EUR/USD Price Forecast: Sellers pause ahead of ECB Lagarde’s testimony

EUR/USD Current price: 1.1690

- The US Dollar surged in Asia after the Japanese Yen collapsed following the result of the latest local elections.

- Political turmoil in France hit the Euro as the newly appointed Prime Minister resigned.

- European Central Bank President Christine Lagarde is due to testify before the European Parliament.

- EUR/USD bounced from its intraday low, stands at the lower end of its recent range.

The EUR/USD pair fell on Monday to 1.1651, its lowest in over a week, as the US Dollar (USD) surged on Asian and European political woes. On the one hand, Japan’s weekend elections ended with Sanae Takaichi becoming the leader of the Liberal Democratic Party (LDP), positioning her to become Japan's first female Prime Minister. The Japanese yen (JPY) collapsed with the headlines amid speculation for a loosened monetary policy and increased government spending, with the USD/JPY up roughly 2%.

On the other hand, the newly appointed French PM Sébastien Lecornu resigned less than a day after his cabinet was unveiled. Lecornu is the fifth PM to resign amid the inability to pass a budget through Parliament to bear with France's massive debt, which now exceeds €3 trillion, equivalent to approximately 114% of its Gross Domestic Product (GDP). The Euro (EUR) came under strong selling pressure with the headlines, further boosting demand for the Greenback.

In the meantime, the United States (US) government shutdown continues, without signs of a near-term solution. Tensions between Democrats and Republicans continue, with US President Donald Trump blaming Democrats for looming massive federal layoffs.

European data failed to impress, as the EU October Sentix Investor Confidence index improved to -5.4 from -9.2 in September. Also, August Retail Sales were up by 0.11% on a monthly basis, improving from the revised -0.4% posted in July.

Later in the day, European Central Bank (ECB) President Christine Lagarde is due to testify before the Committee on Economic and Monetary Affairs of the European Parliament. Lagarde’s comments on future monetary policy may affect the EUR.

EUR/USD short-term technical outlook

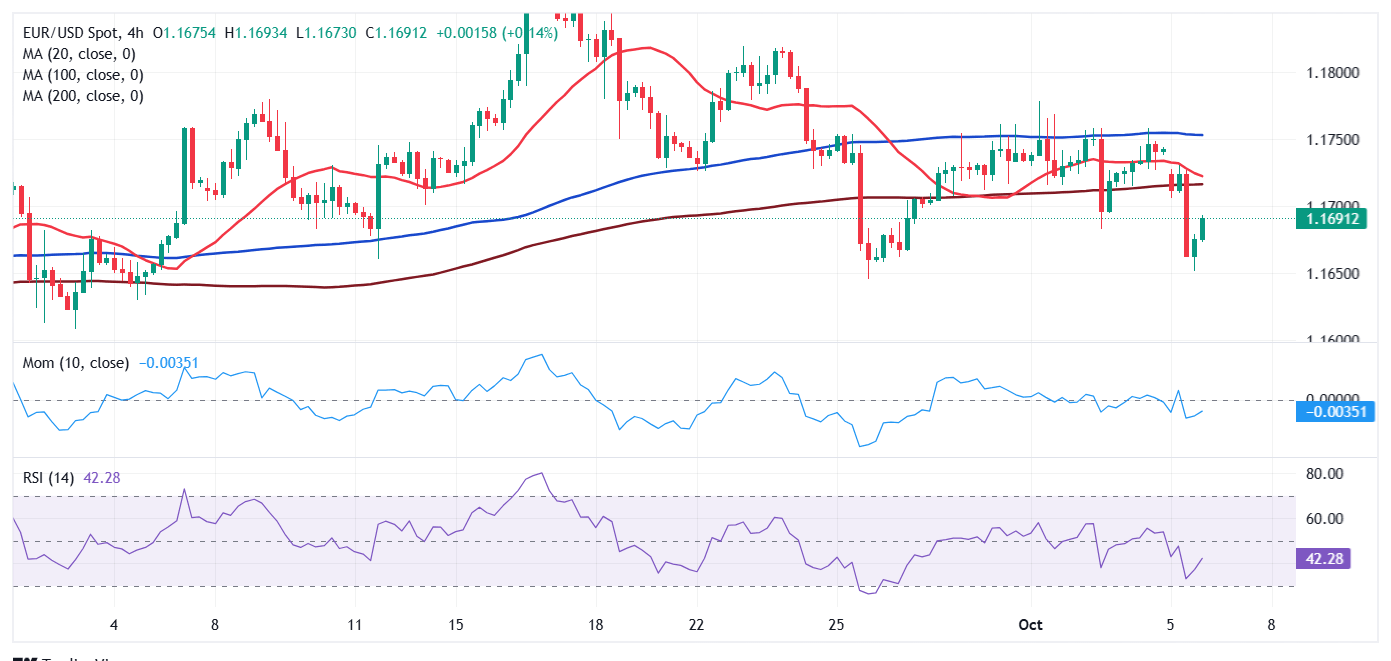

The EUR/USD pair currently trades in the 1.1680 area, and the daily chart shows it holds around the lower end of its latest range, still unable to set a clear directional trend. The risk, however, skews to the downside, and technical indicators gain downward traction below their midlines. At the same time, a flat 20 Simple Moving Average (SMA) keeps acting as dynamic resistance at around 1.1740, while a mildly bullish 100 SMA provides support around 1.1620.

In the near term, selling pressure receded, but additional declines remain on the docket. The 4-hour chart shows that the EUR/USD pair develops below all its moving averages, with the 20 SMA gaining downward traction and about to cross below a flat 200 SMA. Technical indicators, in the meantime, bounced from near oversold readings, but remain nearby, not enough suggesting there’s room for another leg lower, particularly if the pair pierces the aforementioned intraday low.

Support levels: 1.1650 1.1620 1.1590

Resistance levels: 1.1710 1.1745 1.1780

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.