atlantic, European Central Bank (ECB) President Christine Lagarde described growth as "solid, if a little better," yet money markets have already punted the first rate cut for spring 2026.

Speculators trim EUR longs

CFTC data for the week ending July 29 saw net longs in the single currency shaved to about 123.3K contracts, or three-week lows, while institutional traders’ net shorts slipped to roughly 175.8K contracts. IIn addition, open interest decreased for the first time in six weeks, now totalling approximately 828.6K.

Key technical levels in focus

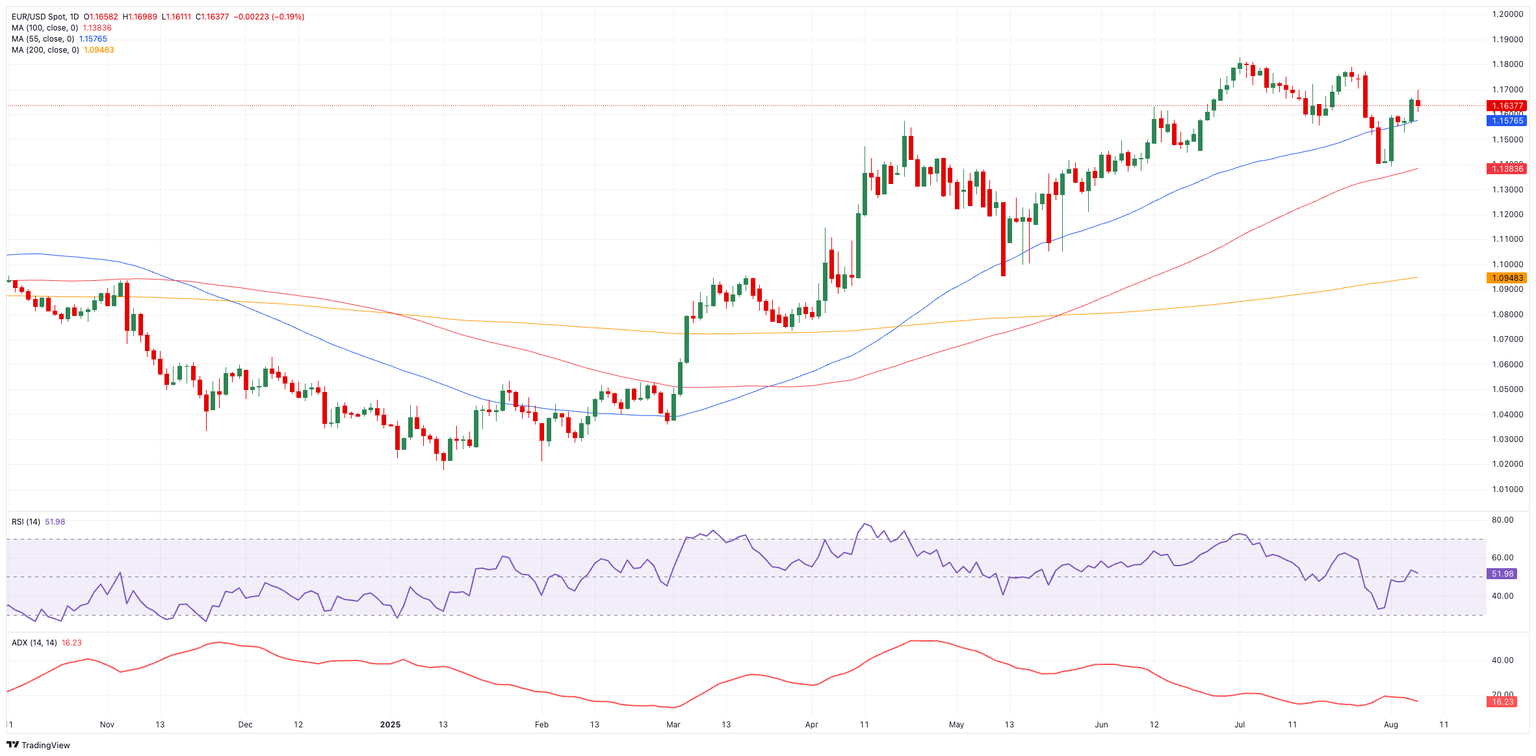

Resistance awaits at the weekly high of 1.1788 (July 24), followed by the 2025 high of 1.1830 (July 1). Beyond that, there's the September 2021 top at 1.1909 (September 3) and the psychological 1.2000 line.

Support begins at the August trough of 1.1391 (August 1), which appears propped up by the interim 100-day, and precedes the weekly floor at 1.1210 (May 29).

Speaking about momentum, the Relative Strength Index (RSI) eases to around 52, suggesting further gains, though an Average Directional Index (ADX) near 19 still signals an inconclusive trend.

EUR/USD daily chart

Outlook: range-bound theme prevails

Absent a dovish shock from the Fed or a genuine thaw in trade tensions, EUR/USD looks set to maintain its consolidative scheme for now, with sentiment around the US Dollar likely dictating the next decisive move.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.