EUR/USD Price Forecast: Risk on rules, sellers around 1.1500

EUR/USD Current price: 1.1470

- The US Consumer Price Index rose by less than anticipated in May.

- US President Donald Trump said a deal with China is “done.”

- EUR/USD turned bullish with US data, still needs to conquer the 1.1500 mark

The EUR/USD pair kept trading within familiar levels throughout the first half of the day, finding near-term sellers around the 1.1450 mark. Financial markets remained cautious even after the United States (US) and China agreed on a “working framework,” meant to bring them back to the Geneva agreement in which both parts accepted a truce. A bit of a disappointing headline, as trade war negotiations returned to square one.

Top representatives will now present the agreement to US President Donald Trump and his Chinese counterpart Xi Jinping for final approval. On a positive note, US Commerce Secretary Howard Lutnick noted that American concerns over China’s restrictions on exports of minerals and magnets had been resolved. He added that the measures that the US had taken in response to those Chinese restrictions would be reversed “in a balanced way.”

Wall Street managed to close Tuesday with gains, with optimism extending into Asia but fading during European trading hours ahead of the US Consumer Price Index (CPI) release.

Meanwhile, US President Trump hit the wires with some positive lines. Trump said that the US relationship with China is “excellent,” adding that the trade deal is “done” but subject to Xi’s approval. Finally, he said that the US would be getting a 55% tariff, while China would be getting a 10% tariff. Ahead of the CPI release, the headlines had a limited impact on financial markets.

The US finally reported that inflation, as measured by the CPI, rose by less than anticipated, sending the USD into a selling spiral. The CPI was up by 2.4% on a yearly basis in May from 2.3% in April, the US Bureau of Labor Statistics (BLS) reported. Market players anticipated an uptick to 2.5%. The core annual reading resulted at 2.8%, matching the previous while below the 2.9% expected, while the monthly CPI printed at 0.1%.

The news not only put the USD under strong selling pressure, but also sent stocks sharply up. Wall Street holds on to substantial gains at the time of writing, hinting a a continued advance through the session.

EUR/USD short-term technical outlook

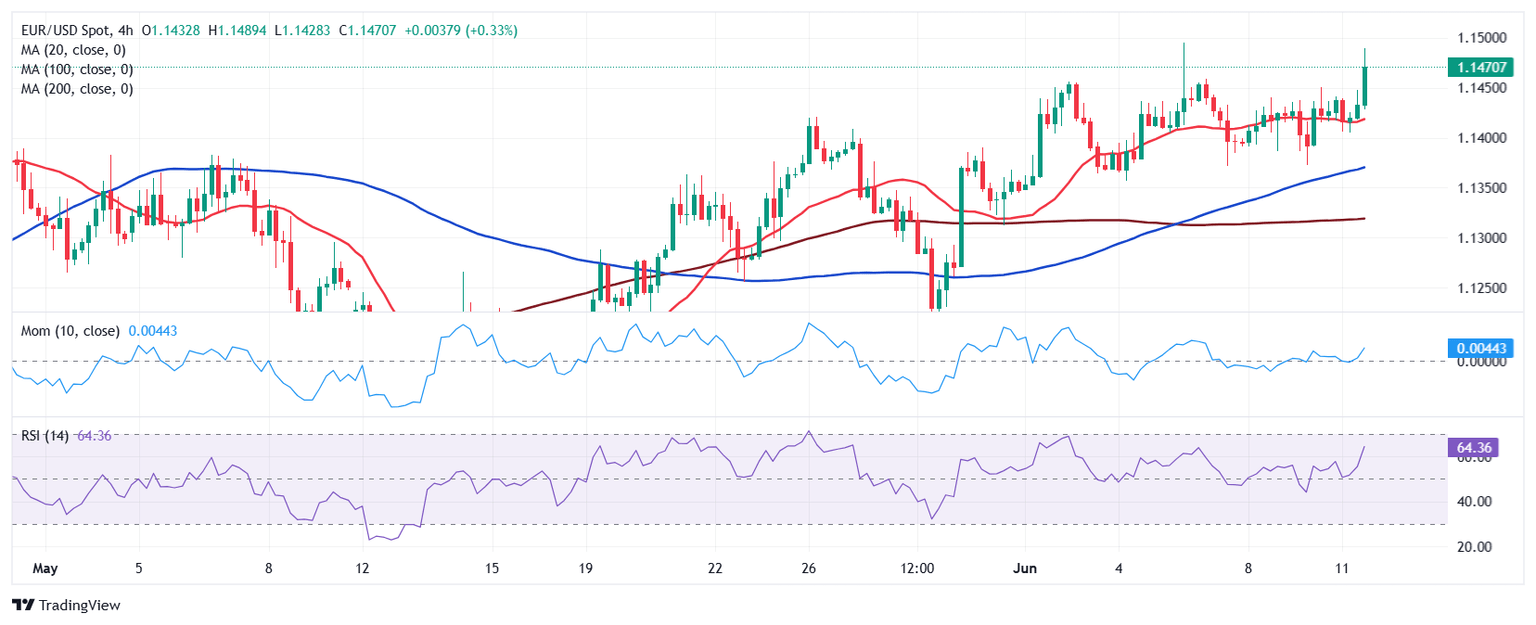

From a technical point of view, the EUR/USD pair is now approaching its recent high at around the 1.1500 threshold and poised to extend its advance. The daily chart shows technical indicators turned north within positive levels, although the Momentum indicator remains below its recent peak, as the pair needs to run past 1.1500 to actually turn bullish. At the same time, the pair develops above all its moving averages, with a bullish 20 Simple Moving Average (SMA) currently at around 1.1345.

The near-term picture is bullish, with EUR/USD running far above a still flat 20 SMA, while the longer ones gain bullish traction below it. Finally, technical indicators accelerated north above their midlines, in line with another leg higher, particularly if the pair runs past the 1.1500 resistance.

Support levels: 1.1430 1.1390 1.1345

Resistance levels: 1.1500 1.1540 1.1575

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.